Palantir Technologies (PLTR +0.02%) emerged as one of the most popular artificial intelligence (AI) software stocks on the market. It is growing at a rapid pace and shows few signs of slowing down. Its stock has also been an absolute rocket ship alongside the business over the past few years, and transformed Palantir into a $425 billion behemoth. This places Palantir inside the 25 largest companies in the world by market cap.

After such a remarkable run-up, the obvious question is, when will Palantir become a $1 trillion company? It will only take slightly more than a double to get there, but it's a lot harder to climb from the half-trillion dollar mark to the $1 trillion mark. So, is this possible by 2030? Or is there something else that's more feasible?

Palantir's products appeal to government and commercial clients alike

Palantir's artificial intelligence-powered data analytics software originally got its start through government contracts. Its ability to sift through massive amounts of real-time data flows allowed those with decision-making authority to have the best information possible available at all times. Eventually, use cases started to develop for Palantir outside of government contracts, so Palantir expanded to the commercial sector.

Adoption of Palantir's products exploded through the rise of generative AI technologies. Instead of humans having to make every decision, AI agents can now assist and make recommendations to end users or entirely automate the process through Palantir's Artificial Intelligence Platform (AIP). This platform has driven massive success in both government and commercial sectors, and it's showing up in Palantir's financial results.

NASDAQ: PLTR

Key Data Points

During Q2, Palantir's overall revenue rose by 48% year over year to more than $1 billion. In particular, U.S. commercial saw the most growth, with an increase of 93% for the quarter. That's impressive, but Palantir is still dependent on government revenue, as it makes up more than half of its total. Fortunately, Palantir is seeing a ton of success in selling more products to its government clients, with overall government revenue increasing 49% year over year (U.S. government spending was slightly stronger with a 53% growth rate). About the only area that isn't seeing success is international commercial revenue, but that could be a future catalyst if the rest of the world decides to go all-in on AI like the U.S. has.

It's hard for a company to grow at a sustained compound annual growth rate (CAGR) of about 50% for the long term, but Palantir could be the company to do that if its AI solutions continue to see widespread adoption. Is that enough to push it across the $1 trillion threshold by 2030?

Palantir's stock already has a lot of success priced into it

Palantir's impressive run hasn't come completely from business performance. Since the start of 2023, Palantir's stock has been up 2,700% while its revenue has only been up 80%. That appears suspect, and after examining its valuation, it's clear that Palantir has a ton of future growth already baked into its stock price.

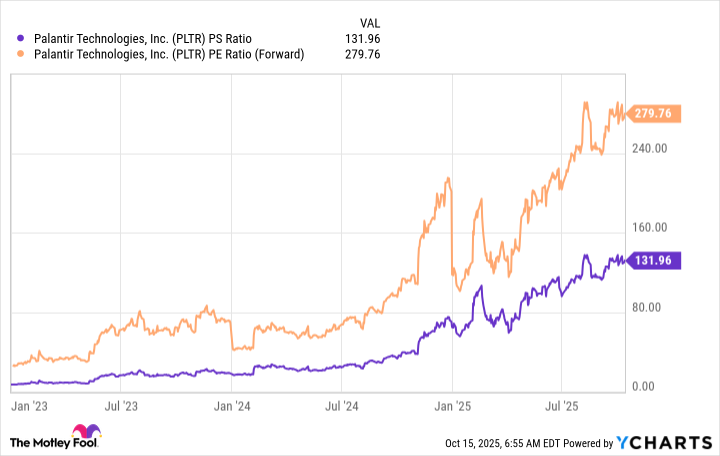

At more than 130 times sales and nearly 280 times forward earnings, Palantir is one of the most expensive stocks on the market.

PLTR PS Ratio data by YCharts

This valuation conveys extreme expectations, and it will take a lot of growth to justify its price tag. For 2025, management projects about $4.1 billion in revenue. If Palantir can grow revenue at a 50% CAGR over the next five years, an extremely difficult task to accomplish, it would result in $31.1 billion in revenue. Assuming that Palantir can achieve a 35% profit margin (its Q2 margin was 22%), that would give Palantir profits of $10.9 billion.

Palantir's forward price-to-earnings (P/E) ratio of 280 isn't sustainable, and I think we should look at other big tech companies to get a better idea of an end valuation. Nvidia trades for 51 times earnings, Alphabet trades for 26, and Microsoft trades for 38 times earnings. If we assign Palantir an aggressive multiple of 40 times earnings, that would price the stock at $436 billion, only a marginal increase from today's $425 billion market cap.

This falls well short of the $1 trillion market cap we were looking for, but it also shows the extreme expectations that are baked into Palantir's stock. Unless these projections are drastically off, I'd expect Palantir to underperform the market over the next five years, as it has already pulled forward several years of growth into today's stock price.