For years, nuclear energy has been pushed to the sidelines, grappling with a tarnished reputation. The catastrophic meltdown at Fukushima left many questioning whether this powerful energy source was truly worth the risk.

Fast forward to today. As global power demands surge and the push for cleaner energy intensifies, with tech giants like Microsoft and Meta Platforms leading the charge, nuclear energy is making a resurgence.

Enter the Global X Uranium ETF (URA +1.62%), an exchange-traded fund (ETF) for investors seeking to capitalize on this renewed interest in nuclear power. Here's why adding the Uranium ETF to your portfolio could be a smart move.

NYSEMKT: URA

Key Data Points

1. Energy demand will rise significantly in the coming years

Energy demand in the U.S. and across the globe is rising. Driving this increased demand are power-hungry data centers that support artificial intelligence (AI) and technology like ChatGPT. Goldman Sachs forecasts that global data center power demand will surge 165% by 2030, primarily driven by the growth of AI.

Data centers are projected to use more energy, while the electrification of vehicles, heating, and industrial processes adds steady new baseload demand. Unlike past cycles, this surge is not cyclical but structural, tied to digital infrastructure, decarbonization mandates, and the reshoring of energy-intensive manufacturing.

Traditional efficiency gains from appliances and lighting are no longer sufficient to offset growth, and grid operators warn of capacity shortfalls in multiple regions.

2. Nuclear provides clean-burning, reliable fuel

As utilities scramble to expand their generation, nuclear power and natural gas are emerging as essential backstops, as renewables alone face challenges related to intermittency and transmission.

Nuclear power offers a unique solution, as it provides massive, steady baseload electricity without producing carbon emissions. Unlike fossil fuels, which release CO2 and pollutants, nuclear reactors generate power through fission, making them one of the cleanest large-scale energy sources available.

Image source: Getty Images.

This positions nuclear as essential for achieving carbon-neutral goals, since it can complement intermittent renewables like wind and solar while displacing coal and natural gas. With governments and utilities under pressure to reduce emissions while meeting surging demand, nuclear energy offers a reliable and scalable path to cleaner energy and long-term climate commitments.

3. Countries are seeking energy security at home

For the U.S., nuclear energy enhances energy security by providing a stable, domestic power source that reduces dependence on foreign oil, gas, and enriched uranium from adversarial nations, such as Russia.

As geopolitical tensions rise, countries are diversifying away from supplier countries that could use energy as a form of leverage and shifting toward trusted partners and homegrown production. This creates an opportunity for nuclear power companies and uranium miners.

4. Supplies are low

Global uranium supplies and production capacity are relatively tight. Over the last decade, as nuclear energy fell out of favor, prices declined, and there was little incentive to invest in new mines, resulting in underinvestment and closures.

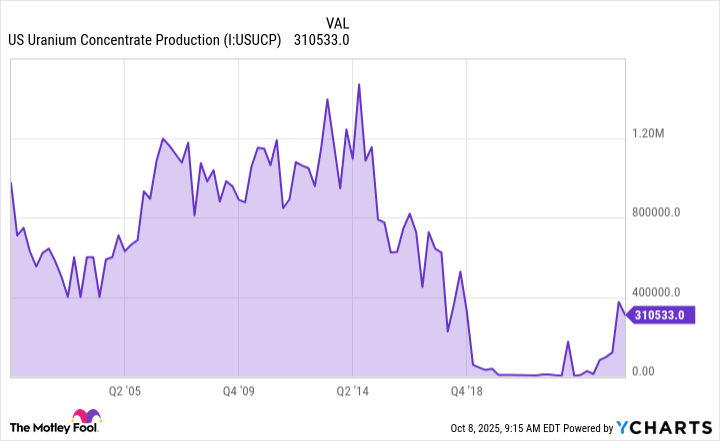

US Uranium Concentrate Production data by YCharts

This, coupled with rising demand as nations expand nuclear fleets and advanced reactors approach deployment, will put pressure on current supplies. With utilities increasingly locking in long-term contracts, supply could fall short of demand later this decade. This imbalance sets the stage for higher uranium prices and positions well-capitalized miners, developers, and fuel-cycle companies for growth.

5. The Global X Uranium ETF provides diverse exposure across nuclear

The Global X Uranium ETF (URA) provides investors with a convenient way to gain broad exposure to the uranium industry across its entire value chain.

Rather than betting on a single miner or fuel-cycle company, this ETF holds a diversified basket of global uranium-related stocks, including uranium producers, developers, exploration companies, and providers of nuclear components or technologies. Its top five largest holdings include Cameco (19.6% of net assets), Oklo (15.5%), Uranium Energy Corporation (5.9%), Centrus Energy (5.6%), and Sprott Physical Uranium Trust (5.4%).

This mix helps balance risk between established players with stable operations and smaller companies with higher growth potential. Importantly, it captures companies at different stages of the supply chain, from mining and refining to reactor construction and fuel services, allowing investors to benefit from rising uranium demand in multiple ways.