Picking a single stock to buy and hold is a terrible investment strategy unless you're 90% invested in index funds -- then it could make sense if you have a high-conviction pick.

Still, I think ranking your stock ideas is a worthy strategy as it exposes what direction you think the market will ultimately go over the next five years. Additionally, it can help you realize your overall risk tolerance, as choosing a quantum computing stock as your top pick is far different than choosing an established, blue chip business like Costco Wholesale.

If I were limited to one stock today, it would be Taiwan Semiconductor Manufacturing (TSM 0.21%). Taiwan Semiconductor is the world's leading chip manufacturer, and has solidified that position over years of innovation and outperformance. Even though TSMC has had an excellent run over the past few years, I think there's still plenty of room for upside.

Image source: Getty Images.

Taiwan Semiconductor is a key supplier in the AI market

One of the biggest catalysts Taiwan Semiconductor has ever experienced for its business is currently ongoing. The artificial intelligence boom is leading to a massive computing buildout, and its chips are the ones powering each player. While Nvidia and its graphics processing units (GPUs) have been the go-to computing unit since the artificial intelligence (AI) boom began in 2023, Advanced Micro Devices and Broadcom have each announced exciting partnerships that could challenge Nvidia's dominance.

I have no idea how this will ultimately pan out, but all three of these companies source their chips from one place: Taiwan Semiconductor. This makes TSMC a winner as long as the buildout is ongoing, making it a neutral way to play this huge trend.

NYSE: TSM

Key Data Points

One issue many investors have had with Taiwan Semiconductor is that the majority of its production is based in Taiwan, which is at potential risk of a mainland China takeover at any moment. This is a legitimate concern. There's no telling what a Chinese takeover of Taiwan could trigger as a worldwide response, and being invested in any stock during that event would likely lead to huge losses.

Taiwan Semiconductor is taking steps to diversify its production footprint, including investing $165 billion in U.S. manufacturing facilities. This helps the company circumvent the tariffs, but also has the benefit of creating new American jobs, which was the goal of the tariffs in the first place.

There's still one major issue that Taiwan Semiconductor skeptics may bring up: What's next? While there is massive projected spending in the AI arena (Nvidia expects global data center capital expenditures to reach $3 trillion to $4 trillion by 2030), Taiwan Semiconductor is highly exposed to this trend, with 57% of Q3 revenue coming from high-powered computing applications.

However, Taiwan Semiconductor could also be boosted by other sectors, such as self-driving cars, quantum computing, or a smartphone refresh cycle. None of this will likely equal what the AI megatrend is contributing. Still, because Taiwan Semiconductor is the largest semiconductor foundry by far, it can control the chip supply to ensure that it can meet the majority of demand while not overbuilding.

An investment in Taiwan Semiconductor boils down to one hypothesis: the world will use more advanced chips in greater quantities in the future. This seems like a no-brainer investment thesis, making the story behind Taiwan Semiconductor solid. The question is, is now the right time to buy the stock?

Taiwan Semiconductor's stock isn't as cheap as it once was

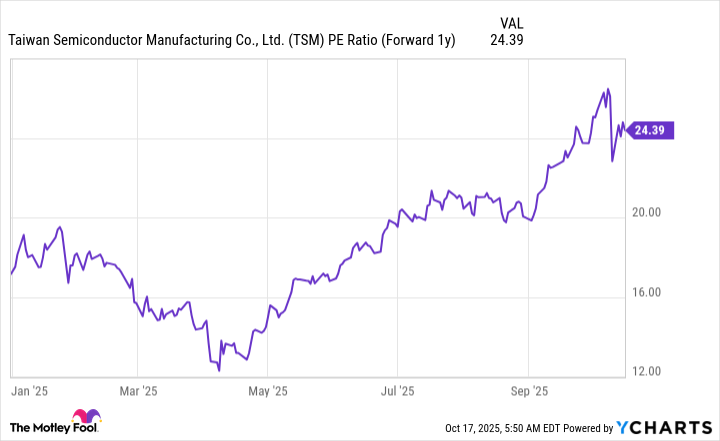

Taiwan Semiconductor has had a strong run in 2025, with the stock up around 50% year to date. The stock was still undervalued heading into 2025, so part of this run-up was getting it to a reasonable valuation point. However, it's still fairly attractive when viewed from the standpoint of next year's forward earnings valuation.

TSM PE Ratio (Forward 1y) data by YCharts

A valuation of 24 times 2026's earnings isn't a cheap price for a stock, but it's in line with what other big tech companies are trading for these days. I think this is a fair price to pay for TSMC's stock in this market, and anyone who isn't invested in this stalwart should consider adding some shares to their portfolio.