The commercial aerospace industry is in an accelerating growth mode. That's the key conclusion from what the leading aerospace companies, like RTX and GE Aerospace, reported this week, and it's definitely the case with smaller companies like Carpenter Technology (CRS 1.40%). In fact, the company's stock rose a whopping 28.5% in the week to early Friday morning trading after an excellent set of first-quarter 2026 earnings.

Image source: Getty Images.

Why Carpenter Technology's stock soared

Carpenter's CEO Tony Thene described the company's favorable end markets as follows on the earnings call: "We continue to see demand environment strengthen, especially in the aerospace supply chain as it gains confidence in the Boeing and Airbus build rate ramp. As a result, September was the highest order intake month in over a year."

NYSE: CRS

Key Data Points

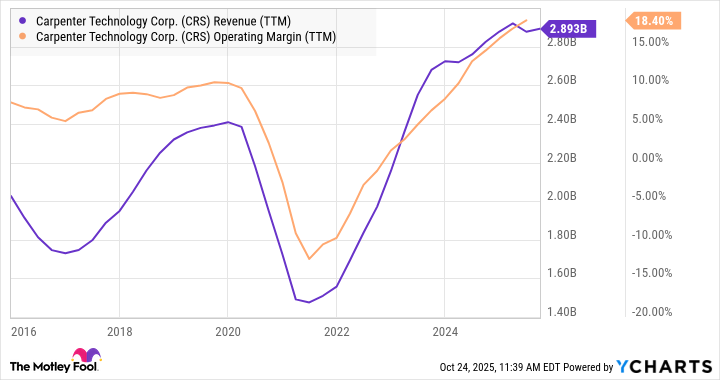

In such an environment, Carpenter is precisely the kind of company that will outperform, and revenue growth tends to drop into margin expansion at companies with relatively high fixed costs.

Indeed, here is a quick look at the company's recovery from the devastation caused by the lockdowns imposed on the aerospace industry.

CRS Revenue (TTM) data by YCharts

Management expects growth to continue in 2026 and beyond, with a target of $660 million to $700 million in operating income for 2026, followed by $765 million to $800 million in 2027, and with operating income up 31% year over year and bookings up 23% sequentially in the first quarter, it looks well on track.