International Business Machines (IBM +0.00%) is again emerging as a force in the tech industry. Until a few years ago, IBM looked increasingly like a company the tech industry had left behind, and its stock performance reflected that.

That has changed under the leadership of CEO Arvind Krishna. He spearheaded the Red Hat acquisition in 2019 that began IBM's comeback, and since becoming CEO in 2020, he has built on that with several acquisitions and a deeper focus on areas such as the hybrid cloud, artificial intelligence (AI), and quantum computing.

Today, it has reinforced this approach with its latest purchase, the specialist in applications working with SAP SE's SAP software, Cognitus. The question for investors is whether this deal will help the company reclaim its edge in AI.

Image source: Getty Images.

Cognitus and IBM's expanded SAP Solutions

Indeed, IBM has been an acquisitive company during Krishna's time as CEO. Since his tenure began, IBM has purchased approximately 55 companies, making Cognitus the latest one IBM plans to integrate into its ecosystem.

From that standpoint, investors can feel confident that Cognitus adds to IBM's capabilities in terms of SAP-related software. Cognitus stood out in the market by offering industry-specific SAP solutions powered by AI. It holds expertise in SAP/S4HANA, a system that helps companies manage core processes in real time using SAP's HANA database.

Moreover, IBM will gain access to proprietary AI-enabled tools used for purposes such as billing and lifecycle management, which can work with IBM's offerings.

That will become important since Cognitus works with companies in a variety of sectors, including defense, energy, and government contracting, with accelerators designed to serve such businesses. Thus, Cognitus should boost IBM's ability to help clients with regulatory and compliance issues.

IBM in the world of AI

Now, what investors probably want to know is how the deal changes IBM as a company. As an innovator in the hybrid cloud in recent years, innovating in AI is a vital part of succeeding in the cloud computing industry.

The Cognitus deal likely plays a more incremental but significant role in improving IBM's AI, particularly since its specialty is SAP-related products. Still, Cognitus can help IBM better integrate and optimize operations within its infrastructure.

For example, IBM's WebSphere application server helps companies with regulatory compliance by utilizing IBM's hybrid cloud. Fortunately for IBM, Cognitus has specialized in applying AI to the regulatory compliance process, a factor that should enhance IBM's AI edge in this specific area.

Also, amid the market's continued focus on AI, the deal could help propel IBM stock higher, as it probably has in the past. The company's stock rose on that news in the following trading session. Still, investors likely care more about the stock's longer-term performance, though Cognitus and other acquisitions have probably played a role in IBM outperforming the S&P 500 during that time.

NYSE: IBM

Key Data Points

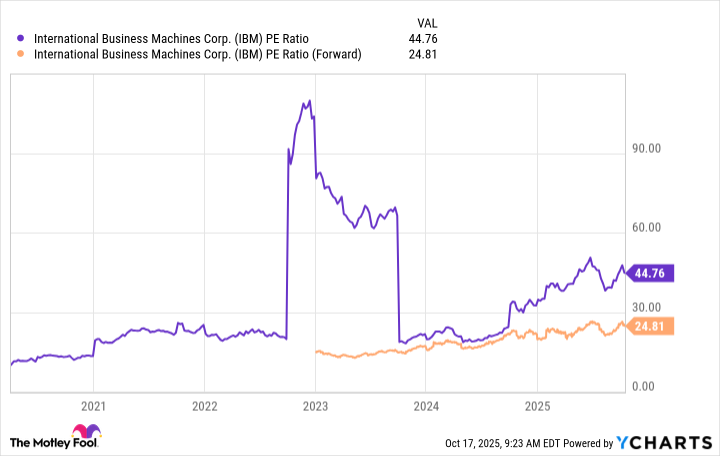

Such gains have resulted in an increased valuation for IBM stock. Today, it sells at a P/E ratio of around 45, a considerable rise from when Krishna became CEO in 2020. Fortunately, the forward P/E ratio of 25 indicates that investors who have not yet bought IBM shares have time to buy as AI-driven growth continues to undergird the stock.

IBM PE Ratio data by YCharts

Is Cognitus the spark that IBM stock needs?

Admittedly, it might be misleading to say IBM's purchase of Cognitus will help it reclaim an edge in AI in a general sense, but it will almost certainly help with any SAP-related software.

Although Cognitus will add to IBM's AI-related capabilities, investors should not necessarily assume it is game-changing for IBM's AI. Instead, investors should look at the cumulative effect of all of IBM's AI-related acquisitions, which have undoubtedly enhanced its renewed reputation as a cutting-edge tech company. Knowing that, investors should watch for future acquisitions and in-house technical innovations and how they will enhance the company's AI edge.

Ultimately, as IBM continues to bring more innovation under its umbrella, investors should look to the growing AI prowess that enhances the company's competitive advantage, increasing the likelihood its stock will continue to rise.