It's no surprise that tech shares are among the best that you can own in the stock market. These are companies that are on the cutting edge of innovation, bringing about changes that will have lasting impacts on how we live and work.

Tech stocks are particularly hot this year with the rise of artificial intelligence (AI). Many companies are working to add AI functionality to customer-facing and internal processes. The explosion in machine learning, large language models, and generative AI is changing the game for many companies.

There are a variety of ways to invest in tech, but two of the most interesting today are Advanced Micro Devices (AMD +0.48%) and Symbotic (SYM +1.69%). Here's why these tech stocks are buys right now.

Image source: Getty Images.

Advanced Micro Devices

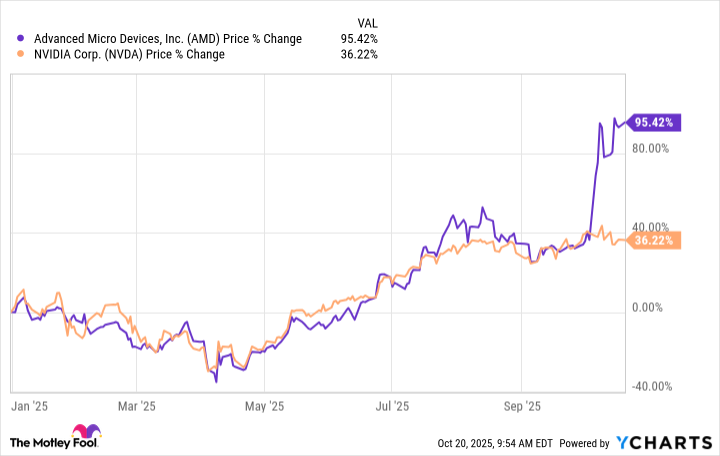

This semiconductor company, also known as AMD, plays second fiddle to Nvidia in the world of chipmaking and high-performance hardware. But that's OK. AMD has a growth story all its own -- and possibly has more room to run than its bigger, more famous counterpart.

While Nvidia rules the roost with its graphics processing units (GPUs) that handle heavy AI workloads including training, inference, and simulations, AMD is best known for its work with central processing units (CPUs). CPUs are used in data centers for lighter processing tasks, as well as in desktop computers. Both of these are important to AMD.

NASDAQ: AMD

Key Data Points

Its Epyc CPUs are designed specifically to power data centers, hyperscale clouds, and supercomputers. AMD's CPUs are used in a variety of cloud environments, including those operated by Amazon, Microsoft, Alphabet's Google, and Oracle.

Meanwhile, AMD is gradually cutting into Intel's dominant market share in the desktop computer processing market. AMD's market share in this area jumped 9.2% on a year-over-year basis to reach 32.2% in the second quarter, while Intel's market share fell to 67.8%. To put it in perspective, Intel sold nine units for every one unit for AMD sold from 2016 to 2018, and AMD has narrowed that gap to a 2-to-1 advantage now.

AMD also got a huge endorsement from OpenAI, the makers of ChatGPT, which signed a partnership that provides OpenAI with warrants to take a 10% stake worth up to 160 million shares of AMD stock, and for AMD to sell up to 6 gigawatts of GPU compute capacity. The deal will see OpenAI purchasing several generations of chips.

Shares of AMD are up 49% this year, beating Nvidia's performance. And when you consider that Nvidia is up 1,400% in the last three years and AMD is up only 300%, it appears that the smaller chip company's window to expand has arrived.

Symbotic

While AMD is a great play on AI infrastructure, Symbotic's work is in applied automation. Symbotic makes AI-powered robotics and software systems that are used to automate warehouses and smooth the bumps in the supply chain. Its autonomous robots can move freely throughout warehouses because they are equipped with depth perception and 3D vision. Many huge retailers, including Walmart, Albertsons, and Target use Symbotic's robotic fleet.

NASDAQ: SYM

Key Data Points

The robots are run on Symbotic's AI-powered software platform, which provides the most efficient routes for the robots to take. The system is also equipped with machine learning that will improve performance and make adjustments over time.

The company isn't making a profit yet, but it's growing quickly. Revenue in the third quarter of fiscal 2025 (ended June 28, 2025) was $592.1 million, up 26% from a year ago. Its loss of $0.05 per share was unchanged from Q3 2024. Symbotic stock is up 128% so far in 2025.

The bottom line

While there are hundreds of tech stocks from which to choose, I like AMD and Symbotic right now to benefit from the massive technological change that's happening. AMD is rising faster than Nvidia this year and has a ton of momentum after its partnership with OpenAI. And Symbotic is providing the tools needed for companies to automate their warehouses and reduce costs.

Both of these stocks have clear growth paths that should be appealing for any investor looking to buy tech stocks right now.