The market loves everything to do with artificial intelligence (AI) right now. Anything else? Not so much. That could be applied to Lululemon (LULU +2.63%) and its apparel brand, which has seen slowing revenue and a stock fall 66% from all-time highs set earlier this year. Investors are worried about increased competition in the athleisure space.

However, if you look at the underlying figures and Lululemon's international growth trajectory, it is clear that the best days are ahead for this storied brand.

Here's why Lululemon is a fantastic growth stock to buy with $1,000 right now.

Better growth in North America

Lululemon's stock price has been hurt because of a revenue slowdown in North America. The entire apparel space has been hit, with larger brands such as Nike seeing declining sales in the important United States and Canadian markets in recent quarters. While it is not immune from broader consumer spending trends, Lululemon's business is still growing, with Americas revenue up 1% year over year last quarter. This may not look like a growth stock, but it is much better than its peers.

For example, last quarter its competitor Athleta had a 9% decline in revenue. Management believes that the Lululemon brand is still gaining market share in the premium athleisure space, and it just signed a new marketing partnership with American Express that could drive wealthy customers to spend more on Lululemon products.

Once the consumer slowdown in athleisure ends, Lululemon is poised to accelerate its revenue growth in North America, which was still 70% of total net revenue as of last quarter.

NASDAQ: LULU

Key Data Points

Room for international expansion

Over time, North America is going to become less important for Lululemon. Why? Because of the huge runway the brand has for global expansion.

In China, the company's revenue is growing 24% year over year in constant dollar terms, which has exploded from $434 million in total revenue in 2021 to $1.5 billion in revenue over the last 12 months. With 1.4 billion people in the nation (going through a consumer recession at the moment), Lululemon is poised to keep expanding in China as well as other Asian countries.

Europe and Latin America have untapped potential. Lululemon just announced a flagship store in Milan, which could spur growth in the fashion-forward country. If brands like Nike and Adidas can do well globally, I see no reason why Lululemon would not have similar success. This provides Lululemon a much longer growth runway than investors are giving it credit for.

Total revenue was $10.9 billion over the last 12 months. With a recovery in North America, expansion in China and Europe, as well as general economic tailwinds, I think Lululemon can reach $20 billion and eventually $30 billion in annual sales within the next 10 years.

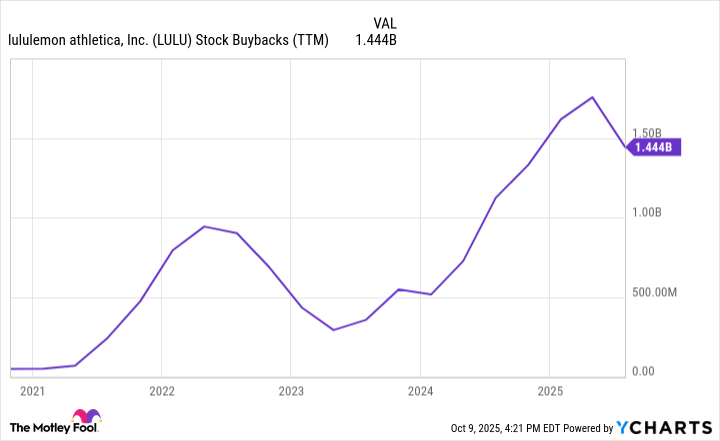

LULU Stock Buybacks (TTM) data by YCharts

Smart capital allocation and a cheap price

Lululemon's share price is in the gutter, and management is trying to take advantage of the situation with a smart share buyback program. Over the last 12 months, Lululemon repurchased $1.444 billion worth of stock, or a buyback yield of 7% versus the current market cap of $20 billion. If this continues, Lululemon's shares outstanding should fall at an accelerating rate, which will accelerate the growth in earnings per share (EPS), the key driver of stock performance over the long haul.

The stock looks cheap at today's levels. It has a price-to-earnings ratio (P/E) of 12, which is well below the S&P 500 Index average of 30. Lululemon will have tariff-related headwinds in future quarters, but it is not going to kill the business and will (hopefully) not last forever. Put it all together, and Lululemon looks like the ultimate growth stock right now. Take $1,000 and buy a few shares for your portfolio. You likely won't regret it a decade from now.