The benchmark S&P 500 (^GSPC 0.06%) hosts 500 companies from 11 different sectors of the economy, so it's extremely diversified. It gives investors exposure to the high-growth technology stocks leading the artificial intelligence (AI) revolution, while balancing them out with the biggest banks, retailers, energy companies, and more.

But then there is the S&P 500 Growth Index, which exclusively holds around 216 of the best-performing growth stocks from the regular S&P 500, and excludes the rest. As a result, it consistently delivers much higher returns.

The Vanguard S&P 500 Growth ETF (VOOG +0.07%) is an exchange-traded fund (ETF) that tracks the performance of the S&P 500 Growth Index. Had you parked $10,000 in it 10 years ago, here's the eye-popping amount you'd be sitting on today.

Image source: Getty Images.

Large positions in some of the fastest-growing stocks

The S&P 500 Growth Index selects stocks based on factors like their momentum and the sales growth of the underlying companies. Therefore, since so many tech companies are ticking those boxes right now, it's no surprise the information technology sector has a whopping 42.6% weighting here, compared to just 34.8% in the S&P 500.

Each of the world's three largest companies are in the information technology sector: Nvidia, Microsoft, and Apple. They have a combined value of $11.9 trillion.

The top 10 holdings in the Vanguard S&P 500 Growth ETF include several tech and tech-adjacent stocks, including Nvidia, Microsoft, and Apple. The table displays their weightings in the Vanguard ETF relative to their weightings in the S&P 500.

|

Stock |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Nvidia |

14.58% |

7.95% |

|

2. Alphabet |

8.17% |

4.46% |

|

3. Microsoft |

6.41% |

6.73% |

|

4. Apple |

5.57% |

6.60% |

|

5. Meta Platforms |

5.10% |

2.78% |

|

6. Broadcom |

4.97% |

2.71% |

|

7. Tesla |

4.00% |

2.18% |

|

8. Amazon |

3.96% |

3.72% |

|

9. Eli Lilly |

1.94% |

1.06% |

|

10. Visa |

1.86% |

0.99% |

Data source: Vanguard. Portfolio weightings are accurate as of Sept. 30, 2025, and are subject to change.

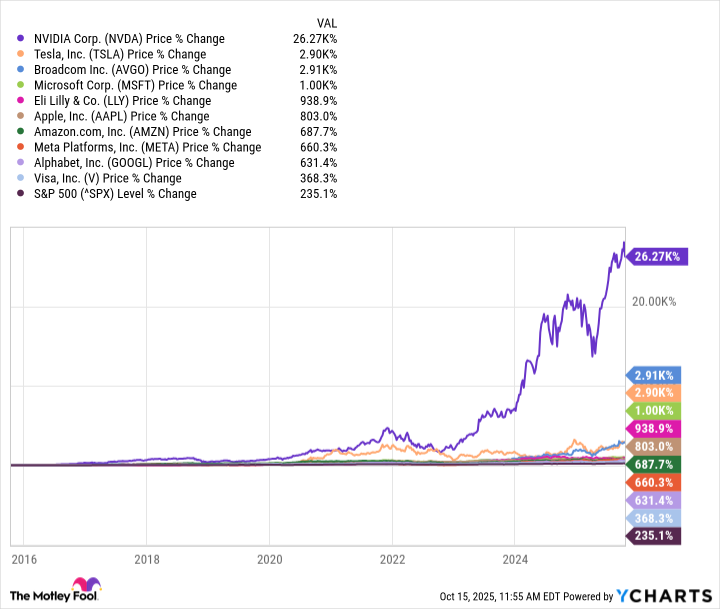

Those 10 stocks have delivered a median return of 870% over the last decade, obliterating the 235% gain in the S&P 500. The S&P 500 Growth Index assigns most of them a much higher weighting than does the S&P 500, which is the source of its outperformance.

A return of 400% over the past decade

The Vanguard S&P 500 Growth ETF has delivered a compound annual return of 16.8% since its inception in 2010, crushing the S&P 500, which has gained 13.8% per year over the same period.

However, the Vanguard ETF has generated an accelerated annual return of 17.5% over the last 10 years specifically, thanks partly to massive contributions from stocks like Nvidia, Tesla, and Broadcom, which lead the way in areas like semiconductors, AI, electric vehicles, and autonomous driving.

Had you invested $10,000 in the Vanguard ETF a decade ago, it would be worth $50,100 today, representing a total return of 400%.

NYSEMKT: VOOG

Key Data Points

It's unrealistic to expect any ETF to grow at this pace forever, because even the best companies eventually run into headwinds. Take Nvidia, for example -- its H100 data center chip was the best in the world for developing AI in 2023, earning a staggering 98% market share. The company continues to grow rapidly, but competitors like Broadcom and Advanced Micro Devices are nipping at its heels. As a result, Nvidia's fastest revenue growth rates are almost certainly in the rearview mirror.

Another example is Meta Platforms. Around 3.5 billion people use one of its social media applications like Facebook, Instagram, and WhatsApp every single day, which is almost half the population of the entire world. Therefore, it will be increasingly difficult to find new signups unless there is significant population growth.

With all that said, the Vanguard ETF could deliver above-average returns for at least the next few years on the back of powerful themes like AI, which is forecast to continue creating trillions of dollars of value. There is no guarantee the ETF will grow by another 400% over the next decade, but it could certainly be a great buy for investors looking to beat the S&P 500.