Palantir Technologies (PLTR +1.91%) is having another terrific year following the remarkable gains it delivered in 2024, but the stock has faced some volatility of late thanks to a couple of factors.

Palantir stock dipped last month on news of potential tariffs on semiconductors, a move that could have an impact on the artificial intelligence (AI) software specialist's margin profile since it would have to pay more for the AI inference applications it delivers. And then, Reuters reported an internal memo from the U.S. Army regarding flaws in the battlefield communications network that Palantir is developing.

The contents of the memo were enough to spark fear among investors, especially considering Palantir cannot make any mistakes, given its expensive valuation. After all, Palantir stock is priced beyond perfection, and the company needs to ensure that it can continue to deliver an acceleration in its growth quarter after quarter to sustain its red-hot rally.

The good part is that investors can expect Palantir stock to receive a nice shot in the arm on Nov. 3. Let's see why that may be the case.

Image source: Getty Images.

Palantir could put all concerns to rest on Nov. 3

Palantir is expected to release its third-quarter results on Nov. 3. It is worth noting that the company's earnings reports have typically been a catalyst for the stock. For instance, the generative AI software provider's stock popped when it released its Q2 report in August. A similar pattern was seen in the first half of the year, as a couple of solid quarterly reports from the company were enough to boost investor confidence.

NASDAQ: PLTR

Key Data Points

All this explains why Palantir stock is still up by an impressive 137% in 2025 despite the recent pullbacks. Don't be surprised to see the stock get a nice shot in the arm once again after it releases its upcoming report. The company has already pointed out that the concerns expressed by the U.S. Army were identified and rectified quickly.

Moreover, a closer look at recent developments suggests that the demand for the company's AI software platform remains robust. Palantir's customers continue to expand their partnerships with the company while it continues to land new customer accounts. For example, Palantir recently signed a partnership with the U.K. government through which it could invest up to $1.8 billion in the country's defense sector, a move that could unlock the company's entry into a potentially lucrative market.

These are the types of developments that are likely to help Palantir coast past investors' expectations. The company has been beating Wall Street's earnings expectations consistently over the past four quarters, driven by an expansion in spending by existing customers, as well as the addition of new customers.

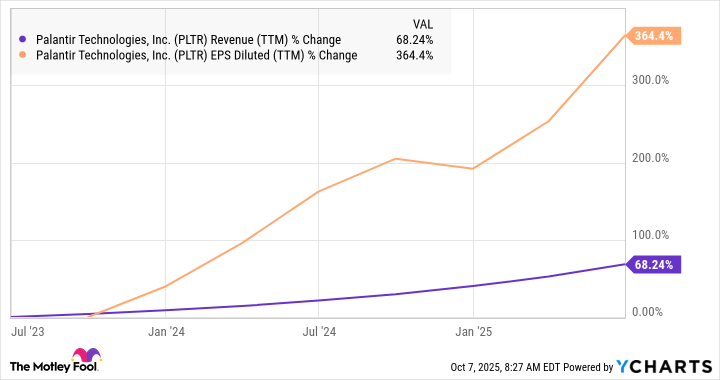

This has allowed it to report an improvement in its revenue and earnings growth in recent quarters.

PLTR Revenue (TTM) data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

Palantir's revenue in Q2 jumped 48% year over year to $1 billion. However, it signed new contracts worth $2.3 billion during the quarter, leading to a 65% spike to $7.1 billion in the total value of its unfulfilled contracts.

The new deals and expansion contracts Palantir has signed of late suggest that it could once again expand its revenue pipeline at a faster pace than its actual revenue. That should ideally help investors understand that Palantir's growth story is still intact.

Moreover, the faster increase in Palantir's revenue pipeline explains why its earnings growth has been fantastic. Its adjusted earnings in Q2 were up by 77% from the year-ago period to $0.16 per share. The company's operating margin stood at 45% in the first half of 2025, up by nine points from the year-ago period.

So, there is room for improvement in this metric, which means Palantir can sustain healthy earnings growth levels in the long run.

The valuation is a concern, but investors should look at the bigger picture

Palantir stock remains under constant scrutiny because of its extremely rich valuation. The stock has a forward price-to-earnings (P/E) ratio of 217. It has been justifying such an expensive valuation thanks to its accelerating earnings growth, better-than-expected results, and a rapidly improving revenue backlog.

Palantir seems capable of delivering on all these fronts next month when it releases its quarterly report. Moreover, this AI stock can soar impressively over the next decade as well, thanks to the massive opportunity in the AI software platforms market, where the company is considered a leader.

So, if you're a Palantir investor, it would make sense to continue holding this stock, as a strong set of results can ensure that its phenomenal surge continues.