In June of this year, Opendoor Technologies (OPEN 2.41%) stock was trading at an all-time low of $0.51. But it has staged an eye-popping 1,370% rally since then, fueled by a social media-led frenzy among retail investors, and it trades at $7.50 as I write this.

Unfortunately, there is almost no fundamental basis for Opendoor's staggering increase in value. In fact, its business continues to face significant challenges, which could put a lid on further upside in its stock price, so is it too late for investors to buy?

Image source: Getty Images.

Opendoor has a very simple business model

Selling a house can be a complicated and stressful process. It typically requires a professional agent who advertises the property and hosts showings for potential buyers, and in some cases, it can take months before a deal actually settles.

Opendoor can streamline the process by purchasing the home directly. After a seller enters some basic details on the company's website, they are presented with a cash offer that they can accept or reject. If they decide to move forward, Opendoor can close the deal in as little as two weeks, but it can also accommodate a longer settlement period if the seller needs time to find a new home.

Opendoor aims to flip the house for a profit as quickly as possible. This business model works extremely well when the real estate market is strong because prices are constantly rising, which pads Opendoor's profit margin. But it can be extremely risky during a downturn because the company holds thousands of homes in its inventory, which can translate to billions of dollars in losses if prices head south.

Companies like Zillow (Z +2.30%)(ZG +1.52%) and Redfin abandoned the direct buying business entirely after the 2021 housing boom ran out of steam, because it simply wasn't profitable. Zillow's direct buying business started losing so much money that it threatened the financial stability of the entire company.

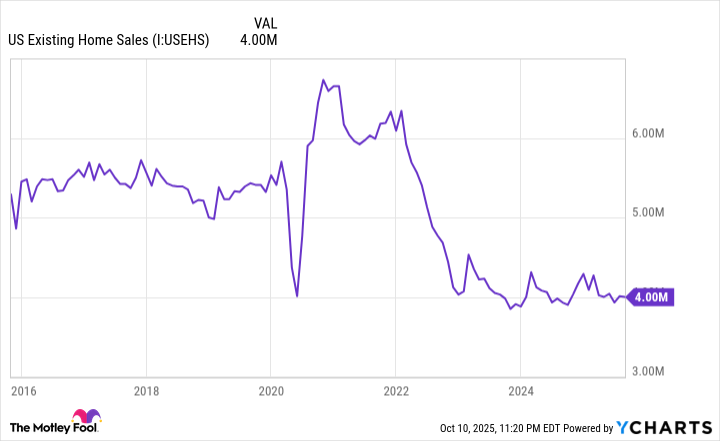

Unfortunately, U.S. existing home sales are currently near a five-year low due to elevated interest rates and rising economic uncertainty. Opendoor CEO Carrie Wheeler made a series of grim comments back in August, saying she expects the housing market to remain weak, and she doesn't see a near-term catalyst that could drive an improvement.

US Existing Home Sales data by YCharts

Opendoor is losing truckloads of money

Opendoor sold 4,299 homes during the second quarter of 2025 (ended June 30), but it only acquired 1,757 homes to replenish its inventory, reflecting management's cautious approach to the current real estate market. The company's revenue came in at $1.6 billion for the quarter, which was actually a modest 5% increase compared to the year-ago period.

But Opendoor's main issue is at the bottom line, because it's extremely hard to run a profitable direct buying business in a sluggish real estate market. During the first half of 2025, the company lost $114 million on a generally accepted accounting principles (GAAP) basis. That followed a $392 million net loss during the whole of 2024, and a $275 million net loss throughout 2023.

Opendoor's operating costs are very modest, so there isn't enough meat on the bone to cut back on things like marketing in order to achieve profitability. The real problem is the ultra-slim gross profit margin the company earns when it's selling homes, which was just 8.3% in the first half of 2025.

If the real estate market doesn't improve, Opendoor will probably continue burning through cash. It had around $789 million in liquidity on hand as of June 30, after tapping investors to raise $325 million worth of convertible debt back in May. That is probably enough cushion for a couple of years as things currently stand, so the company will be hoping the housing market improves by then.

NASDAQ: OPEN

Key Data Points

Is it too late to buy Opendoor stock?

The U.S. Federal Reserve cut interest rates three times in the final months of 2024, and it executed its first cut of 2025 back in September. According to the Fed's guidance, there could be two more cuts before this year is over. Falling rates are typically great for the real estate market over the long term because they increase consumers' borrowing power, which is a tailwind for Opendoor.

However, I personally wouldn't invest in a real estate company that draws most of its revenue from direct buying. Zillow and Redfin serve as cautionary tales, and Opendoor hasn't presented any evidence that it can make this business model work in the long run, which is why its stock plummeted to a record low of $0.51 just a few months ago.

Retail investors have used social media platforms like X (formerly Twitter) and Reddit to great effect when it comes to promoting certain stocks. We saw this with GameStop and AMC in 2021, but both of those stocks crashed once the speculative frenzies ran out of steam. I don't think Opendoor will hold onto its recent gains either, unless there is a material improvement in its fundamentals, which seems unlikely in the near term.