The energy sector is a bit out of favor right now. That's because oil prices have been relatively weak after a massive price spike that followed the end of the coronavirus pandemic. That was an unusual period, but commodity volatility is actually normal in the energy sector. And that is why you should be thinking about Chevron (CVX +2.06%), one of the smartest plays in the energy sector.

What does Chevron do?

Chevron takes a very practical approach to operating in what is a very volatile sector. It starts with its business model, which is integrated. That basically means the company has exposure across the entire energy sector, including the upstream (energy production), the midstream (pipelines), and the downstream (chemicals and refining). This diversification doesn't eliminate the impact of oil and natural gas price swings, but it helps to soften the peaks and valleys.

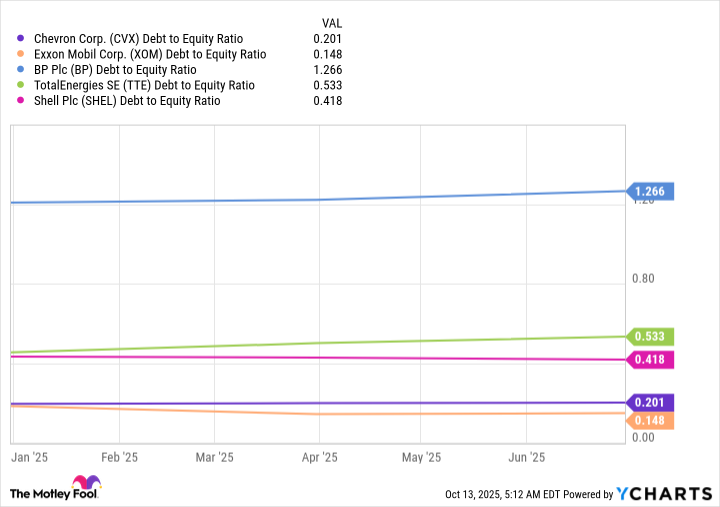

CVX Debt to Equity Ratio data by YCharts

On top of that, Chevron also takes great care with its balance sheet. At the end of the second quarter, Chevron's debt-to-equity ratio was roughly 0.2. That would be low for any company and it is also among the lowest of the company's closest peers. This gives management the leeway to take on debt during industry downturns so it can support its business and dividend. When energy prices recover, as they always have historically, leverage is reduced again.

The proof that this model works very well is seen in Chevron's 38-year history of annual dividend increases. The only competitor with a better dividend history is ExxonMobil (XOM +2.89%), which has 43 dividend hikes under its belt. Before you switch gears and start thinking about Exxon, there's one more factor to consider.

Image source: Getty Images.

Chevron's got a very attractive risk/reward profile

So Chevron's business is built to survive, but it is basically the same approach that Exxon has. And Exxon even has a lower debt-to-equity ratio, at around 0.15. In some ways, Exxon, which is a larger company, is actually a safer choice. But it isn't drastically safer, given that energy swings hit its business in the same way that they hit Chevron's business. You have to take on some risk with either one.

That's where a comparison of dividend yields comes into play. The average energy stock has a yield of roughly 3.2%. Exxon's yield is currently around 3.6%. And Chevron's yield is nearly 4.6%. Investors aren't taking on drastically more risk with Chevron, but they are getting a very meaningful boost in yield. You can look at that as 1 full percentage point more dividend yield or an over 25% increase in the income you'll generate with Chevron over Exxon.

NYSE: CVX

Key Data Points

It is generally not a smart idea to chase yield, which can lead you into high-risk investments. However, Chevron isn't really a high-risk investment, as highlighted above. There are some idiosyncratic risks specific to Chevron, including a large and long-delayed acquisition that is currently being integrated and the company's politically charged investment in Venezuela. But these issues are unlikely to derail the company over the long term.

If you are balancing risk and reward, Chevron stands out in the energy patch for dividend investors.

All energy stocks come with risk

The big story here is that every single energy stock comes with risk because of the inherent volatility of the commodity-driven sector. Chevron, while facing company-specific risks of its own right now, has proven it can survive the industry's broad swings while rewarding investors well via a progressive dividend.

Add in the higher-than-average dividend yield and it looks like smart income investors should give Chevron strong consideration in the out-of-favor energy patch right now.