AMD's (AMD +1.79%) deal with OpenAI has shaken up the artificial intelligence (AI) investing landscape. The terms of the deal are unique, as AMD is essentially providing OpenAI with chips in exchange for shares of AMD that vest as certain milestones are reached. This could develop into a long-term partnership with one of the leaders in the AI arms race, potentially disrupting Nvidia's (NVDA 0.29%) status as the king of AI computing hardware.

However, AMD's stock has soared in the days following the announcement, and is up over 40% since October began (at the time of this writing). With that kind of rise, is AMD still a good buy? Or is Nvidia still a better pick here?

Image source: Getty Images.

OpenAI has struck deals with AMD and Nvidia recently

One thing investors must keep in mind is how good a deal this is for OpenAI. OpenAI recently cut a deal with another artificial intelligence computing leader, Broadcom (AVGO +2.63%). Broadcom's custom AI accelerator chips are starting to become another alternative to Nvidia's graphics processing units (GPUs), but there's a stark difference in Broadcom's deal versus AMD's. Broadcom's deal is an actual sale of $10 billion in chips, while AMD is selling chips to OpenAI, but OpenAI also has the option to invest in AMD at low prices via warrants, which offset some of the costs of the chips if the stock is successful.

This deal is expected to help AMD through a ripple effect and potentially cause other AI hyperscalers to buy its chips once it sees that OpenAI is having success with them. Time will tell if this strategy will allow AMD to get back into the AI arms race, but it certainly seems like a last-ditch effort to catch Nvidia.

NASDAQ: AMD

Key Data Points

One thing investors are forgetting is the deal that OpenAI struck with Nvidia in September. In that deal, Nvidia and OpenAI announced a partnership that will allow OpenAI to deploy at least 10 gigawatts of Nvidia computing. In exchange, Nvidia will invest up to $100 billion in OpenAI. For reference, AMD's deal is for about 6 gigawatts of computing power.

The difference between these two deals is enormous. AMD is selling its chips to OpenAI for OpenAI to become an investor in AMD and create a resurgence in its AI technology. Nvidia is investing in OpenAI in exchange for its chips, so it at least gets something out of the deal.

NASDAQ: NVDA

Key Data Points

I think this gives investors all they need to know about which company is still the AI leader, as it's the one with all of the bargaining power.

AMD's stock is booming after the announcement

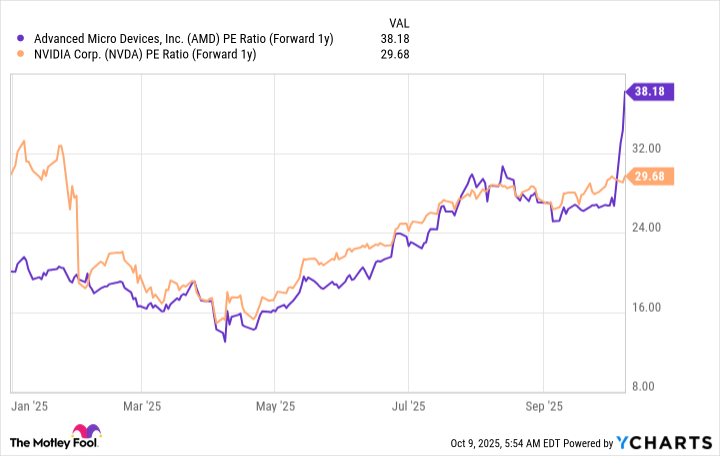

After AMD's massive surge, the stock has gotten very expensive. It now trades for nearly 40 times 2026 earnings, while Nvidia's stock trades for less than 30.

AMD PE Ratio (Forward 1y) data by YCharts

However, analysts have yet to rework their AMD projections following the deal, and this could further affect how each company is valued. On the flip side, the OpenAI deal isn't expected to see its first sales until the second half of 2026, which is still a ways out.

So, is AMD a better investment than Nvidia right now? I'd say investors need to stay patient. We're still a year out from the first gigawatt of computing power being built. Additionally, time will tell if AMD's chips are worth anything compared to its Nvidia counterparts. Many companies are seeing excellent results with Nvidia hardware, and may not be as willing to switch back and forth like OpenAI. Nvidia is posting much better results than AMD is currently, and it still has plenty of deals with AI hyperscalers and startups on its books.

It's too early to declare AMD a winner from these recent deal announcements; however, AMD's footing is improving. I still think Nvidia is the best AI stock on the market, but if AMD's new deal can bring real growth, then it is certainly one to watch. However, after a massive 40% or greater run in the stock price, I think investors can be patient and get into AMD at a much better price within the next few months.