Among the soaring stocks in the hot quantum computing sector is D-Wave Quantum (QBTS +3.96%). Its shares are up more than 2,000% over the past 12 months through Oct. 20.

D-Wave's incredible share price gains have been fueled by investor interest in quantum technology. The hype around the tech is understandably high. D-Wave stated that its latest quantum computing system, the Advantage 2 released earlier this year, is "capable of solving computationally complex problems beyond the reach of classical computers."

The implications of such potent machines are high for industries, such as artificial intelligence, which require enormous amounts of computing power. Could this mean that now is the time to buy D-Wave stock?

The answer isn't straightforward, so let's dive into this pure-play quantum computer company to see if it's a worthwhile long-term investment.

Image source: Getty Images.

D-Wave's wins in 2025

When it comes to evaluating D-Wave as a quantum computing investment, a key factor to consider is its technological strengths. The industry is in its early stages, so the long-term winners will be those with superior technology.

D-Wave's differentiator against its many competitors is its annealing quantum computers, which focus on a technique to calculate the optimal solution among many possibilities. The approach works well in scenarios where optimization is the priority, such as for training artificial intelligence.

With organizations around the world rushing to adopt AI, D-Wave strategically launched an AI toolkit this year. The goal is to help software developers adopt annealing quantum computers as part of their process for building AI models.

The company's efforts appear to be paying off. Through the first half of 2025, D-Wave's sales are up 289% year over year to $18.1 million.

Since then, the company has achieved additional wins. In August, it signed a new agreement with Japan Tobacco's pharmaceutical division, which will use quantum computers for drug discovery. In October, D-Wave secured a 10-million-euro agreement with Swiss Quantum Technology SA (SQT) to deploy an Advantage 2 system in Europe.

NYSE: QBTS

Key Data Points

D-Wave's downsides

Despite D-Wave's successes, its financial health is another matter. The company's sales are not rising as rapidly as its operating expenses, which reached $53.6 million through the first six months of 2025, up from $39.4 million in 2024.

On top of that, D-Wave reported a massive net loss of $167.3 million in the second quarter, a significant increase from a $17.8 million loss in 2024. The big net loss jump was due primarily to D-Wave's issuance of stock warrants.

The substantial increase in its stock price resulted in the company taking a $142 million charge in Q2 as the value of those warrants changed. This won't be a consideration in the near future. In an effort to simplify its capital structure, D-Wave decided to redeem all outstanding public warrants in November.

Even so, at this point, D-Wave is a long way from becoming a profitable company. To sustain its business, the company executed an equity offering that brought its cash balance to $815 million as of July 1. This hefty sum provides a cushion for the company as it attempts to ramp up revenue further, a necessity if its business is to survive for the long run.

Evaluating whether to buy D-Wave stock

Along with its financial fragility, another factor to weigh is D-Wave's stock valuation, which looks to be based on speculative future potential. Shares hit a 52-week high of $46.75 on Oct. 15 after its SQT deal was announced.

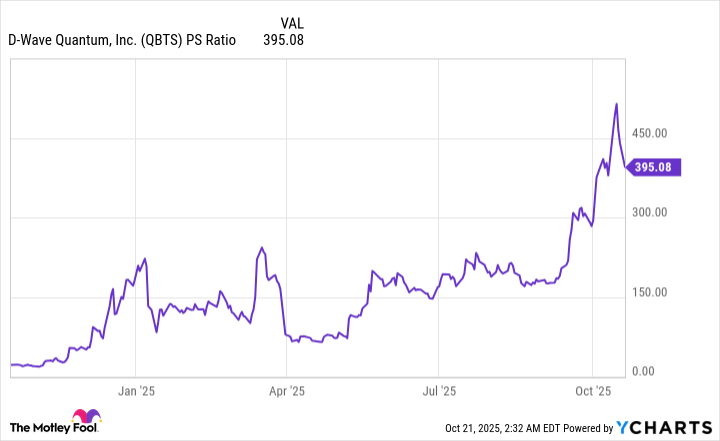

Although the price has dipped since then, D-Wave's share price valuation remains high. This can be seen in the stock's price-to-sales (P/S) ratio, which indicates how much investors are prepared to pay for each dollar of revenue generated over the past 12 months.

Data by YCharts.

The chart shows that D-Wave's P/S ratio has hovered near its highest level over the past year. Compare this to competitors such as IBM, which is at a sales multiple of 4. IBM has worked in quantum computing for years, and has the deep pockets to continue building out its tech.

D-Wave's sky-high valuation, rising costs, and small sales in the face of larger rivals make investing in its stock risky. Only investors with a high risk tolerance should consider buying shares, and even then, only if the stock price drops further.