Eaton Corporation (ETN +0.86%) has garnered significant investor interest due to its exposure to the rapidly growing data center infrastructure market, and rightly so. Still, is it enough to justify the current valuation, and what do investors need to assume about the company's growth prospects to buy the stock? Here's the lowdown.

A valuation change

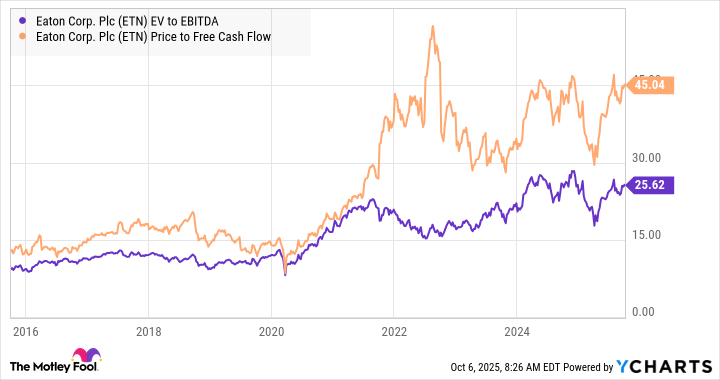

The change in investor sentiment toward Eaton is expressed in the chart below. Traditionally, electrical and power products companies were viewed as mature and relatively low-growth entities that struggled to expand beyond the confines of low-single-digit gross domestic product growth. As a rough rule of thumb, such companies in the industrial world are accorded a ratio of enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization (EBITDA) of about 11 and/or a price-to-free-cash-flow ratio of about 20.

As you can see in the following chart, these valuations are mainly consistent with what Eaton previously traded at. However, in recent years, there has been a significant increase in the valuation investors are willing to pay.

ETN EV to EBITDA data by YCharts.

Why investors view Eaton more favorably

The increase in valuation is due to the increase in its growth rate -- in 2019, its three-year average revenue growth rate was 2.7% compared to 8.2% in 2024 -- and the potential for growth stemming from its exposure to data centers, particularly in North America. The need for data centers is being largely driven by the increasing use of artificial intelligence (AI). The table below breaks out Eaton's revenue by segment, illustrating the significant contribution of the Electrical Americas segment over the past few years.

|

Segment |

Operating Profit 2022 |

Operating Profit 2023 |

Operating Profit 2024 |

Share of Profit Increase From 2022 to 2024 |

|---|---|---|---|---|

|

Electrical Americas |

$1,913 million |

$2,675 million |

$3,455 million |

87.5% |

|

Electrical Global |

$1,134 million |

$1,176 million |

$1,149 million |

0.9% |

|

Aerospace |

$705 million |

$780 million |

$859 million |

8.7% |

|

Vehicle |

$453 million |

$482 million |

$502 million |

2.8% |

|

eMobility |

($9) million |

($21) million |

($7) million |

0.1% |

Data source: Eaton SEC filings.

The growth in the Electrical Americas segment is expected to be driven by data centers in the near term, as they have now become Eaton's second-largest end market by sales, with management estimating that data centers will be responsible for 17% of total revenue in 2025. Moreover, it's reasonable to argue that its second-fastest growing end market, utilities (11% of revenue), is at least in part driven by demand for power from data centers.

In addition, Eaton is a beneficiary of the "electrification of everything" megatrend, with solid end demand from defense and aerospace (estimated to account for 6% of 2025 sales). It also has growth prospects in commercial aerospace (9%), given Boeing and Airbus' backlogs and plans to ramp up production.

Image source: Getty Images.

Is Eaton Stock a buy?

The growth case is compelling, and Wall Street analysts expect Eaton's revenue to grow at a 9% compound annual growth rate (CAGR) to 2027, with earnings growing at a near 14% annual rate.

That being said, there are a few key considerations to keep in mind. First, data centers and utilities are expected to account for a combined 28% of revenue in 2025, and there's no guarantee that the torrid rates of growth in AI-led data center spending will continue.

Second, as the table above indicates, its eMobility business (components for electric vehicles) is not currently profitable. Since management expects to grow at a double-digit rate to 2030, the vehicle business (internal combustion engine components) is only expected to grow by low single digits to 2030; it's hard to see how this relative shift in automotive-related revenue won't result in some margin pressure.

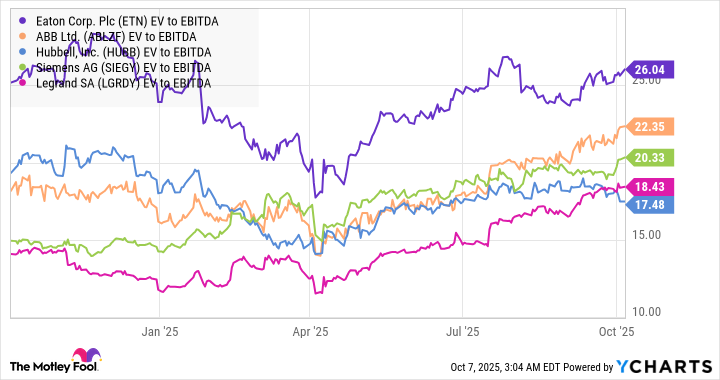

Third, the company's valuation relative to non-pure play data center peers appears high. A stock like Vertiv might be a better fit for investors seeking a pure-play data center stock.

ETN EV to EBITDA data by YCharts.

Trading at an EV/EBITDA of 19 using estimates for 2027 and at a price-to-free-cash-flow of 28.6 using 2027 estimates, Eaton looks like a fully valued stock because it will need more than a ramp-up in data center spending expectations before the stock seems like a good value.