Amazon (AMZN 3.43%) and Alphabet (GOOG 3.00%) (GOOGL 2.87%) are two of the biggest companies in the world, ranking as the fifth and fourth largest, respectively. Conventional wisdom states that as these companies become larger, it becomes more difficult for them to grow at a rapid rate.

However, both of these companies have put up respectable growth rates that are often quicker than the broader market.

Each of these stocks is a popular investment, but does one look like a better buy right now?

Image source: Getty Images.

Each business is subject to economic conditions

Both Amazon and Alphabet draw a significant portion of their revenue from consumer-facing products. For Amazon, its commerce divisions are obviously affected by the strength of the consumer. If we hit an economic downturn or recession, Amazon's sales are sure to tank. In Q2, 60% of Amazon's sales came from its North American commerce divisions with an additional 22% coming internationally.

Alphabet, the parent company of Google, is in the same boat, but for a different reason. The majority of Alphabet's revenue comes from its advertising businesses. In Q2, Google advertising generated $71.3 billion in sales for Alphabet. In total, Alphabet generated $96.4 billion during Q2, so it's just as exposed to an economic downturn or recession.

NASDAQ: GOOGL

Key Data Points

Both Amazon and Alphabet will see strong revenue growth when economic conditions are good, but may see stagnant revenue growth when conditions become more difficult. However, Amazon has one ace up its sleeve.

Revenue isn't everything when considering an investment; investors also have to consider profits. Although Amazon gets a large chunk of its revenue from consumer-facing businesses, it gets more than half of its profits from its cloud computing business, Amazon Web Services (AWS). In Q2, AWS accounted for 53% of Amazon's total operating profits despite making up 18% of revenue.

Cloud computing is a more resilient industry than goods or advertising. It will hold up a lot better during a downturn because many workload migrations need to happen regardless of what is going on in the economy. Additionally, this is a subscription service, so companies must pay the bill each month to use it.

NASDAQ: AMZN

Key Data Points

Alphabet also has a cloud computing wing, but it is much smaller than AWS. Furthermore, Alphabet's overall operating margin on its advertising side is greater than Amazon's commerce divisions, so Google Cloud will never have the impact on its company's profit picture compared to AWS.

I think this makes Amazon slightly more resilient, giving it the edge in the business comparison side.

Winner: Amazon

Growth rates are similar for both companies

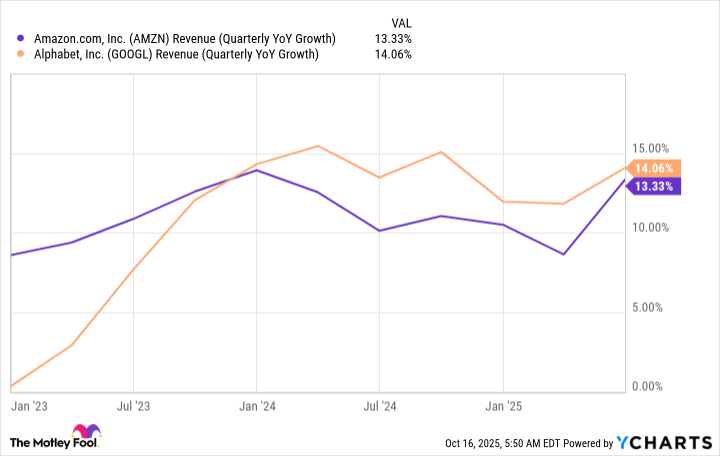

When reviewing growth rates, it's difficult to establish a winner. Alphabet has had a slight edge over the past few quarters, but the difference is minimal.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

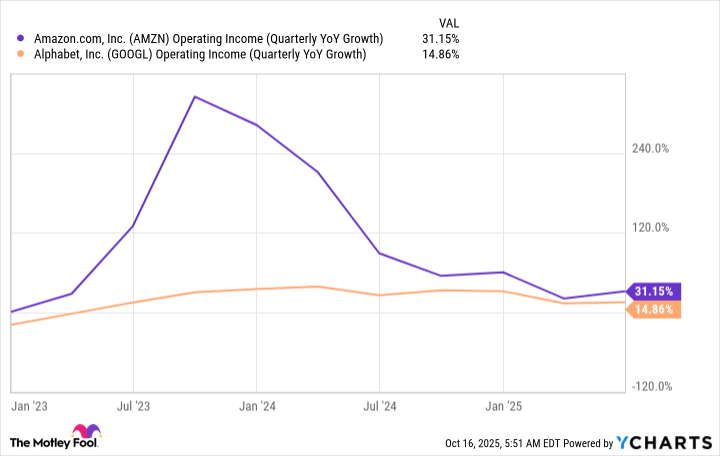

However, any Amazon investor knows that it isn't a revenue growth story; it's a profit growth story. Amazon's operating profits have grown much quicker than Alphabet's. That pattern will likely continue as Amazon's high-margin businesses (AWS and advertising services) grow at a quicker rate than other divisions.

AMZN Operating Income (Quarterly YoY Growth) data by YCharts

Winner: Amazon

Alphabet is a far cheaper stock

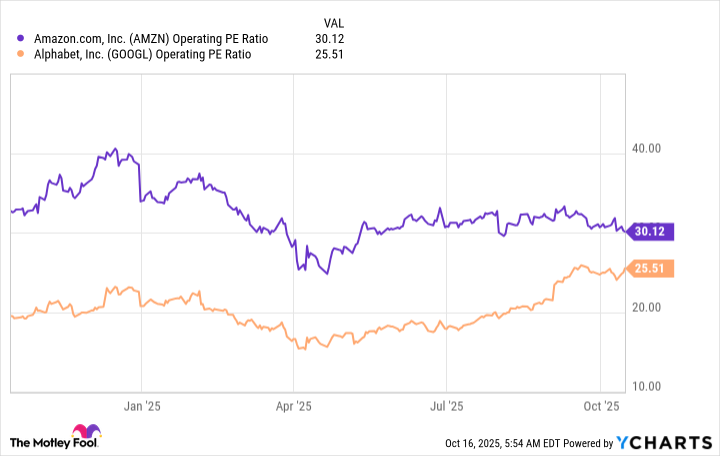

Moving to the last category, Amazon is up two points to zero, but if the stock is far too expensive, Alphabet could easily be the better buy. Amazon's price-to-earnings (P/E) ratio is a bit skewed because it has a significant investment portfolio, so it's forced to report gains and losses on these investments each quarter, even if it never sells any stock. As a result, the price-to-operating profit ratio is a much better comparison tool.

AMZN Operating PE Ratio data by YCharts

Winner: Alphabet

From this standpoint, Alphabet used to be a far greater value just six months ago. However, the gap has now closed. While Alphabet still trades at a decent discount to Amazon, I don't think it's enough to warrant declaring Alphabet the outright winner in this comparison.

Although Alphabet is a fantastic investment and I think it's an overall great buy, Amazon's growth and resilience, combined with a reasonable valuation, make it a slightly better buy than Alphabet, although by a narrow margin.