If you're looking to find a stock that could set you up for life, it could be a smart idea to add a few higher-risk, high-reward bets that could pay off big. Not all of these are going to hit, but if one does, it could help set you up for life. Let's look at three stocks that have this potential.

1. IonQ

IonQ (IONQ 0.23%) is trying to do for quantum computing what Nvidia did for artificial intelligence (AI). If it can accomplish this, the stock is going to have a ton of potential upside. IonQ management talks a big game, but it's also trying to follow Nvidia's (NVDA 2.82%) playbook by not being just focused on quantum computers, but by trying to carve out an important position throughout the entire quantum computing ecosystem.

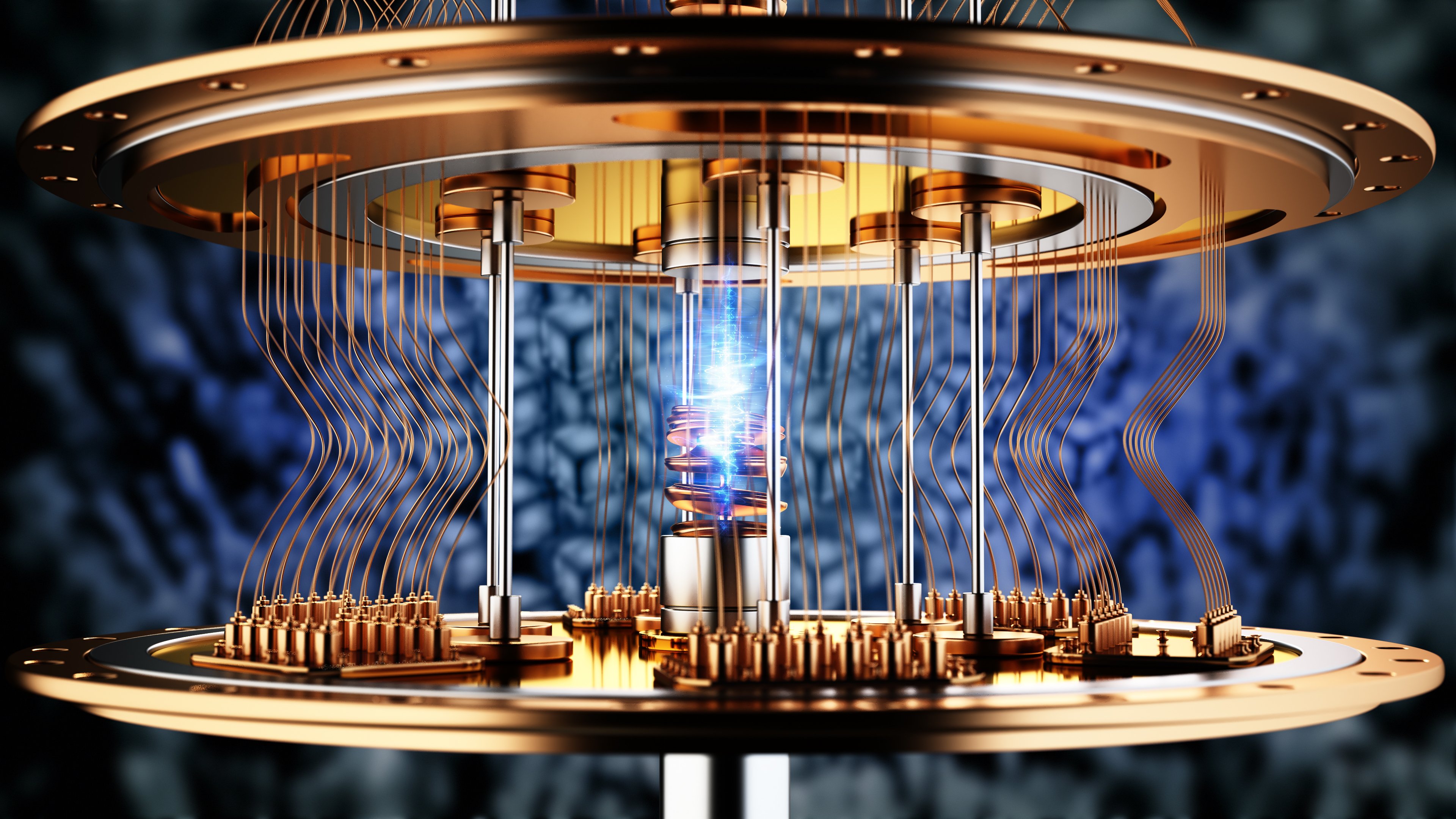

Image source: Getty Images.

Its platform starts with its trapped-ion system, which uses real atoms instead of fabricated qubits, creating far more stable results with fewer errors. That approach is harder and more expensive, but it gives IonQ's machines a distinct edge in reliability, which is a massive hurdle in the race to build useful quantum computers.

Meanwhile, IonQ has been expanding its technology stack beyond just hardware. It's developing software like its Clifford Noise Reduction system to lower logical error rates and make its systems more scalable.

NYSE: IONQ

Key Data Points

IonQ also recently showed its systems can convert photons from its trapped-ion machines into telecom wavelengths, meaning future quantum computers could communicate over existing fiber networks. That could one day be the foundation for a true quantum internet. The company is also aggressively making acquisitions to add new technologies and talent to its fold.

That said, quantum computing technology is still very young. IonQ only generated $28.3 million in revenue in the first half of the year while having a negative free cash flow of $89 million. However, it's well-financed and has a strong plan in place. If IonQ can execute and realize its long-term vision, the stock's potential upside is massive.

2. SoundHound AI

SoundHound AI (SOUN 1.90%) is a company that has shown it is able to go with the flow in an ever-changing tech landscape. It started out in music recognition, and then pivoted to voice AI, where it gained strong traction in the automobile and restaurant sectors due to its speech-to-meaning and deep-meaning understanding technology. More recently, it acquired a company called Amelia, which added conversational intelligence and a strong foothold in regulated industries like healthcare and finance that have their own jargon and compliance guidelines.

NASDAQ: SOUN

Key Data Points

The Amelia acquisition was also a springboard to the company launching AI agents on its new Amelia 7.0 platform. The addition of AI agents moved the company beyond voice AI into one of the hottest areas of AI. While a lot of companies are chasing AI agents, SoundHound's voice-first approach, which can interpret intent even before a speaker finishes talking, is a huge potential advantage. The company has already begun transitioning 15 of its largest clients to Amelia 7.0, and it's made another acquisition, Interactions, to help improve how its AI agents work together.

SoundHound has already been growing like a weed, with revenue surging 217% year over year last quarter to $42.7 million. If its agentic AI push proves to be successful, the sky is the limit for the stock.

3. UiPath

UiPath (PATH 2.91%) is working to change the narrative that it will be an AI loser and instead be an AI winner. The company started out in robotic process automation (RPA), where bots can automate simple repetitive tasks. That still has a place, as it's much cheaper than running AI, but it is now looking to orchestrate how AI agents, bots, and humans can best work together.

With so many companies chasing AI agents, UiPath's platform is aimed to help these different agents and bots interact and work with each other. This gives customers the most flexibility by not being locked into one AI agent vendor, while also being able to save costs using bots when more pricey AI agents are not needed. Essentially, UiPath is looking to be the Switzerland of AI agents, and more of an orchestration platform.

NYSE: PATH

Key Data Points

It recently announced collaborations with several top AI companies, including Nvidia, Alphabet, and OpenAI. But perhaps the most interesting one is with Snowflake (SNOW 9.15%), where it will combine UiPath's automation tools with Snowflake's Cortex AI system, so businesses can move directly from data insights to real-time automated actions. That's a strong alternative to Palantir's data-driven platforms, and lets Snowflake clients use the data they already store to generate instant operational outcomes.

UiPath is starting to see early signs of a turnaround, and most new customers are adopting both its AI and RPA tools. With the stock trading at a forward price-to-sales (P/S) ratio of only around 5 times 2026 revenue estimates, the stock could have huge upside if it can become an essential AI agent orchestration tool and growth begins to significantly reaccelerate as a result.