UnitedHealth Group (UNH 1.72%) has been a top dividend stock to own for years. It has consistently provided investors with a reliable dividend, and it has made generous increases to the payout over time. This year, however, it has come under pressure as its expenses have continued to rise, and it has disappointed investors with its recent earnings numbers.

The stock has been in the midst of a free fall, and as a result, its dividend yield has become unusually high. Can dividend investors continue to rely on UnitedHealth for recurring income?

Image source: Getty Images.

Rising costs haven't been the only problem for UnitedHealth

This year hasn't been a good one for UnitedHealth, with its shares falling by 28% thus far in 2025 as I write this on Oct. 20. Its costs have been rising, which resulted in the company missing analysts' earnings expectations in July by a wide margin. There's also been a change in CEO and a Department of Justice investigation related to its billing practices, both of which have given investors plenty to think about.

Despite this flurry of bad news, however, UnitedHealth still has a fairly strong health insurance business. The company has generated $21.3 billion in profit over the trailing 12 months. Its payout ratio of 37% is also fairly healthy, leaving plenty of room for the health insurer to continue paying and potentially increasing its dividend in the future.

While its costs have been on the rise, that's due to not only inflation, but also an increase in utilization rates. Amid a return to normal after the pandemic's height, there have been increases in procedures and surgeries, which may have been put off in previous years. As a result, UnitedHealth's medical care ratio rose to 89.4% in its most recent results. That's a sizable increase from the 82.5% it averaged in 2019, which was already an increase from 81.6% in the previous year. But as the company focuses on trimming costs, this ratio should come down.

With strong financial results, the dividend still looks safe.

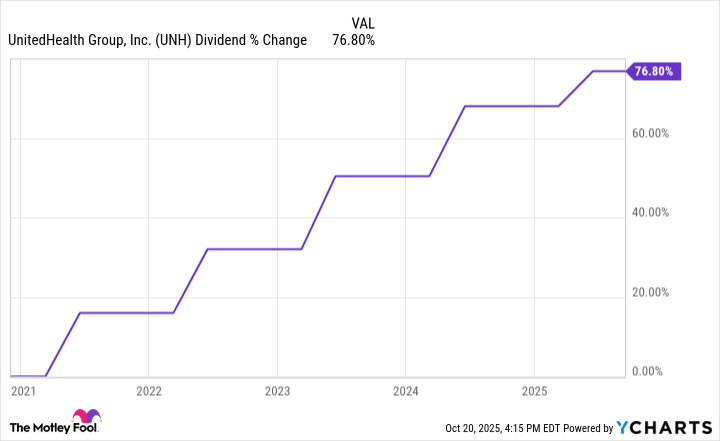

The dividend keeps growing

Earlier this year, UnitedHealth raised its quarterly dividend by $0.11, to $2.21, amounting to an increase of more than 5%. The healthcare stock's consistent and reliable dividend growth is a key reason why this has historically been a good income investment to hang on to.

UNH Dividend data by YCharts.

The dividend growth is a great reason to remain invested in one of the top healthcare companies in the U.S. At a current 2.5% dividend yield, investors who buy shares of UnitedHealth are collecting a dividend that's more than twice that of the average stock on the S&P 500, which pays a little less than 1.2%. If you hang on for the long haul, that dividend income is likely to rise.

NYSE: UNH

Key Data Points

UnitedHealth can still be a good long-term buy

This has been an uncharacteristically bad year for UnitedHealth. But despite the challenges it's facing, I believe UnitedHealth, which plays a vital role in the healthcare industry by insuring over 50 million people, will prevail over the current headwinds. Utilization rates, while high, should come down over time, bringing down the company's medical care ratio and costs in the process.

Meanwhile, UnitedHealth's financials are strong enough to handle the adversity and enable the business to continue growing its dividend for the foreseeable future. Overall, the stock could make for a good buy on weakness right now. Not only is the yield higher than normal, the stock itself is trading at a modest price-to-earnings multiple of 15, giving investors a good margin of safety.