CoreWeave (CRWV +6.55%) has been one of the hottest IPO stocks on the market this year. While it was a lackluster performer for its first month or so, mostly hovering in the vicinity of its $40 per share IPO price, it then began a two-month surge that lifted it to over $180.Currently, it's trading about 27% off of its all-time high, at prices in the neighborhood of $134.

With all of the artificial intelligence (AI) computing deals that have been announced in recent weeks, it's unusual for an AI-related stock not to be near its all-time high. This makes CoreWeave look like it could be an attractive investment -- but is this a buying opportunity or a trap?

Image source: Getty Images.

CoreWeave is an AI-focused cloud computing business

CoreWeave's business model is extremely simple: Purchase best-in-class graphics processing units (GPUs) from Nvidia, place them in servers in data centers, and rent out that computing capacity to AI hyperscalers. That's no different than what other cloud computing providers do, but what sets CoreWeave apart is that it optimizes its servers for AI workloads.

CoreWeave has attracted several big-name clients like Meta Platforms. Using its services allows those AI hyperscalers to access the AI computing power they need immediately, rather than having to wait for new computing infrastructure to be built.

NASDAQ: CRWV

Key Data Points

However, that raises the first concern investors may have about CoreWeave. Will its current clients be long-term customers, or are they just using its data centers until the new ones they are building are up and running? The fact that its most important customers are in the process of expanding their own AI infrastructure could become a long-term headwind for CoreWeave that limits its growth potential. The most likely scenario I see for the company is that its clientele will maintain deals with it as a backup in case one of their own data centers goes down or they need extra capacity when workloads peak. This limits the upside for the company, and is a huge red flag.

Still, CoreWeave is rapidly growing; there are clearly some companies that are finding value in its service. However, that value is coming at the expense of its shareholders, which could present issues for the longevity of the business.

CoreWeave is burning cash

In Q2, CoreWeave's revenue exploded 207% higher, rising from $395 million a year earlier to $1.2 billion. However, it's still unprofitable.

Normally, I'm OK when young and growing companies operate at a loss, but it doesn't make sense for CoreWeave to do so. Its business model is to buy a computing unit, place it in a data center, and then rent processing time on it, charging more money over the long term for that service than it costs to purchase and operate the processing unit over its lifespan.

According to one high-level Alphabet executive, the useful lifespan of GPUs is only one to three years. This means these GPUs must be replaced often, and if CoreWeave can't turn a profit now, it could have issues doing so in the future.

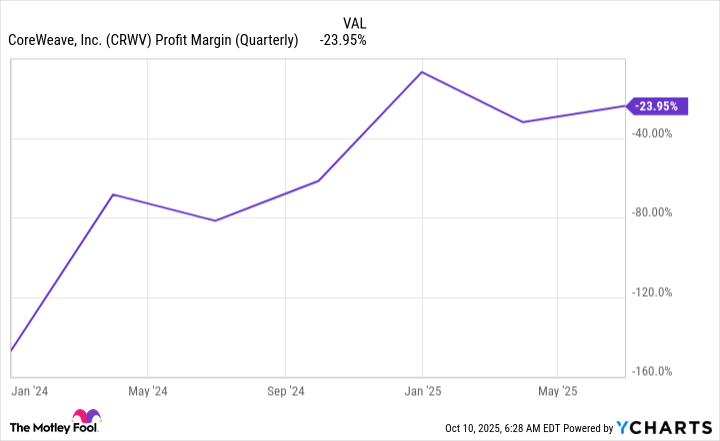

CRWV Profit Margin (Quarterly) data by YCharts.

Because it is essentially a commodity company that rents its products for their short lifespans, it needs to figure out how to turn a profit quickly. If it can't, investors should find other AI stocks to put their money into.

The reality is, it may be cheaper for tech companies to rent computing power from CoreWeave than it would be to build data centers for themselves, precisely because it is operating at a loss. If it were generating substantial profits, that cost effectiveness would likely no longer be there, and CoreWeave's customer base would be smaller.

This is a difficult market to operate in, and given the brief lifespans of GPUs, I think there are far better investment options out there than CoreWeave. Probably the best is Nvidia, as it supplies the GPUs that CoreWeave will have to replace at intervals. It is also going to sell increasingly more GPUs as AI-related demand for computing power grows. I'd rather invest in the highly profitable source of that computing hardware than a downstream buyer of it that is failing to operate profitably.