Organizations around the world are racing to adopt artificial intelligence (AI), creating growth opportunities for many tech companies. These include two businesses delivering AI solutions to the U.S. government: BigBear.ai (BBAI 8.75%) and C3.ai (AI 0.72%).

The fervor around artificial intelligence helped BigBear.ai shares to soar more than 60% so far this year. Meanwhile, C3.ai stock was down nearly 50% in that time.

Considering the different directions each company's stock is headed, the question is whether BigBear.ai's rising share price means it's the better investment between the pair, or if C3.ai's price drop signals a buy opportunity. To figure out which is the superior AI stock, let's unpack what's going on with these companies.

Image source: Getty Images.

BigBear.ai's ups and downs

President Donald Trump touted the importance of U.S. leadership in artificial intelligence, so this should be a boon for BigBear.ai and C3.ai. However, the Trump administration undertook spending cuts this year, and very little seemed spared.

These reductions hit BigBear.ai particularly hard, since the majority of its revenue comes from the federal government. The company's second-quarter sales fell to $32.5 million, down from $39.8 million in 2024.

BigBear.ai also slashed its 2025 sales outlook to a range between $125 million to $140 million. That's a sharp decline from 2024's $158.2 million in revenue.

Normally, these results would be bad news for BigBear.ai stock, but shares seem to be buoyed by some factors in the company's favor. First, the passage of the One Big Beautiful Bill Act provided historic funding levels to the Department of Homeland Security (DHS), one of BigBear.ai's customers.

Adding to this, BigBear.ai CEO Kevin McAleenan ran the DHS during Trump's first term. His connections to the agency may help the company win more DHS contracts in the future.

In addition, BigBear.ai forged a partnership with Tsecond, a defense technology company, in October. The deal means BigBear.ai's edge computing capabilities don't have to rely on an internet connection, making its AI battlefield technology more appealing to the U.S. military.

These factors may contribute to BigBear.ai's revenue growth in the future. Even so, the company isn't running a profitable business. In Q2, it had an operating loss of $90.3 million, up from the prior year's loss of $16.7 million, due to a goodwill impairment charge of $70.6 million.

NYSE: BBAI

Key Data Points

C3.ai's challenging 2025

While C3.ai has contracts with the federal government, it differs from BigBear.ai by also having a healthy business outside government circles. This is thanks to partnerships with Microsoft and other organizations, which act as an extended sales team by selling C3.ai's solutions.

The strategy is paying off. In C3.ai's fiscal first quarter ended July 31, the company booked 40 of 46 contracts through its partner network, with Microsoft contributing 24 deals. Of these, 28% involved the federal government, with the majority coming from diverse industries, such as manufacturing, energy, and healthcare.

However, C3.ai faces challenges this year, which caused its stock to fall. CEO Tom Siebe, had to step down for health reasons. The resulting organizational impact led to a letdown in its fiscal Q1 performance. Revenue dropped to $70.3 million from the prior year's $87.2 million, while its loss from operations grew to $124.8 million from $72.6 million in the previous year.

This raises questions whether the company can return to sales growth without Siebel. C3.ai hired a new CEO, Stephen Ehikian, on Sept. 3. The coming quarters should shed light on whether Ehikian can boost the company's future prospects.

NYSE: AI

Key Data Points

Choosing between BigBear.ai and C3.ai stock

Although 2025 introduced difficulties for BigBear.ai and C3.ai, both have the potential to bounce back. Wall Street seems to favor BigBear.ai, considering the company's share price is up this year, but so, too, is its valuation.

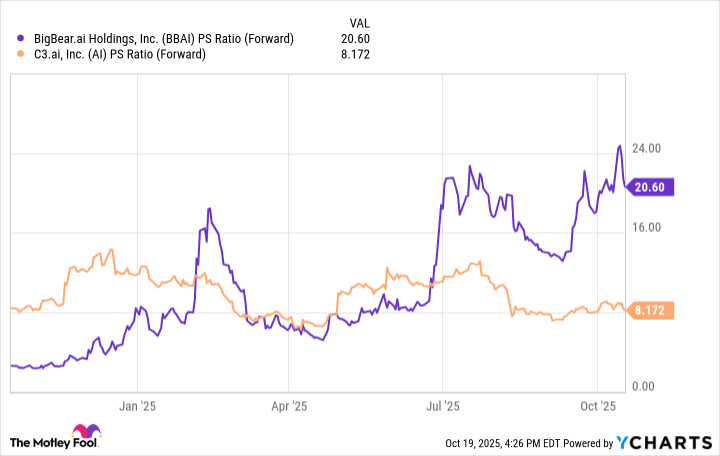

You can view this by contrasting the stock's forward price-to-sales (P/S) ratio to C3.ai's. After the sagging sales these companies experienced this year, the forward P/S multiple is helpful to see how their stock valuations compare in relation to the revenue they're expected to earn in the next 12 months.

Data by YCharts.

C3.ai was more expensive than BigBear.ai a year ago, but now, its stock is a far better value, given its lower P/S ratio. In fact, C3.ai stock's valuation looks attractive, considering its sales multiple has dropped in recent months.

At this stage, given the uncertainty around when these companies can rebound, the prudent approach is to see how they perform in the next quarter or two, then reevaluate which to invest in.

But if you had to choose one now, C3.ai is the better buy, thanks to its low share price valuation, greater revenue diversification across industries, and the support of a partner network with marquee AI allies such as Microsoft.