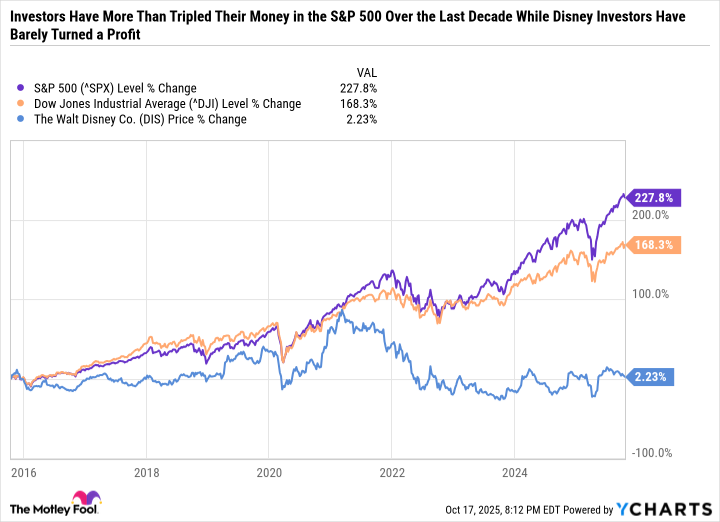

The S&P 500 (^GSPC 1.07%) has crushed the Dow Jones Industrial Average (^DJI 1.12%) over the last decade largely thanks to its increased concentration in tech stocks.

Investors buying a basket of Dow stocks still would have produced solid gains. That is, unless they were only invested in Walt Disney (DIS 1.18%), which is basically flat over the last decade.

Here's why the value stock can turn it around and even beat the S&P 500 over the next 10 years.

Image source: Walt Disney.

Back to the drawing board

It's been a rough decade for Disney. In the mid to late 2010s, the company was releasing box office hit after hit, largely thanks to its Marvel and Star Wars franchises.

The launch of Disney+ in November 2019 was meant to put Disney on the streaming map. And it did at first. But the COVID-19 pandemic crushed its parks, experiences, and movie business. Disney+ was growing subscribers, but it was burning through cash at a breakneck pace. It took years for Disney to recover and get Disney+ to consistent profitability. But that came at a cost, as its legacy cable business, which Disney calls linear networks, has been in gradual decline.

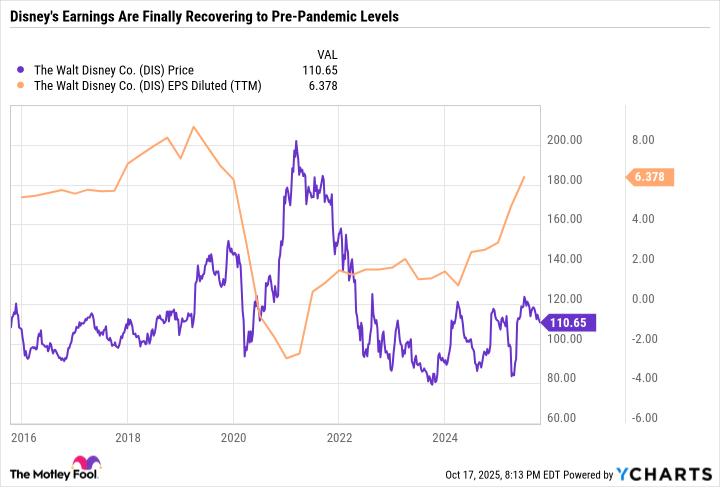

Fast-forward to today, and Disney's linear networks and box office movie businesses are arguably weaker than they were a decade ago. But Disney+ is turning a profit, and its parks and cruise lines are thriving. Still, when you add it all up, Disney's earnings have barely grown over the last decade.

In a 1993 interview with Charlie Rose, the famous Fidelity mutual fund manager Peter Lynch simplified what drives stock prices over the long run:

I don't think people understand there's a 100% correlation between what happens to a company's earnings over several years and what happens to the stock. McDonald's has done very well as a company, the stock has done very well. People worry about too much money supply, what's happened to the price of oil, who the president is, who's being nominated to the Supreme Court, the ozone layer. It has nothing to do. McDonald's earnings go up over the next 10 years, the stock will go up.

It sounds simple, but what Lynch is getting at is that long-term investors should focus on how a company plans to grow its earnings first, rather than speculating on what the stock price will do.

Disney's poor stock performance embodies Lynch's logic, as its earnings have been down in recent years. But investors care more about where a company is headed than where it has been. Disney can outperform the S&P 500 over the next decade because it has what it takes to grow earnings at a good pace, and the stock price will follow.

The glass-half-full outlook on Disney

Fiscal 2025 has been an outstanding year for Disney, especially considering consumer-facing companies have been one of the weakest parts of the market. Many retailers, restaurant stocks, and car companies that depend on big-ticket sales are struggling as consumers navigate cost-of-living challenges.

And yet, for full-year fiscal 2025, Disney is forecasting 8% operating income growth from its experiences segment, double-digit percentage operating income growth from entertainment, entertainment direct-to-consumer (led by Disney+) up $1.3 billion in operating income, and adjusted earnings per share of $5.85 -- an 18% increase from fiscal 2024.

This fiscal year has been arguably Disney's best in the post-pandemic era because it validates that Disney+ can be a steadily growing cash cow and that consumers will still pay up for vacations to Disney's parks and cruises even when budgets are tight.

The biggest growth catalysts for Disney over the next decade are its direct-to-consumer service through Disney+ (including Hulu) and the launch of ESPN's stand-alone direct-to-consumer segment, as well as investments paying off in its parks and cruises.

In September 2023, Disney announced plans to double capital expenditures over the next 10 years in its Parks, Experiences, and Products segment to $60 billion. A key aspect of that buildout is cruise ships. The fleet is more than doubling from five ships at the start of 2024 to 13 by 2031, including the addition of five "Wish-class" ships (Disney Treasure in December 2024, Disney Destiny in November 2025, Disney Adventure in March 2026, a fourth ship in 2027, and another in 2029) and then three smaller ships in 2029, 2030, and 2031.

Disney is expanding its existing parks with new attractions and lands, including massive upgrades at Disneyland and Walt Disney World. In May 2025, Disney announced plans for a new theme park and resort in Abu Dhabi, which will likely open sometime in the early 2030s.

Buying Disney stock now is a bet that investments in direct-to-consumer and experiences will translate to earnings growth.

Disney's stock could rise based on its earnings growth and a valuation expansion. Disney trades at a discount to its historical average, with a price-to-earnings (P/E) ratio of 17.4 and a forward P/E of 17.1 compared to a 10-year median P/E of 21.5.

Disney is a top buy for long-term value investors

Disney is a no-brainer buy for investors who are confident in its capital allocation plans. With mixed results at the box office and declining linear networks, Disney is shifting its focus to its high-margin cash cows. It's the right move, and one that aligns with Disney's franchise flywheel model.

Disney extends the useful life of its content by monetizing it across on-screen and in-person experiences. For example, Toy Story has produced multiple movies, merchandise, and rides at the parks. That's a much longer shelf life than a one-off box office hit.

If Wall Street starts valuing Disney's streaming earnings similarly to Netflix and experiences investments pay off, then Disney could beat the S&P 500 just by generating consistently decent earnings growth. All told, it stands out as a moderate risk/potentially high-reward buy for long-term investors.