The race to various market cap levels has always been an interesting one to watch. Apple (AAPL 3.95%) was the first to reach the $1 trillion, $2 trillion, and $3 trillion valuation marks, but it didn't win the race to $4 trillion. That race was run by Nvidia (NVDA -0.31%), slightly edging out Microsoft (MSFT 0.57%) to get there.

Right now, Nvidia is about a $4.4 trillion company, while Microsoft lags at $3.8 trillion. Apple isn't far behind Microsoft at $3.7 trillion, but I don't think it will get to $5 trillion before this other company. I think the first three companies to reach the $5 trillion mark will be Nvidia, Microsoft, and Alphabet (GOOG 1.29%) (GOOGL 1.24%).

While Alphabet may be a dark horse candidate to beat Apple to the $5 trillion mark, I think it has a great chance of doing so.

Image source: Getty Images.

Nvidia and Microsoft have an easy path to reach $5 trillion

Let's start with why Nvidia and Microsoft will reach the $5 trillion mark before anyone else. Nvidia isn't that far away with its current market cap, and only needs to rise another 14% to reach that threshold. That's not an unreasonable amount to rise over the last few months of 2025, especially if we get a big earnings announcement from Nvidia in November. There is huge momentum in the artificial intelligence computing space, and Nvidia's graphics processing units (GPUs) are the leading computing product.

Microsoft is similarly benefiting from the AI megatrend, but it's mostly seeing the benefit by offering all of the various generative AI models in its cloud computing wing, Azure. Azure has been a huge source of growth for Microsoft, as it's becoming one of the top cloud computing providers to build AI models on. While Microsoft doesn't break out exactly how much revenue Azure generates, in Q4 of fiscal year 2025 (ended June 30), Azure grew at a 39% pace from a year ago. It powered the intelligent cloud division to $29.9 billion in revenue, nearly equal to the $33.1 billion generated by productivity and business processes, which are Microsoft's legacy businesses. This tailwind isn't subsiding any time soon, and Microsoft will continue to grow revenue and profits at a rapid pace and push it toward the $5 trillion threshold throughout 2026.

Both Nvidia and Microsoft have clear paths to $5 trillion valuations, but what about Apple and Alphabet?

Apple needs to sustain solid growth to make a comeback

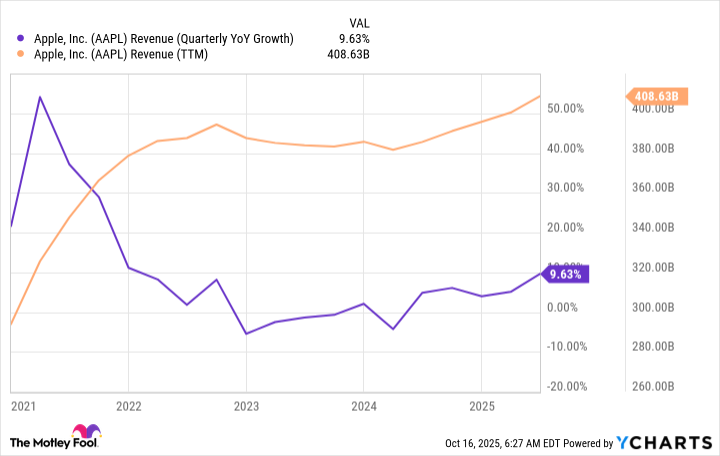

Apple stock has benefited from its brand power more than any other stock that I know of. Since 2022, Apple failed to grow revenue at a reasonable pace and has only recently broken out to new revenue highs.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

If any other big tech stock grew as slowly as Apple (which also included a few quarters of negative growth), its stock would have gotten slammed, but not Apple's. Even after years of lackluster product launches, Apple still holds a premium valuation. However, the tides could be shifting, as Apple failed to bring any sort of generative AI breakthrough to its customers. This could become a deterrent for Apple in the near future, causing investors to turn off the stock.

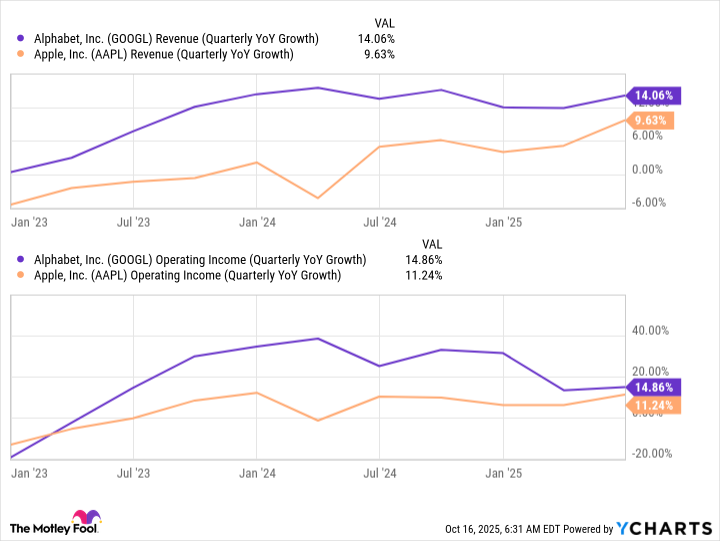

In its place, Alphabet could arise, as it's a leader in the AI space and has a promising cloud computing business. Additionally, investors were worried about Alphabet's core advertising business from the Google Search engine, but it seems to have found its footing and is delivering solid results after adopting a hybrid search option. This has led to solid growth for Alphabet, and it is outperforming Apple in many categories.

GOOGL Revenue (Quarterly YoY Growth) data by YCharts

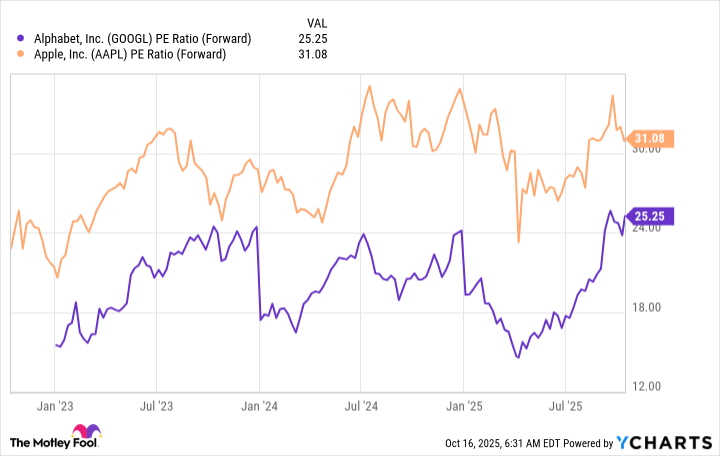

Alphabet is also trading at a discount to Apple despite stronger growth rates.

GOOGL PE Ratio (Forward) data by YCharts

Alphabet has had a strong few months, as the market is starting to recognize its dominance. With Alphabet growing at a faster pace than Apple, I think Alphabet could eventually close the gap and surpass Apple as the third-largest company in the world, and beat it to the punch to become a $5 trillion company. This would make Alphabet a fantastic stock to buy and hold, leading to significant outperformance over the next few years.