Quantum computing investing is not an easy field to pick stocks in. There's a lot of complex knowledge needed to understand the technology, making it hard for investors to discern which company is currently leading the way. Furthermore, the space is rapidly shifting, with new announcements occurring every week that change the landscape.

This makes it difficult to be a quantum computing investor, but I think there is a way to spread out the risk a bit and still have exposure to this important and emerging space. By taking a basket approach and picking a few stocks, investors can increase their odds of success by sacrificing maximum return for a better chance of success. I think this is the best way to approach quantum computing, and I've got five picks that help make up a quantum computing basket.

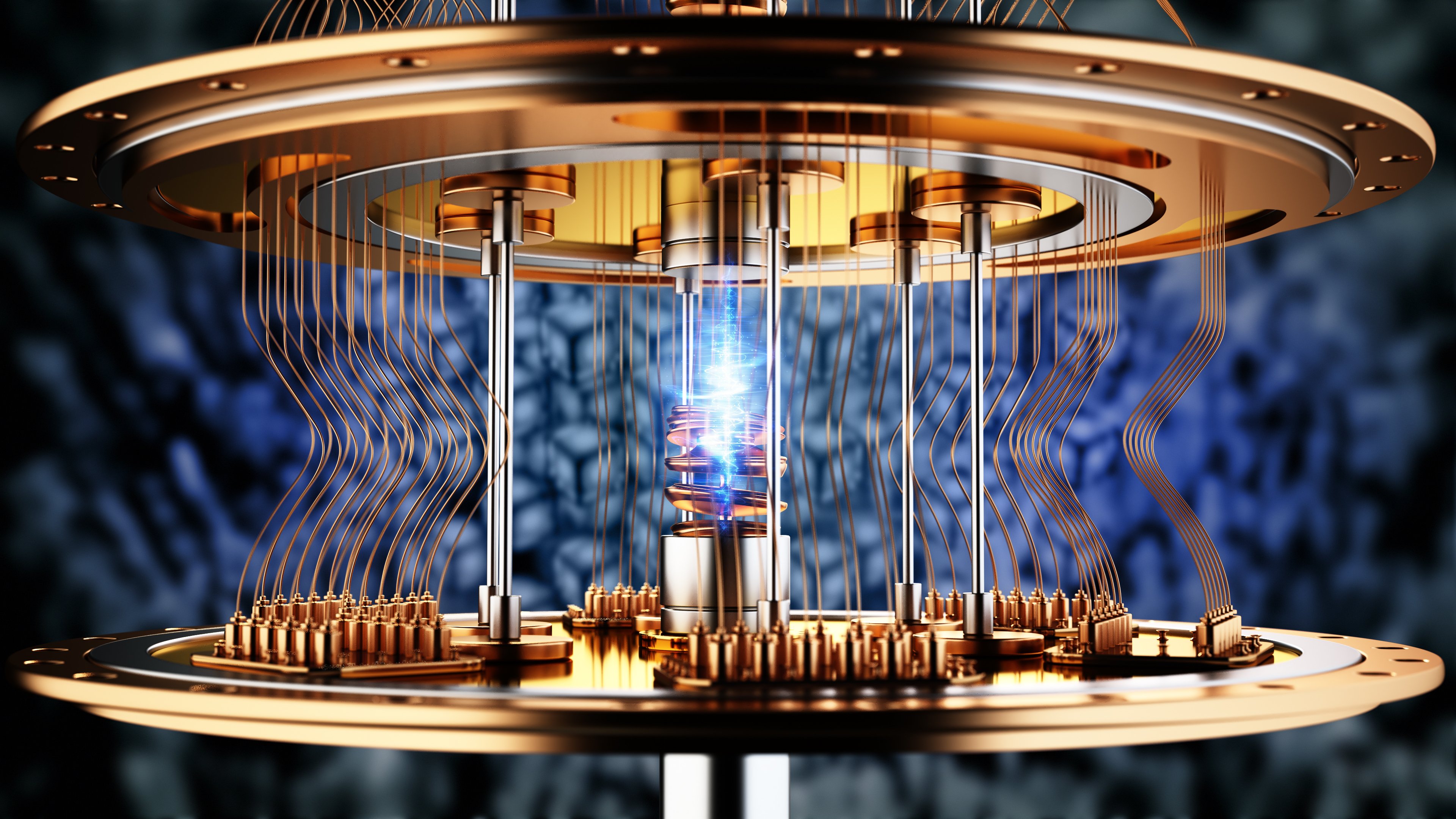

Image source: Getty Images.

Quantum computing pure plays

First, let's look at some pure plays in this space. These companies are the most exciting, as they're relatively small but have the chance to turn into giant tech companies if their technology is successful.

First is IonQ (IONQ +6.75%). It was the first quantum computing pure play company to go public, and has seen tremendous success over the past year. It's taking a unique approach to the quantum computing realm, utilizing a trapped-ion technology versus the more popular superconducting option.

A trapped-ion quantum computer is inherently more accurate, but trades off processing speed. Still, with quantum computing accuracy being the biggest problem surrounding widespread commercial adoption, investing in a company whose technology is a leader in solving this problem is a wise idea.

NYSE: IONQ

Key Data Points

Next is Rigetti Computing (RGTI +3.72%). Rigetti is deploying the superconducting quantum computing approach and has seen some recent successes with it. On Sept. 30, Rigetti announced the sale of two quantum computing systems that totaled $5.7 million.

While that's not the billion-dollar enterprise many investors picture this technology having, it's a start. Furthermore, because these customers likely explored other quantum computing options available, it's a big deal that they decided to pick Rigetti over some others.

NASDAQ: RGTI

Key Data Points

Last on the pure play list is D-Wave Quantum (QBTS +0.38%). D-Wave Quantum is taking a completely different approach to quantum computing than IonQ or Rigetti. It's developing a quantum annealing computer, which can't be used for general-purpose computing like the other two options. Instead, quantum annealing focuses on solving optimization problems, which is incredibly useful for weather patterns, logistics networks, and artificial intelligence (AI) training.

If D-Wave can develop a winning option with this approach, it could dominate the fields that are recognized as having the most value for quantum computing.

Legacy tech players

Next are some legacy tech players competing in the quantum computing space. While these options don't have nearly the upside of the pure plays, they're also less risky. If IonQ, D-Wave, or Rigetti fail to produce a commercially viable product, it's likely that their stock will go to zero. For Alphabet (GOOG 0.85%) (GOOGL 0.83%) and Nvidia (NVDA 0.44%), they have other primary businesses that will ensure their viability for years to come.

NASDAQ: GOOGL

Key Data Points

Alphabet is seen as a leader in quantum computing from the big tech standpoint. It's developing quantum computing for internal use, but also to be rented out via its cloud computing service, Google Cloud. If Alphabet can develop its own quantum computer in-house, it can increase its margins in this area, as it won't have to pay for other companies' profits, as it does when it buys Nvidia's graphics processing units (GPUs) now. Alphabet has resources that the pure play companies can only dream about, and in a trend that needs heavy capital influx to develop the product, Alphabet could be a huge winner.

Last is Nvidia. Nvidia currently produces the most powerful classical computing units available, and has no plans to develop a quantum computing option. However, Nvidia sees that the real value in quantum computing will be a hybrid approach that uses its GPUs alongside a quantum computing unit. To ensure its hardware is used in this hybrid approach, Nvidia is evolving its leading software, CUDA, for quantum computing, renaming it CUDA-Q.

CUDA software is a primary reason why Nvidia has been so successful in the AI arms race so far, and by offering a quantum computing alternative, it will ensure that its computing products will be used for years to come, even if quantum computing takes the world by storm.