Nvidia has been the dominant force in the global semiconductor industry thanks to its graphics processing units (GPUs), which have played a critical role in enabling the proliferation of artificial intelligence (AI) applications. The demand for Nvidia's GPUs has been so solid in the past three years that Nvidia has now become the world's largest company.

Nvidia continues to rule the AI data center GPU market, facing very little threat from its peers so far. Analysts are expecting its top line to jump by an impressive 58% in the current fiscal year to more than $206 billion. That's quite impressive for a company of Nvidia's size. The stock registered respectable gains of 34% on the market this year based on the healthy growth that the company continues to deliver.

However, Nvidia's stock market performance has been overshadowed by Broadcom (AVGO +2.63%). Broadcom has appreciated 48% this year and looks set to end 2025 on a high note following recent developments. In fact, it won't be surprising to see Broadcom stock outperforming Nvidia next year as well. Let's see why that may be the case.

Image source: Nvidia.

Custom AI chips are expected to witness stronger demand in 2026

So far, the majority of AI model training and inference has been carried out by Nvidia's GPUs. GPUs are general-purpose computing chips with massive parallel computing power, making them ideal for quickly training AI models and moving them into production. OpenAI chose Nvidia's A100 data center GPUs to train its popular chatbot ChatGPT three years ago.

Nvidia built upon its first-mover advantage and controlled an estimated 92% of the AI data center GPU market at the end of last year. However, the latest deal struck between OpenAI and Broadcom indicates that Nvidia's influence over the AI chip market could wane. OpenAI will buy custom AI accelerators worth a whopping 10 gigawatts (GW) from Broadcom starting in the second half of 2026.

The deployment is expected to be completed by the end of 2029. This is a massive deal for Broadcom considering that it reportedly costs around $10 billion to build a 1 GW data center. Around 60% of the investment that goes into building a data center is allocated toward chips and other computing hardware, which would put Broadcom's potential addressable market from each gigawatt of OpenAI's deployment at $6 billion.

NASDAQ: AVGO

Key Data Points

So, Broadcom could be sitting on a potential revenue opportunity worth $60 billion from this deal over the next three years. Broadcom's custom AI processors have already been in terrific demand as hyperscalers and AI giants such as OpenAI are gravitating toward these chips because of the advantages they enjoy over GPUs.

Custom AI processors are designed for performing targeted tasks, such as AI inference. As a result, they are not only more power-efficient at running those workloads but also enjoy a performance advantage since they don't need to perform any other tasks. Hence, deploying custom AI processors can help save costs for hyperscalers.

Shipments of application-specific integrated circuits (ASICs) meant for deployment in AI data centers are expected to increase by 45% in 2026, compared to the expected growth of 16% in GPUs. Broadcom is in the best position to make the most of this growth opportunity as it leads the ASIC market with an estimated share of 70%.

Moreover, the new deal with OpenAI along with another $10 billion contract with an unnamed customer that the company announced last month should ensure outstanding growth in Broadcom's AI revenue next year.

Broadcom's AI revenue could now increase at a faster pace

Broadcom is on track to end the current fiscal year with almost $20 billion in AI revenue, an increase of 64% from the previous year. The company reported a record revenue backlog of $110 billion at the end of the fiscal third quarter (which ended on Aug. 3). That backlog is likely to have moved higher following the recent deals struck by the company.

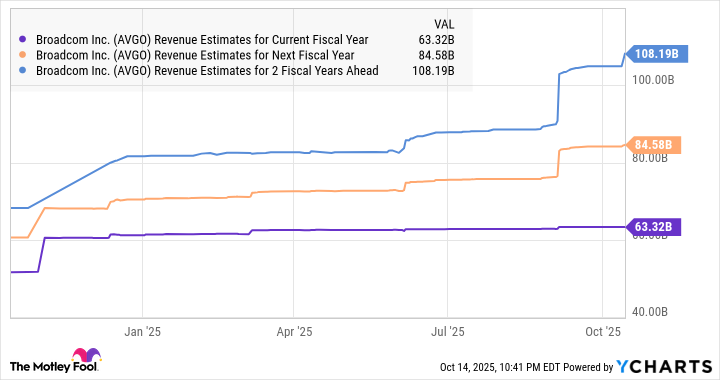

Don't be surprised to see Broadcom's revenue jumping at a faster pace than the 33% growth that Wall Street is expecting next fiscal year, which would be a nice improvement over the 23% growth it is expected to deliver in the current one. There is a good chance that its revenue growth in the long run could be better than expectations as well.

AVGO Revenue Estimates for Current Fiscal Year data by YCharts

Broadcom was already anticipating a serviceable addressable market worth $60 billion to $90 billion based on the three AI customers it was serving until earlier this year. That addressable market is now much bigger following the OpenAI contract, which opens up the possibility of stronger growth and more upside for Broadcom investors.