It's been about a year since Goldman Sachs (GS 0.57%) analysts predicted slow returns in the S&P 500 (^GSPC 0.83%) for the next decade. Due to historically lofty stock valuations and extremely concentrated holdings in any market cap-weighted market index, Goldman's team suggested stepping away from the S&P 500 for a while. Instead of -- or in addition to -- standard index trackers such as SPDR S&P 500 Trust (SPY 0.80%) and Vanguard S&P 500 ETF (VOO 0.81%), they suggested equal-weighted funds. The Invesco S&P 500 Equal Weight ETF (RSP +0.20%) would be one reasonable example.

Let's see how Goldman's bearish forecast has worked out one year later.

Image source: Getty Images.

How the S&P 500 has performed since Goldman Sachs sounded the alarm

In the 51 weeks since Goldman's research report, the S&P 500 grew even more lopsided.

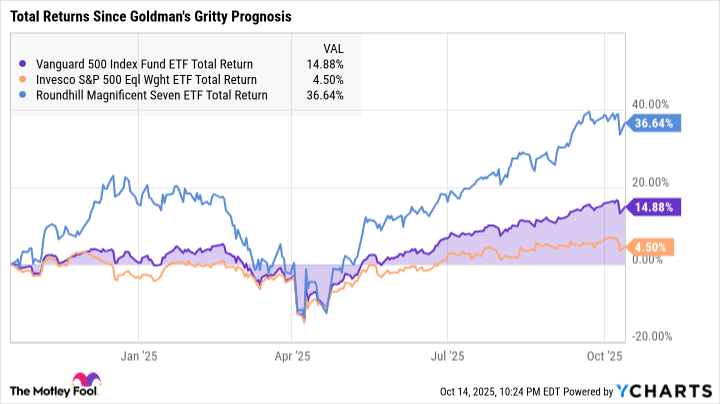

The index posted a total return of 14.9% between the gloomy market report and October 14, 2025. An equal-weighted S&P 500 tracker gained 4.5% over the same period while the Roundhill Magnificent Seven ETF (MAGS 1.80%) enjoyed a 36.6% surge:

VOO Total Return Level data by YCharts

So the market has not reversed course since October 2024. If anything, the Magnificent 7 giants have soared to new heights as the artificial intelligence (AI) boom continued to drive Wall Street's narrative. AI hardware leader Nvidia (NVDA 2.09%) is the most valuable company on the planet with a $4.37 trillion market cap, far ahead of Apple's (AAPL 1.01%) second-place value of $3.82 trillion.

At the same time, the market's nearly 15% return is far ahead of the predicted long-term average of roughly 3%. The Goldman report hasn't been accurate at all so far.

Why Goldman Sachs might still have the last laugh (someday)

Then again, Goldman's analysts weren't trying to pinpoint market trends for 2025. Their report is an updated long-term view with a 10-year horizon. A downturn, recession, or bear market in the next few years could very well make the report look prophetic after all. It's too early to pass a permanent judgment on it.

And on that note, I largely agree with Goldman's assumptions. The stock market is indeed supported by an unprecedented AI boom, where a few companies are gaining market influence over smaller names. This situation could go on for a few more years, but it can't last forever. And what happens if and when the AI-driven hypergrowth fades out? Let's just say that I would rather own equal-weighted funds than cap-weighted ones at that point.

NYSEMKT: RSP

Key Data Points

How I'm handling the S&P 500 drama in my own portfolio

In fact, I like Goldman's thinking so much that I started taking actions in the same vein a month ago. Mind you, I reached similar conclusions without reading the Goldman report. The valuation and concentration issues were simply too obvious to miss.

So far, my modest Invesco S&P 500 Equal Weight position has performed very similarly to the cap-weighted version. And it's a smaller position, with the Vanguard S&P 500 ETF remaining one of my largest holdings. Still, last Friday provided a dress rehearsal for a full-blown bear market, and the equal-weighted fund posted a slightly smaller dip that day.

I'm not talking about game-changing differences here. The Vanguard S&P 500 fund is still one of the best ways to invest in the broader market for the long haul, no matter what shenanigans the economy is up to. And if you own both fund types for a decade or more, the cap-weighted version tends to come out ahead by a small margin.

You can't really go wrong with either fund. But if you're putting new money in the market right now, you should at least consider grabbing a few equal-weighted shares. Whether Goldman's dire market predictions turn out to be perfectly accurate or not, I don't mind being prepared for a variety of long-term market trends.