Quantum computing stocks are hot in 2025, coinciding with the 100th anniversary of quantum mechanics, the scientific principle upon which these computers are based. Among these stocks is IonQ (IONQ +3.96%), the first pure-play quantum computer company to go public back in 2021.

Its shares have surged nearly 300% in the past 12 months through Oct. 21. The company reports third-quarter earnings on Nov. 5, so does it make sense to scoop up shares before then?

Some factors suggest you may want to hold off for now. Here's a look into what those are, and why you should wait to buy shares.

Image source: Getty Images.

Weighing whether to buy IonQ stock ahead of Q3 earnings

IonQ has been on a roll in 2025. Its sales in the first half of the year grew to $28.3 million, up from 2024's $19 million.

In addition, IonQ announced a new world record in fidelity on Oct. 21, achieving the highest level of accuracy ever seen in quantum computing. The milestone is important, since the industry's quantum machines suffer from error rates that have hindered their scalability and widespread adoption.

NYSE: IONQ

Key Data Points

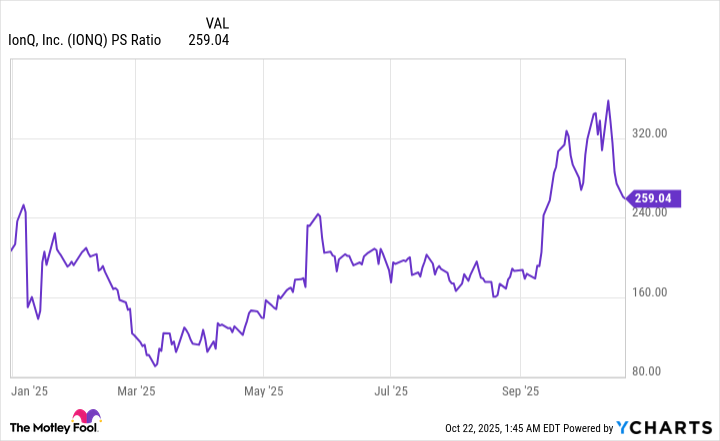

IonQ's successes contributed to its stock's price-to-sales (P/S) ratio soaring, indicating its shares are expensive. The chart shows IonQ's P/S multiple is higher than it's been for most of 2025.

Data by YCharts.

Along with a lofty share price valuation, the company is not profitable. In fact, its operating loss more than tripled year over year to $160.6 million in the second quarter.

Overpaying for an unprofitable company with rapidly rising losses is very risky. Wait for IonQ's Q3 performance to be unveiled on Nov. 5, and for the share price to drop, before deciding to buy the stock.