President Trump recently reminded investors that it doesn't take much to send a buoyant stock market reeling. When the market opened on Friday, Oct. 10, 2025, the Nasdaq Composite (^IXIC 0.06%) index traded above $23,100 for the first time.

On Oct. 10, at 10:57 am ET, President Trump commented that China was increasingly hostile regarding the rare earth metals it refines. In response, his administration is considering a massive increase in tariffs on Chinese products entering the country. By the end of the day, the Nasdaq Composite index was down 3.96% from the peak it set that morning.

The major market indexes mostly recovered on Monday, Oct. 13, after President Trump downplayed the new tariff threat he lobbed at China three days earlier.

Image source: Getty Images.

New tariff threats directed at China and an ongoing government shutdown put the stock market in a sensitive position at a time when it appears overbought. The average stock in the S&P 500 index has been trading for 22.3 times forward earnings estimates. The last time this figure climbed this high was in late 2021, before a severe bear market in 2022.

We never know when the next market crash will happen, but we know that they have always recovered. This is why you want to be ready with a list of top stocks to buy when a market crash causes them to trade at a relative discount. With strong advantages over their competitors, Intuitive Surgical (ISRG 1.17%) and Vertex Pharmaceuticals (VRTX +0.59%) are two unstoppable growth stocks for investors to consider during a market downturn.

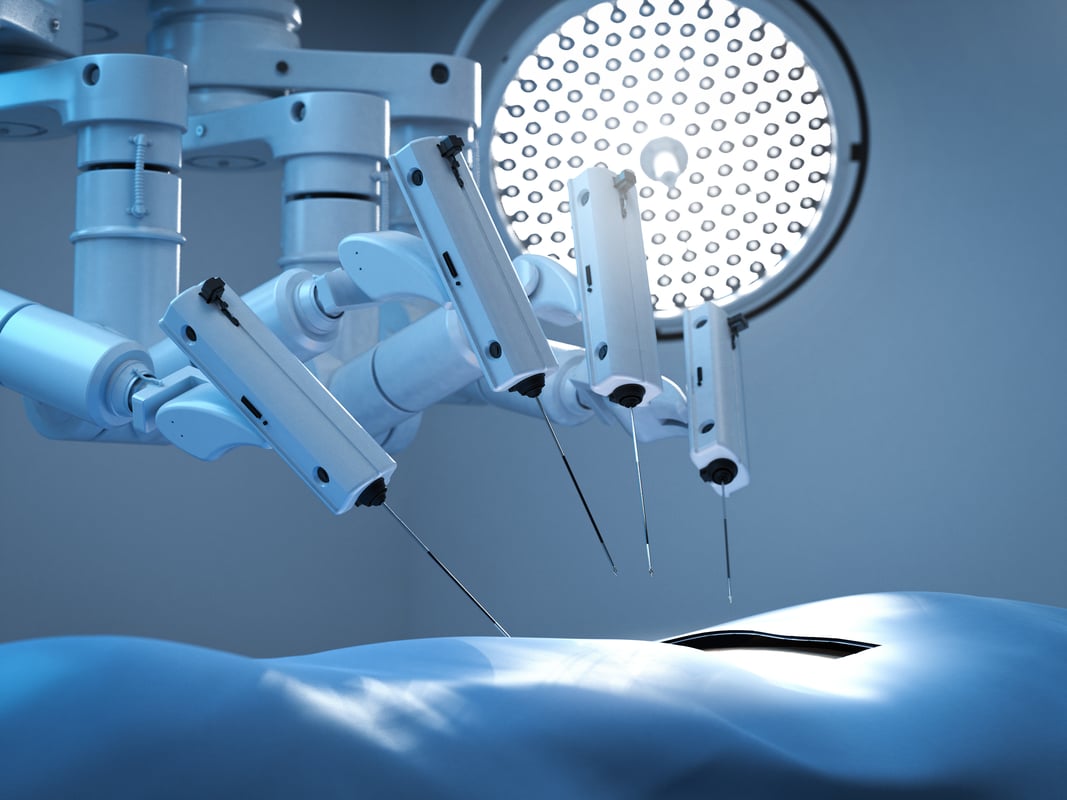

1. Intuitive Surgical

About 25 years ago, Intuitive Surgical became the first company to market a robot-assisted surgical system. With over 11,000 robotic systems installed across 74 countries, it's still the largest member of this lucrative industry.

Intuitive Surgical's stock price is down by 29% from the all-time high it reached earlier this year. Despite the recent drop, the stock has gained about 18,790% since its initial public offering.

NASDAQ: ISRG

Key Data Points

Other companies have their own robot-assisted surgical systems, but they're generally used to perform different procedures than Intuitive's da Vinci machines. That's because there are two big barriers to competition. First, getting the Food and Drug Administration (FDA) to green-light a new system for a specific procedure requires clinical trial data that shows it is at least equal to a da Vinci machine.

If a competing surgical system earns approval for the same procedures as da Vinci machines, switching costs present another huge barrier for competitors. Training surgeons to use a new system is an expense most hospitals would like to avoid.

Intuitive Surgical reported a 14% year-over-year gain in procedure volume during the second quarter. Between procedures, surgeons need to replace instruments and accessories that can only be purchased from Intuitive Surgical. By raising prices on those instruments, the company was able to record second-quarter revenue that rose 21% higher year over year.

Intuitive Surgical stock has been trading at the nosebleed-inducing multiple of 53.6 times forward-looking earnings expectations. That's not an unreasonable multiple to pay for such a rapidly growing business. Patient investors who wait for the next time the market crashes, though, could get in at a much more attractive valuation.

2. Vertex Pharmaceuticals

Cystic fibrosis is an inherited disorder that makes it hard to breathe for about 109,000 people around the world. Over the past 20 years, Vertex Pharmaceuticals' stock has risen 1,820% because it's the only company selling drugs that address the disease's underlying cause.

A majority of people born with cystic fibrosis between 2020 and 2024 are expected to reach age 65 or older. The median survival age for people born just 20 years earlier is only 34 years old. Credit for the improvement goes almost entirely to Vertex Pharmaceuticals.

NASDAQ: VRTX

Key Data Points

Hundreds of known mutations in the CFTR gene can cause the lungs to produce sticky mucus that is difficult to clear. Vertex's first CF treatment, Kalydeco, earned its first approval from the FDA in 2012, but it only addressed a small percentage of CF patients.

While Kalydeco's main patents could expire over the next several years, investors don't need to worry about a patent cliff. Last December, the FDA approved Alyftrek, a three-drug combination that works for a larger number of known CFTR mutations than previous treatments. Without any other CFTR modulators that appear competitive in clinical trials, it could be more than a decade before Vertex encounters significant competition for its CF franchise.

Shares of Vertex stock are already trading for a relatively low multiple of 22.7 times forward-looking earnings estimates. Picking the stock up now, or after the next market crash, looks like a smart move for patient investors.