Artificial intelligence is creating a gold rush for investors, and arguably the leader of AI is Nvidia (NVDA 0.44%). Thanks to businesses and governments around the world hungry for its AI semiconductor products, Nvidia became the first public company to reach a $4 trillion market cap.

The semiconductor giant may be sitting on the AI throne today, but CEO Niccolo de Masi of newcomer IonQ (IONQ +6.81%) declared the intention to take the crown. He stated that the company aims to become the Nvidia of the quantum computing era.

Quantum computers possess the computational power to elevate AI to new heights. Does that make IonQ the company to buy shares in? Or is reigning AI champ Nvidia the superior investment? Here's a look at both companies to arrive at an answer.

Image source: Getty Images.

Nvidia and the rise of AI inference

Nvidia's ascent to AI superstardom is well-earned. In its 2025 fiscal year ended Jan. 26, sales soared 114% year over year to a record $130.5 billion.

The company is on track to exceed that total in fiscal 2026. Revenue through the first half of its fiscal year stood at $90.8 billion, up from $56.1 billion in the previous year. At the same time, this revenue growth boosted Nvidia's operating income, which increased more than 40% year over year to $50.1 billion in the first half of fiscal 2026.

As astounding as its growth has been, Nvidia is poised for more as the AI industry focuses on its next phase of expansion, AI inference. For the last few years, tech companies, such as ChatGPT creator OpenAI, worked to train and build up AI models. Now, the sector is concentrating on AI inference, the post-training process where an AI analyzes data and draws conclusions from the info.

However, AI inference requires far more computing power than training, and Nvidia is ready with its latest AI product, Blackwell. The company's CEO, Jensen Huang, asserted: "Blackwell is the AI platform the world has been waiting for." This is no idle boast.

The British government targets adopting 120,000 Blackwell chips for its AI infrastructure needs. Nvidia is selling more around the world.

That's just the start. OpenAI partnered with Nvidia in September with the goal of using millions of Nvidia chips over the coming years to advance OpenAI's artificial intelligence models.

NASDAQ: NVDA

Key Data Points

IonQ's AI strengths

IonQ is focused on developing quantum computing chips and networking capabilities "to build the next generation of the internet," according to its management. This goal encompasses AI.

Earlier this year, IonQ showcased its quantum computer's ability to enhance AI inference. Quantum-trained AI models outperformed those developed on conventional computers, and also achieved "significant energy savings," according to IonQ.

Moreover, the company demonstrated how quantum computers can boost AI models when data is sparse. Without sufficient data, AI struggles to perform accurately, or can fail completely. A quantum computer's computational power can identify nuanced relationships in data that conventional computers strain to handle. Quantum devices can do this because they operate using the unique properties of quantum mechanics.

The strength of IonQ's tech led to organizations around the globe adopting it. As a result, the company experienced Nvidia-like sales growth.

In 2024, IonQ generated $43.1 million in 2024 revenue, nearly double the prior year's $22 million. It estimated a repeat performance in 2025, with sales forecasted to reach between $82 million and $100 million.

However, building cutting-edge quantum computers is a costly endeavor, so the company isn't profitable. In fact, its operating loss shot up to $160.6 million in the second quarter, a substantial increase from the prior year's loss of $48.9 million.

NYSE: IONQ

Key Data Points

Deciding between Nvidia and IonQ stock

Both companies have strengths to capitalize on the AI market's growth. Nvidia offers organizations readily available tech to power AI, while IonQ's quantum computers point to AI's future, given inference and energy consumption improvements.

But if you had to pick one to invest in, Nvidia edges out IonQ as the better AI stock. One key reason is share price valuation.

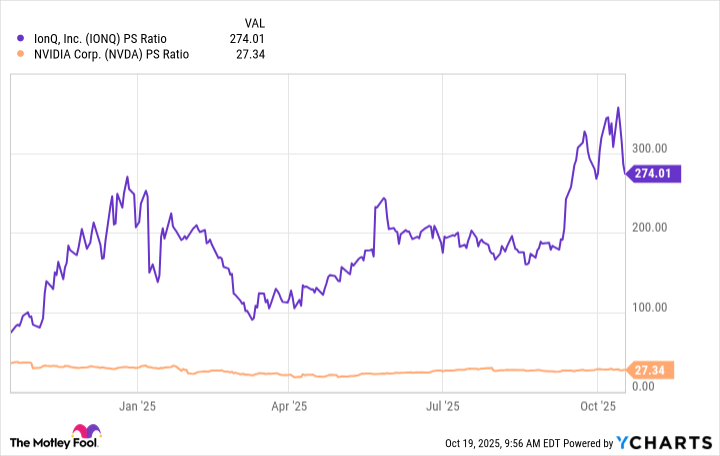

The exciting potential of IonQ's quantum computers led to its shares skyrocketing more than 370% over the past 12 months. Consequently, its stock valuation is exceedingly high, as seen in its price-to-sales (P/S) ratio.

IONQ PS Ratio data by YCharts

The chart reveals that Nvidia's P/S multiple is a fraction of IonQ's. In fact, the latter has surged so much in recent months that it's higher than it's been for most of the past year. This shows that Nvidia stock is the better value.

Moreover, Nvidia is profitable, while IonQ's operating loss is growing. The quantum computing company's saving grace is that it stockpiled $1.7 billion in cash and equivalents, and has no debt as of Sept. 12.

But Nvidia is already a proven AI leader, and positioned for years of sales growth ahead with the likes of OpenAI in its corner. Meanwhile, IonQ's quantum tech is still nascent. Looking at these factors and the stock valuation, Nvidia is the better AI choice at this time.