Archer Aviation (ACHR +0.00%) struggled to lift off on the stock market Wednesday. The company's shares only gained 0.1% that trading session, as investors processed the potential pros and cons of the company's latest acquisition. That performance trailed the S&P 500 (^GSPC 0.06%), which inched up slightly higher by 0.4%.

Buying a large IP portfolio

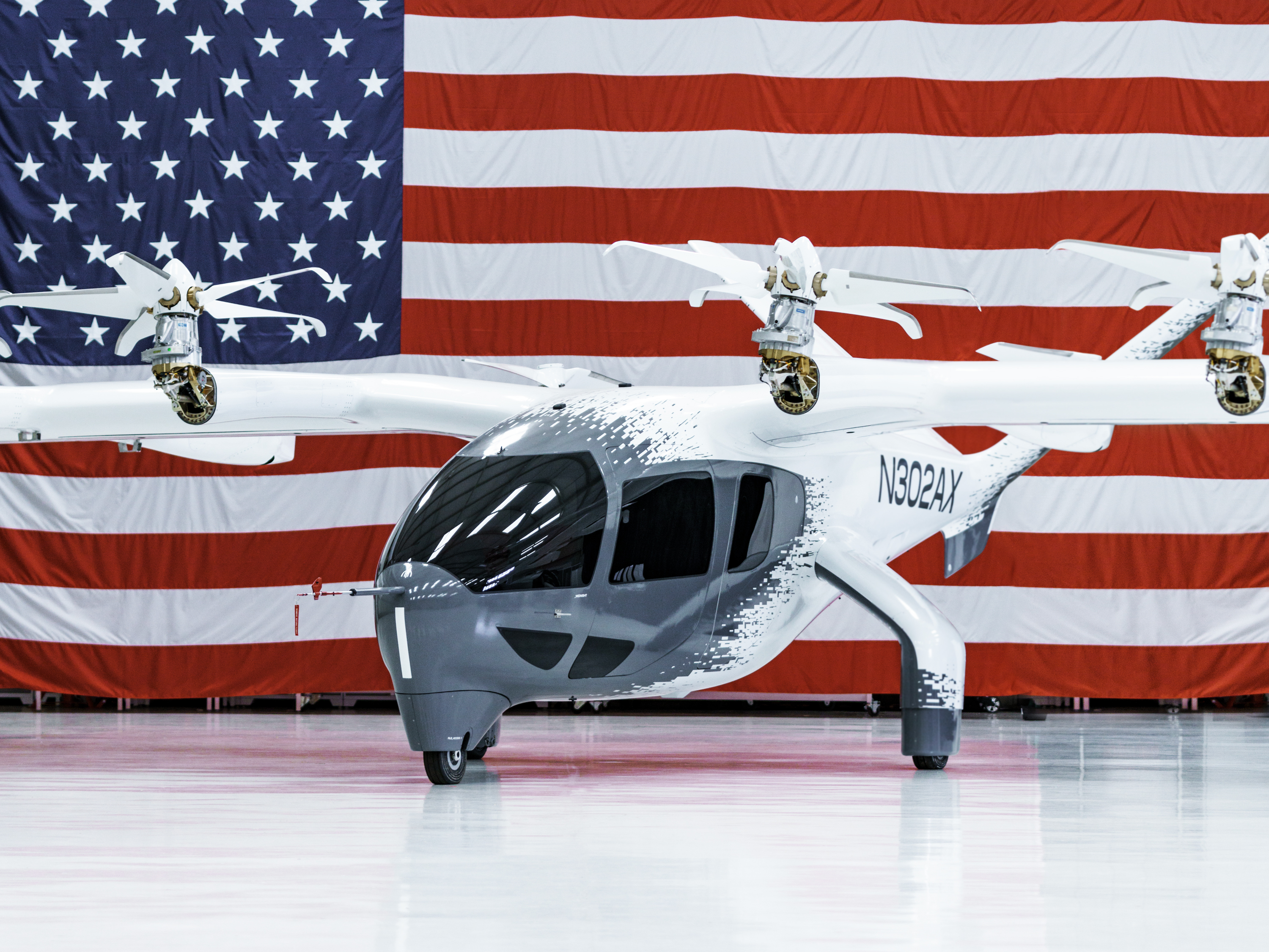

Archer, a next-generation industrial company in the business of developing electric vertical takeoff and landing (eVTOL) aircraft, revealed that morning that it won a patent portfolio held by peer Lilium in an auction. Its winning bid was 18 million euros ($20.8 million).

Image source: Getty Images.

For its money, Archer is gaining possession of roughly 300 next-generation patents related to the aircraft technology that it's developing. These pieces of intellectual property (IP) cover such areas as flight controls, aircraft design, battery management, and others.

In its press release, Archer said the purchase "strengthens Archer's leadership position in next-generation electric aviation and reinforces its commitment to ensuring the U.S. leads the way when it comes to critical eVTOL technology."

NYSE: ACHR

Key Data Points

A cash drain

While Archer has plenty of cash in its coffers -- upwards of $1.7 billion as of the end of June -- a $20 million-plus outlay is a big financial hit. Some investors are likely worried that this isn't the optimal use of the company's greenbacks, considering that it continues to book deep bottom-line losses.