Earlier this year, Berkshire Hathaway (BRK.A +0.15%)(BRK.B 0.42%) made the announcement that everyone knew was coming, but nobody really wanted to hear. The company's CEO, world-famous investor Warren Buffett, is going to retire at the end of 2025. Here are three reasons you might still want to buy Berkshire stock like there's no tomorrow.

1. Everyone knew what was going to happen at Berkshire Hathaway

The only thing that was unknown about Warren Buffett's retirement was the exact date. That was the key missing piece that was announced earlier in 2025, with the end of the year set as the handoff of the top job to a new CEO.

In fact, even the name of the incoming CEO, Greg Abel, has been known for some time. The CEO transition news should not be a shock to anybody, even if people had hoped that Buffett would remain in the top post at the conglomerate forever.

Image source: Getty Images.

The key here is that his replacement isn't some unknown quantity. Abel has worked for the company for decades. In recent years, he has been intimately involved in major decisions as well.

So he is steeped in Warren Buffett's approach to investment and management. Abel will run Berkshire differently because he is not Buffett, but his approach is likely to be very similar.

2. Cash is good and bad, but mostly good

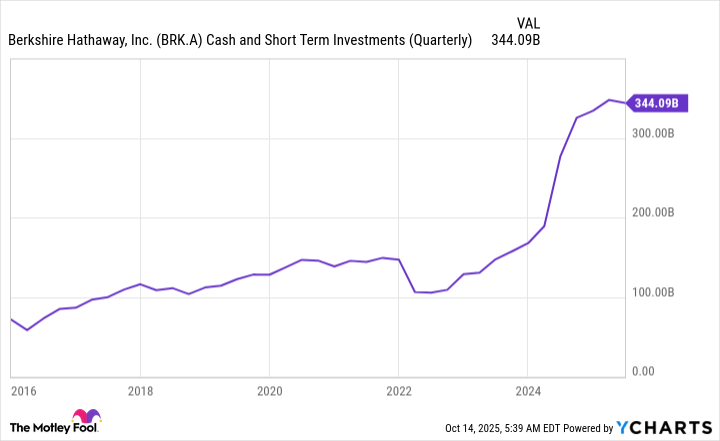

One of the things that Buffett is handing off to Abel is a cash pile that, at the end of the second quarter, was more than $340 billion. That's a lot of cash to be carrying on a balance sheet, and it will act as a drag on financial performance in the near term. That's not good, per se, but it wouldn't have been any different if Buffett had remained CEO.

The long-term picture is a lot brighter regarding the cash. Right now, the S&P 500 index (^GSPC 0.53%) is trading near all-time highs. The cash buildup is a sign of discipline, since the company isn't simply buying things to spend money. It wants to ensure it gets a good value, and that's hard to come by when stock prices are so lofty.

However, if there's a recession or a bear market, Berkshire will have a solid cash cushion to protect its business. And, more to the point, it will have a lot of firepower to buy things when prices are more attractive.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts.

So Berkshire Hathaway is getting a new CEO while the business itself is in very strong financial shape.

3. Buffett is setting up Abel for success

Leaving Abel a large cash hoard is one way in which Buffett is giving his successor a leg up. And there are other ways, too. For example, just as Buffett is departing, Berkshire agreed to buy the chemicals business of Occidental Petroleum (OXY +2.24%). The deal is big at around $9.7 billion, but it will barely put a dent in the cash the company has.

If the deal is successful, Abel can take credit. If it fails to impress, he can leave the blame for Buffett, who lined up the deal in the first place. That's a nice handoff gift. And there's one more important factor here.

NYSE: BRK.B

Key Data Points

Buffett isn't actually leaving the company, he's just leaving the CEO post. He will remain as the chairman of the board of directors, so he will technically still be Abel's boss. Thus, he will be available to Abel as the new CEO takes the reins. That could end up being an even more material helping hand than the Oxy deal.

The CEO shift is not a reason to avoid Berkshire Hathaway

Now that investors know so much about the CEO transition set to take place at Berkshire Hathaway, there's no reason to fear it anymore. Sure, things will be different, but Abel is steeped in Buffett's ways.

The company is also financially strong, with plenty of cash to invest if there is a market decline. Meanwhile, Buffett isn't leaving Abel out on a ledge, since he is handing off the acquisition from Occidental Petroleum and will still be around to help.