Artificial intelligence (AI) is one of the most transformative technologies in history, and as such, is full of investment opportunities. But choosing individual AI stocks can be tricky.

Fortunately, there are several artificial intelligence ETFs that allow investors to get exposure to AI without the homework involved with creating a portfolio manually. But there's one that stands out from the pack, and it's the Ark Autonomous Technology and Robotics ETF (ARKQ 3.04%).

Here's a rundown of what this ETF invests in, why it's different from all the other AI ETFs in the market, and why it could deliver big gains over the next several years.

Image source: Getty Images.

Meet the Ark Autonomous Technology and Robotics ETF

As mentioned, there are several major artificial intelligence ETFs you can choose from. However, most are index funds that are weighted heavily toward the largest megacap AI stocks like Nvidia and Microsoft.

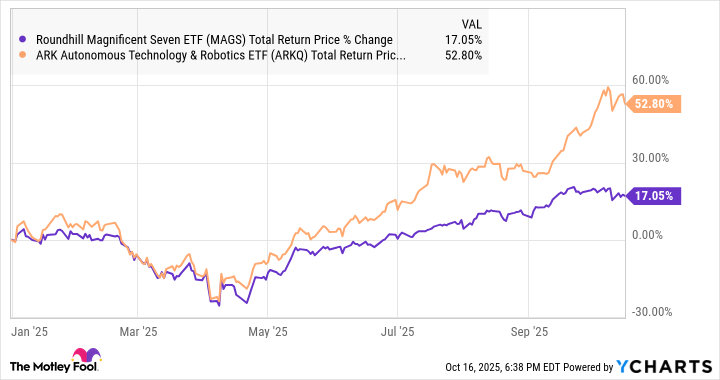

The Ark Autonomous Technology and Robotics ETF does things a little differently. For one thing, it's an actively managed fund. That means fund managers (in this case, notable tech investor Cathie Wood) are hand-selecting stocks with the goal of beating a benchmark index. And the recent success is impressive -- the ETF has delivered more than triple the total return of the "Magnificent Seven" so far in 2025.

MAGS Total Return Price data by YCharts

Additionally, while most AI ETFs are focused on the industry's biggest players, that is not the case here. Aside from the top holding, Tesla, most of the top holdings of the Ark Autonomous Technology and Robotics ETF are companies that are largely under the radar, such as Kratos Defense & Security, Archer Aviation, and Teradyne. Nvidia is in the portfolio, but it isn't even in the top 10 in this ETF's 36-stock portfolio.

The Ark Autonomous Technology and Robotics ETF has a 0.75% expense ratio. This is the fund's management fee that is reflected in the performance over time, and essentially means that if you invest $10,000 in the ETF, you're effectively paying $75 in management fees annually.

This might sound high -- and it is, compared with something like an S&P 500 (^GSPC 0.43%) index fund. But it's par for the course for a specialized ETF like this, and in fact, it is cheaper than the fees charged by some of the most popular artificial intelligence index funds that simply aim to match a benchmark.

NYSEMKT: ARKQ

Key Data Points

Could the Ark Autonomous Technology and Robotics ETF triple your money by 2030?

First, it's important to be aware that an investment in an actively managed, artificial intelligence-focused ETF that primarily invests in smaller, high-potential companies is likely to be far more volatile than, say, an S&P 500 ETF. And much of the ETF's performance over the next five years will depend on overall market conditions. For example, if a recession comes, it could cause a massive slowdown in AI investment.

Having said that, the Ark Autonomous Technology and Robotics ETF invests in a collection of highly innovative businesses, many of which have already produced big gains. For example, top 10 holdings Rocket Lab USA and Palantir have produced more than 10X returns within the past couple of years. And there are other companies that have massive potential if they can execute on their visions -- Archer Aviation is a good example.

In a nutshell, I think that assuming economic and regulatory conditions cooperate, the Ark Autonomous Technology and Robotics ETF could triple investors' money in a five-year period. Just keep in mind that this is likely to be a volatile investment, and that there's absolutely no guarantee that it will perform well.