Everyone loves to have found a hidden gem, or the next big high-flying stock, and share the victory story next to the office coffee pot. Unfortunately, this is far easier said than done, and finding the next high-growth stock, especially one that you can hold stress-free for the long term, is a challenge. Here are two incredible stocks that are positioned to thrive long into the future.

Racing by competitors

When looking for high-flying winners, investors would probably scratch the automotive industry off their list, but that would be a huge mistake. Ferrari (RACE 1.76%) has been a strong performer, with shares up more than double the rise of the S&P 500 over the past decade. You're probably aware that Ferrari designs, engineers, and manufactures some of the world's most expensive ultra-luxury vehicles. Supply is carefully calculated to check in below demand, supporting its significant brand and pricing power through exclusivity.

NYSE: RACE

Key Data Points

There are a few intriguing things about Ferrari that make it an excellent investment long-term. Roughly 70% of its vehicles are sold to existing Ferrari clients, forming something to the effect of recurring revenue. The company is also diversified, with the Europe, Middle East, and Africa region accounting for about 47% of revenue, while the Americas generate 33%. The rest comes from Asia, with a limited exposure to China.

Ferrari's growth comes in an equally intriguing way, as the company has focused on horizontal growth. Rather than producing more volume or participating in more affordable segments, and reducing its pricing power, it has widened its portfolio of vehicles but still only sells a limited number, often around 1,000 units, per model annually. However, its total volume has grown 88% over the past decade, according to Morningstar.

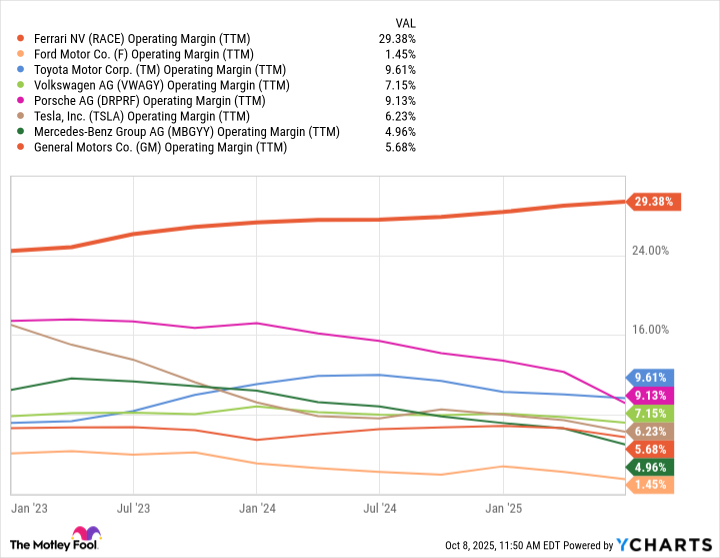

This has created a need for Ferrari collectors, and traditional buyers, to purchase a Ferrari for different driving occasions. It offers the widest product portfolio among luxury supercar manufacturers. It also boasts margins the rest of the industry dreams of, as you can see below.

RACE Operating Margin (TTM) data by YCharts.

Not only is Ferrari in a completely different ballpark than its more mainstream competitors in terms of operating margins, it's also increasing that metric while the competition is stagnant or declining.

Lastly, investors might have noticed that Ferrari's stock took a dive late last week -- in fact, its single largest one-day drop since its IPO -- but fear not. The driving force came during the company's capital markets day when Ferrari raised 2025 guidance, but gave top-line 2030 guidance that checked in slightly below analysts estimates. It seems like a knee-jerk overreaction, and it doesn't help that the stock was trading at a steep premium and even after the drop still trades at a lofty 38 times earnings. Ferrari as a business remains fundamentally sound with long-term competitive advantages, don't worry about last week's decline, if anything it offers a small buying opportunity.

A way to play artificial intelligence

Advanced Micro Devices Inc. (AMD 1.75%) designs a multitude of digital semiconductors for markets spanning personal computers, gaming consoles, data centers, artificial intelligence, and automotive applications. Historically, the company's strength was driven by central processing units and graphics processing units used in PCs and data centers. But now AMD is evolving and becoming a prominent player in artificial intelligence (AI).

Image source: Getty Images.

In fact, AMD and OpenAI recently reached an agreement where AMD will supply AI gear for up to 6 gigawatts of OpenAI's AI infrastructure. The deal is expected to earn tens of billions of dollars in annual incremental revenue with its rollout in the second half of 2026 -- in other words, strong growth.

Not only is this a huge deal in terms of generating incremental growth on the top line, it validates and gives credibility to AMD's emerging AI technology. In fact, this deal has fundamentally changed how analysts view the company, with Morningstar raising its fair value estimate for AMD to $210 per share, up from the prior $155 estimate. It also doubled its estimates for AMD's AI GPU revenue for 2027 and beyond and now projects about $42.2 billion for AMD revenue by 2029, compared to the prior estimate of $20.7 billion.

Buy and hold

Both of these stocks are incredibly intriguing over the long term. On one hand, Ferrari has built an incredible business that focuses on exclusivity and pricing power that drive substantially higher margins than the traditional automotive business. With its innovation history and (literal) track record, expect people to line up for its vehicles for the long haul.

AMD is almost the opposite. It's focusing on rapidly expanding its AI prowess, and has impressively become a prominent player in AI. While the company won't likely overtake Nvidia's position anytime soon, its recent deal with OpenAI signals that it's here to stay.

Both stocks appear to be excellent buy-and-hold candidates for investors seeking strong returns over the coming decades.