Berkshire Hathaway (BRK.A 0.64%)(BRK.B 0.09%) is synonymous with legendary investor Warren Buffett. Buffett, who took over as chief executive officer of the then-struggling textile company in 1965, has delivered investors incredible returns of nearly 20% compounded annually. Put differently, if you'd invested $100 in Berkshire Hathaway back then, that investment would be worth more than $5.5 million today.

While it has done well, Berkshire is currently undergoing a transition in leadership. Buffett announced earlier this year that he would step down from the top role at the company at the end of 2025.

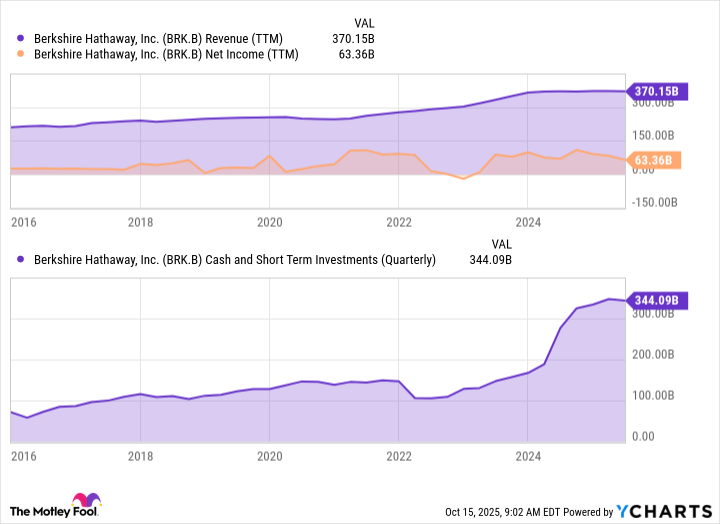

Berkshire Hathaway remains a highly diversified conglomerate with money-producing businesses spanning multiple industries. The company also boasts a vast cash stockpile that gives its new leadership flexibility for investing in stocks or acquiring companies outright.

Berkshire has been a steady compounder for investors. Could buying the stock today set you up for life? Let's dive into the business and explore what's next for the conglomerate.

Image source: The Motley Fool.

Berkshire Hathaway is a cash-generating machine

Berkshire Hathaway operates a diversified group of businesses, spanning major sectors such as insurance, freight rail transportation, and utilities and energy.

Some of its core businesses include GEICO, the Berkshire Hathaway Reinsurance Group, the Burlington Northern Santa Fe railroad, and Berkshire Hathaway Energy. These are supplemented by numerous manufacturing, service, and retailing operations, including Precision Castparts, Clayton Homes, McLane Distribution, and Pilot Travel Centers.

One significant component of Berkshire's core operations is its numerous insurance businesses. Buffett loves insurance because it generates something called float. Float, which is the pool of premiums collected up front that can be invested before claims are paid, acts as a low-cost source of capital that fuels Berkshire Hathaway's other investments. This float has grown substantially, reaching about $171 billion at the end of 2024.

Berkshire can invest this float in short-term instruments, such as U.S. Treasury bills, which generate interest income for the company. As policies lapse over time, Berkshire retains the remaining amount after paying claims, which gives it a substantial cash reserve for investment purposes.

BRK.B Revenue (TTM) data by YCharts

Looking toward the future of a Berkshire Hathaway post-Warren Buffett

Investors may be concerned about Berkshire's future after Buffett steps down at the end of this year. After all, Buffett, alongside his right-hand man, the late Charles Munger, has displayed stellar investing acumen and patience over the years.

Investors will want to get familiar with Todd Combs and Ted Weschler. Buffett and Munger handpicked the two in the early 2010s to help manage Berkshire Hathaway's vast investment portfolio and prepare for the company's long-term succession.

Both brought strong track records from their hedge fund backgrounds: Combs from Castle Point Capital, where he specialized in financials, and Weschler from Peninsula Capital Advisors, where his returns exceeded 23% annually from 1999 to 2011.

Since joining, they've gradually taken over billions in Berkshire's equity portfolio and helped modernize its holdings. One of their most influential moves was encouraging Berkshire's position in Apple, a company Buffett once avoided for being too tech-oriented. The investment has since become Berkshire's single most valuable stock holding, contributing tens of billions in gains.

Berkshire Hathaway is an enormous conglomerate with a huge cash stockpile of nearly $340 billion. The company looks well positioned to continue generating steady cash flows from its core businesses, and under its new investing lieutenants, could grow its public stock portfolio, too.

NYSE: BRK.B

Key Data Points

Could buying Berkshire Hathaway set you up for life?

If Berkshire delivers average annual returns of 11% (which it has since 2000), a $10,000 investment would be worth $80,623 after 20 years and $228,923 after 30 years. This demonstrates the power of compound returns over time and how single stocks can significantly contribute to your investment journey.

Berkshire owns numerous businesses, so investors could feel comfortable allocating a larger proportion of their portfolios to this stock. However, it remains essential to maintain a diversified portfolio of stocks that you contribute to over time.

Berkshire is an excellent company that is diversified across the economy. I think Buffett's hand-picked investing lieutenants could breathe life into its investment portfolio. If Buffett and Munger were as adept at selecting successors as they are with stocks, then Berkshire investors should be in good hands for years to come.