Quantum computing stocks are undeniably hot. Just look at IonQ (IONQ +5.35%) shares, which soared roughly 295% in the past year through Oct. 23. Not to be outdone, competitor D-Wave Quantum (QBTS +4.02%) saw its stock skyrocket more than 2,490% in that time.

These astounding returns are happening even though quantum computing is still in its infancy. Once the tech matures, IonQ and D-Wave shares are likely to see further growth.

That has some investors wondering if now is a good time to invest in these pure-play quantum computing companies. My analysis suggests that, between the two, one looks like a more promising investment in this emerging sector. Let's see what the analysis revealed.

Image source: Getty Images.

D-Wave's technological strengths

One key consideration in choosing between D-Wave and IonQ is their approach to quantum computing technology. The company with the superior solutions will likely capture more market share as the industry expands.

D-Wave chose to focus on annealing quantum computers, a computing technique that uses quantum mechanics to find the lowest-energy state of a system, identifying the best solution among many possible choices. This approach can be applied to optimization scenarios, such as when constructing artificial intelligence models.

Given the unprecedented global demand for AI, D-Wave's tech puts it in an advantageous position. Quantum computers can perform certain complex computations in minutes that would take a million years on today's standard supercomputers.

These strengths explain why the company released a set of AI tools earlier this year, providing access to D-Wave's quantum computers for AI development. Japan Tobacco's pharmaceutical division is among the organizations using D-Wave to integrate AI with quantum computing for new drug research.

But D-Wave's technological advances have produced limited revenue so far. Sales in its second quarter totaled a paltry $3.1 million. While that sum represented 42% year-over-year growth, its second-quarter operating expenses were $28.5 million, a 41% increase from 2024's $20.2 million.

With expenses costing significantly more than the sales coming in, D-Wave's business would be headed for financial trouble if it didn't execute an equity offering this year. The move brought the company's cash balance to $815 million as of July 1, which should sustain its operations for a time while it attempts to increase income.

NYSE: QBTS

Key Data Points

How IonQ has fared

IonQ's tech uses a different approach from D-Wave, employing ions to perform all types of calculations, not just optimizations. This versatility makes IonQ's machines applicable to a broader range of scenarios.

In addition, on Oct. 21, IonQ touted a world record for the fidelity of its quantum computers. Fidelity measures the accuracy of quantum computing calculations. The industry has been plagued by high error rates up to this point, preventing the technology from scaling up.

By achieving a world record in accuracy, IonQ is positioned to accomplish the kind of scale that can enable quantum devices to eventually replace classical computers.

The company's successes have translated into strong sales growth. In Q2, IonQ's revenue reached $20.7 million, up from 2024's $11.4 million. It forecasted third-quarter sales to come in between $25 million and $29 million, which is more than double the $12.4 million made in 2024.

But like D-Wave, IonQ's costs soared in Q2, more than doubling year over year to $181.3 million. Consequently, the company's Q2 operating loss was $160.6 million, more than triple the $48.9 million loss in 2024.

To raise money to fund its costly operations, IonQ performed a $1 billion equity offering in the summer and announced another on Oct. 10 for $2 billion.

NYSE: IONQ

Key Data Points

Deciding between D-Wave Quantum and IonQ stocks

Since D-Wave and IonQ both possess unique technological strengths, it means each can carve out a niche in the broader quantum technology landscape. After all, the industry is forecasted to produce as much as $97 billion in global revenue by 2035.

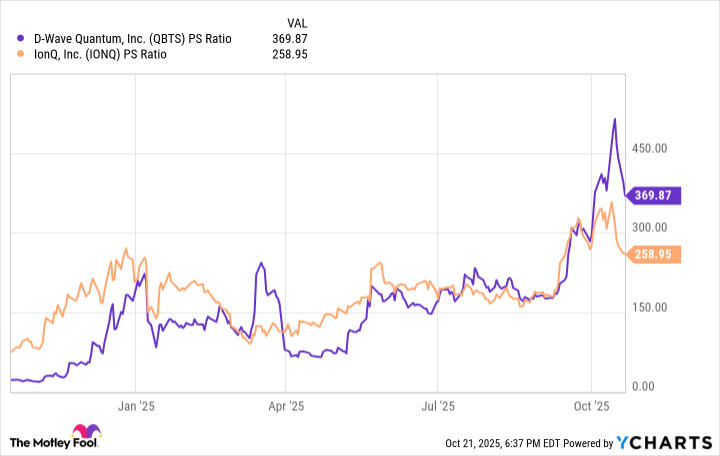

But when it comes to investing in one of these companies, alongside business performance, share price valuation is a key consideration. To assess this, here's a look at each company's price-to-sales (P/S) ratio.

Data by YCharts.

The chart shows that a year ago, IonQ possessed the higher P/S multiple between the two companies, but now that's reversed. Consequently, D-Wave shares are more expensive at this time.

That said, both stocks are pricey, suggesting they are trading more on the speculative future potential of their technologies than current business performance. But if you wanted to invest in one of these companies, the better choice at this time is IonQ.

Not only does its stock sport a superior valuation compared to D-Wave, but it's also generating significantly more sales, an important factor for long-term business viability. D-Wave's annealing approach is also more of a niche technology than IonQ's, which can limit its potential market share.

These factors make IonQ the better quantum computing stock to invest in over D-Wave. But since the industry is in its early stages, which technology will eventually become the dominant one is still unknown.

Therefore, purchasing IonQ shares is only for investors with a high risk tolerance. Given the elevated valuation, consider waiting for the stock to drop before deciding to buy.