Artificial intelligence (AI) stocks have driven the stock market higher in recent years, but this isn't the only hot technology that could transform the way the world operates. Investors also have been turning to companies operating in the field of quantum computing -- a technology that may make today's unsolvable problems ones that could be resolved in a flash.

And one of the companies that aims to do just this is IonQ (IONQ -4.04%), a quantum player that stands out thanks to its method of tackling this complex technology. Investors already have recognized IonQ as a potential future winner as they've piled into the stock -- driving it to an increase of more than 1,200% over the past three years. Now the question is: Is it too late to buy this possible quantum computing star after such a performance?

Image source: Getty Images.

Solving complex problems

So, first, before diving into the IonQ story, we'll start with a quick bit about quantum computing in general. The technology is seen as the key to unlocking answers to problems that are too complex for today's classical computers. The computer of today works by storing and processing data as a zero or a one through the use of bits. A quantum computer, instead of bits, relies on qubits -- and qubits can process data as a zero, a one, or a combination of both. And when qubits are combined, they quickly can scale up to tackle the most difficult of problems.

Today, well-established tech giants such as Alphabet and Microsoft are working on quantum technology, but a handful of pure-play quantum computing players also have emerged -- and IonQ is among these.

In fact, IonQ has pretty big ambitions, aiming to become the Nvidia of quantum computing. Nvidia isn't just a chip designer, but offers a full range of products and services to AI customers, and IonQ aims to do the same in the quantum space by building out its offerings through internal development and acquisitions.

IonQ's business today

Right now, the company sells quantum hardware and networking products along with related services -- and it makes its quantum computers accessible to customers through major cloud platforms, Microsoft Azure, Amazon's Amazon Web Services, and Alphabet's Google Cloud. IonQ also offers consulting services, advising companies about how they can use quantum computing in their businesses. Eventually, IonQ's goal is to sell complete quantum computing systems -- but this may take some time as the technology still is in the development stages.

As mentioned earlier, IonQ stands out as it doesn't use the most common of qubit types, superconducting qubits, to operate. Instead, the company uses trapped-ion technology. Superconducting qubits have proven to be faster so far, but trapped ions have led to higher reliability. Both techniques have their strengths, and as development continues, they may see improvements in their areas of weakness, so it's too soon to say which technique will dominate over the long term. But at this stage, with high error levels being a problem in quantum computing, the trapped-ion method's accuracy could be a plus.

Gains in revenue but deepening losses

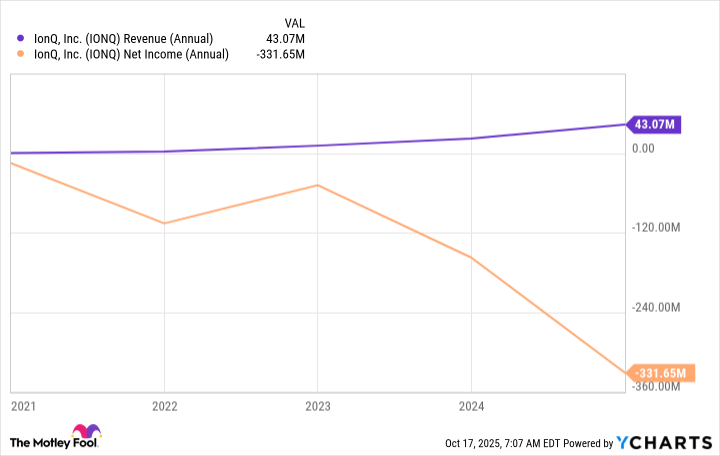

IonQ's revenue has advanced over the past few years, but as you might expect when developing a new technology, the company's losses have deepened.

IONQ Revenue (Annual) data by YCharts

This isn't surprising as IonQ -- and others in this space -- must invest in order to build the quantum computers of the future.

So now, let's return to our question: Is it too late to buy IonQ after its enormous gain over the past few years? Before making any decisions, it's important to consider your investment style. IonQ comes with risk today because the company is investing heavily in a technology that may take a number of years to develop -- and that means significant revenue growth and profitability may be many years away too. As with any newish technology, early on, it's difficult to say what the landscape will look like several years down the road.

All of this means IonQ isn't the right choice for you if you're a cautious investor. But, if you can handle some risk, you may consider adding a few shares of IonQ to your portfolio even after its great gains. This is because, if IonQ does reach its goal of becoming the Nvidia of quantum computing or even comes close, the stock could explode higher over the long run.