In roughly 10 weeks, one of Wall Street's greatest investors will ride off into the proverbial sunset.

For the last 60 years, billionaire Warren Buffett has dazzled investors with his ability to spot amazing deals hiding in plain sight. Since taking over as CEO of Berkshire Hathaway (BRK.A 0.47%)(BRK.B 0.32%) in the mid-1960s, the aptly dubbed Oracle of Omaha has overseen a cumulative return in his company's Class A shares (BRK.A) of nearly 6,000,000%, as of the closing bell on Oct. 17. This blows the respective returns of the S&P 500 (^GSPC +1.16%), Nasdaq Composite (^IXIC +1.18%), and Dow Jones Industrial Average (^DJI +1.21%) out of the water.

But as noted during Berkshire Hathaway's shareholder meeting in May, Buffett plans to retire from the CEO role and hand over the day-to-day operations, including investment portfolio oversight, to predetermined successor Greg Abel, when 2025 comes to a close.

However, this transition isn't occurring without one last warning from the value-focused Warren Buffett.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

Nothing is of greater importance to Warren Buffett the investor than getting a good deal

For decades, Berkshire Hathaway's billionaire chief has grown his company's book value through investments. He's overseen the acquisition of around five dozen companies, and holds stakes in close to four dozen publicly traded companies in Berkshire's $304 billion investment portfolio.

But there's been a decisive shift in the Oracle of Omaha's thought process since the third quarter of 2022 came to a close. In each of the last 11 reported quarters (Oct 1, 2022 – June 30, 2025), he's been a net-seller of equities. In plain English, he's selling more stocks, in aggregate, than he's purchasing each quarter, to the cumulative tune of $177.4 billion.

This persistent net-selling activity is a reminder that Buffett puts "value" at the top of the pedestal when evaluating businesses for investment or acquisition. While there are certain unwritten rules Berkshire's billionaire chief may be willing to break, such as thinking short-term for an arbitrage opportunity, he doesn't waver when it comes to getting a good deal.

Recently, the market cap-to-GDP ratio, which has affably become known as the Buffett Indicator, hit an all-time high. When looking back to 1970, the cumulative value of all publicly traded stocks divided by U.S. gross domestic product (GDP) has averaged about 85%. Recently, the Buffett Indicator hit 221%.

Buffett has demonstrated a willingness to sit on his hands and allow valuations to come into his wheelhouse.

NYSE: BRK.B

Key Data Points

This billionaire's warning is impossible to ignore

However, it's not Buffett's lack of buying other stocks that's at the top of the list of worries. Rather, it's the fact that he's passed on purchasing shares of his favorite stock -- his own company -- for 13 consecutive months, based on Berkshire Hathaway's quarterly operating results.

Prior to July 2018, share buybacks were off-limits for Berkshire Hathaway's CEO unless his company dipped to or below 120% of book value (i.e., no more than 20% above listed book value, as of the most recent quarter). With Berkshire's stock not falling to this preset threshold, not one penny was spent on share repurchases.

On July 17, 2018, Berkshire Hathaway's board amended the rules governing buybacks to get its CEO off the proverbial sidelines and into the game. The new guidelines allowed Buffett to pull the trigger on buybacks as long as Berkshire had at least $30 billion in combined cash, cash equivalents, and U.S. Treasuries on its balance sheet, and Buffett believed his company's stock was intrinsically cheap.

For 24 consecutive quarters (July 17, 2018 – June 30, 2024), Berkshire's billionaire boss purchased shares of his own company's stock. The nearly $78 billion he spent buying his own company's stock was far and away more than was put to work in any other stock -- including core holdings!

But over the last 13 months, June 2024 through June 2025, Warren Buffett hasn't spent a dime buying shares of his company.

The "why?" looks to be very simple: valuation.

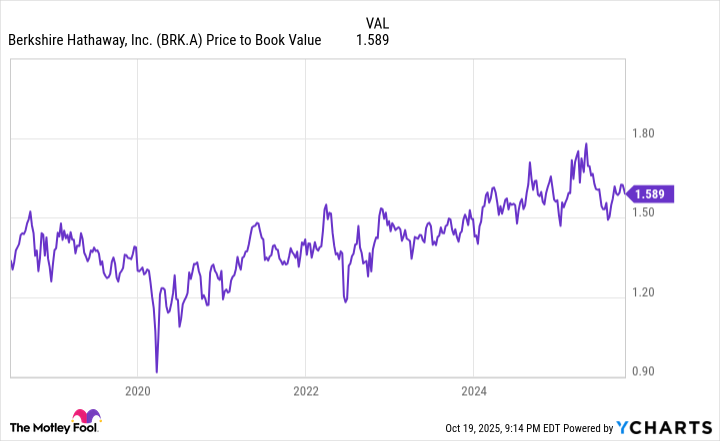

BRK.A Price to Book Value data by YCharts.

During the 24-quarter stretch where Buffett was mashing the buy button on Berkshire Hathaway stock with some level of regularity, its shares were hovering between a 30% and 50% premium to book value. Over the previous year and change, this premium to book jumped to a relatively consistent range of 60% to 80%. No matter how much Warren Buffett likes a company (even his own), he won't be a buyer if the valuation doesn't make sense.

This is the warning to Wall Street that investors can't ignore. If Berkshire's billionaire boss won't buy shares of his own company, stock valuations must be really out of whack.

Six decades as CEO have taught the Oracle of Omaha the value of patience

Although Berkshire's soon-to-be-retiring CEO has been a decisive net-seller of stocks and won't buy back shares of his own company, he's also an investor who won't wager against the U.S. economy or stock market.

No matter how dire things may seem on for the U.S. economy or Wall Street, the Oracle of Omaha's experience has taught him that time in the market consistently trumps trying to time the market.

Image source: Getty Images.

For instance, the U.S. economy has endured 12 recessions since the end of World War II. No amount of fiscal or monetary policy maneuvering can stop these inevitable events from taking shape. But at the same time, the average of these 12 economic downturns resolved in 10 months, with none lasting longer than the 18-month recession during the financial crisis.

At the other end of the spectrum, the average economic expansion has stuck around for approximately five years, with two of these growth periods enduring for more than 10 years. A steadily expanding economy leads to corporate earnings growth and eventual record highs for the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average over long periods.

These same principles, which are based entirely on patience and adhering to a simple numbers game, are evident on Wall Street, as well.

A June 2023 data set published on X (formerly Twitter) by the researchers at Bespoke Investment Group compared the length of every bull and bear market in the benchmark S&P 500 since the Great Depression began in September 1929.

Bespoke's data showed that the average of 27 bear markets spanning almost 94 years was just 286 calendar days, or less than 10 months. In comparison, the typical S&P 500 bull market persisted for 1,011 calendar days, or approximately 3.5 times longer.

Berkshire Hathaway's billionaire CEO is well aware of this milewide gap between optimism and pessimism, which is why he chooses to be a long-term optimist -- even when valuations and/or economic data aren't conducive to buying (at least in the short run).