Got some idle cash you're ready to put to work (say $500), but you aren't quite sure where to put it? Or perhaps the recent artificial intelligence (AI)-driven run-ups by several of the market's most popular stocks have you worried that valuations have gotten a bit frothy.

Whatever has you lingering on the sidelines, you can never really go wrong with an index fund like the SPDR S&P 500 ETF Trust (SPY 0.55%) or the Vanguard S&P 500 ETF (VOO 0.48%), both of which are built to mirror the performance of the S&P 500 (^GSPC 0.53%).

Right now, however, your better bet might be the Invesco S&P 500 Equal Weight ETF (RSP +0.46%).

Image source: Getty Images.

Major indexes are imbalanced enough to worry about it

Equal-weight funds aren't complicated. While the sizes of most index exchange-traded funds' holdings are proportional to their constituents' market caps, for equal-weight funds, all positions are roughly the same size regardless of the underlying company's size. In the case of the Invesco S&P 500 Equal Weight ETF, each of its 500 positions only accounts for about 0.2% of the fund's total holdings. Naturally, as stocks rise and fall, those positions change somewhat, so at the end of each quarter, the fund's managers rebalance every position back to equality.

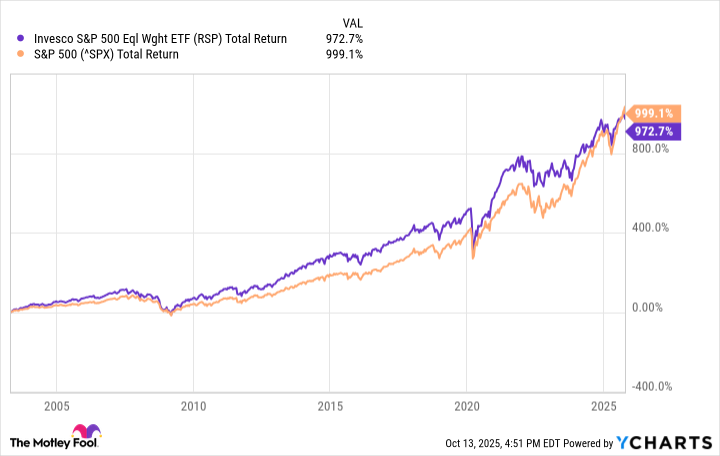

Truth be told, most of the time, this difference in strategy doesn't really matter much. Stocks tend to move as a herd, with most of them rising and falling over time by about as much as the average. That's why the Invesco S&P 500 Equal Weight ETF typically performs about as well as SPY, VIG, and of course, the S&P 500 itself.

Data by YCharts.

The past three years have been particularly unusual ones, though. Due to the explosive rise of the artificial intelligence trend, a small number of already-large companies have become much, much bigger. The market's five biggest companies now account for about 25% of the S&P 500's total value, in fact, while its 10 biggest names make up about 40%. That's not exactly the kind of diversification most investors are looking for when they step into an index fund. Moreover, mostly thanks to the increased investor attention being paid to AI, numbers from Yardeni Research indicate the so-called "Magnificent Seven" stocks alone have accounted for roughly one-third of the S&P 500's total gains since 2022.

Due for a valuation correction

In and of itself, this lopsidedness isn't inherently a recipe for disaster. People buy index funds to invest in a cross-section of the market, and most index funds still offer that. It just so happens that the broad market isn't all that well-balanced right now. These things happen, but the issue usually self-corrects eventually, one way or another.

However, the correction to this particular problem could be more than a little bit painful for patient holders of index-based ETFs.

See, while few would dispute that the market's current mega-companies like Nvidia, Microsoft, and Alphabet should be the world's biggest public companies because of what they're doing with and for AI, their earnings-based valuations are stretched, to say the least. Yardeni's data reveals that the average Magnificent Seven stock's forward price/earnings ratio now stands at an eye-popping 29.5, versus the S&P 500's weighted average of just under a still-frothy 23. Remove the Magnificent Seven's sky-high ratios from the calculation, though, and the S&P 500's forward P/E multiple stands at a historically reasonable 20.1.

In other words, the only real valuation correction that needs to be made is to the prices of a small handful of massive technology companies. Most everything else is valued relatively fairly, and should (in theory, anyway) stand up to any bearish pressure prompted by a pullback of the market's most popular tickers.

It's all about balancing risk and reward

There's the rub, of course -- most tickers aren't overvalued right now. But just because they aren't overvalued doesn't mean they won't suffer if shares of the megacaps like Microsoft and Broadcom finally cool off. Right or wrong, stocks tend to move as a herd.

There's also no assurance that the much-needed valuation correction of the Magnificent Seven stocks is in the immediate offing ... if it's ever going to happen. It's possible that these stocks will simply hold their ground here and wait for their earnings to catch up. The market's other stocks could drift higher while we're waiting, in step with their own earnings growth. Nobody really knows for sure.

NYSEMKT: RSP

Key Data Points

What we do know as investors is that the "right" move is to attempt to maximize our potential for gains while minimizing the risks we take in doing so. Three years ago (coming out of the COVID-19 pandemic), for instance, it made sense to own a cap-weighted fund like the SPDR S&P 500 ETF Trust or the Vanguard S&P 500 ETF to capitalize on whatever the post-pandemic economic recovery looked like. We now know it was led by tech, and AI tech in particular. Now, though, it makes more sense to contain your risk of overexposure to technology stocks by owning an ETF that holds plenty of everything else.

So, if you're looking for an investment like this that's not only simple and easy to own, but also allows you to comfortably remain in the market -- which is key -- that's the Invesco S&P 500 Equal Weight ETF, only 14% of which is made up of tech stocks, and more than 15% of which is made up of industrials.

By the way ... if you already happen to own something like VIG or SPY, this doesn't necessarily mean you should sell your shares of either one. All of these ETFs should be OK in the long run. But the Invesco S&P 500 Equal Weight ETF is just what you may need if you're looking for a way to play a little more defense for the time being without getting entirely out of the market.