Wall Street has never seen a $5 trillion stock. However, Nvidia (NVDA +2.26%) is getting awfully close, hovering at about a $4.5 trillion market capitalization. Less than a decade ago, Wall Street had never seen a $1 trillion company, so this meteoric rise from a company that was worth about $14 billion a decade ago is nothing short of incredible.

I think Nvidia will be the first company to cross the $5 trillion threshold, beating Apple and Microsoft to the punch. However, there are concerns about an artificial intelligence (AI) bubble forming. Could it stop this giant from reaching that important milestone?

Image source: Getty Images.

Nvidia expects growth to continue for multiple years

Nvidia makes graphics processing units (GPUs), which are generally used to process workloads that need a lot of computing power. GPUs were invented to process gaming graphics, but eventually found use cases in other areas like engineering simulations, drug discovery, and cryptocurrency mining. Artificial intelligence workloads have been the largest use case for GPUs by far, and that doesn't seem to be slowing down anytime soon.

Nvidia's co-founder and CEO, Jensen Huang, commented during the company's Q2 earnings release that he expects AI data center capital expenditures to rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030. That's a bold projection, and has caused many to fear that companies like Nvidia have gotten too bullish on the AI buildout.

However, investors must understand that these AI data centers are planned years in advance. The AI hyperscalers must get approval to build them from various municipalities, secure electricity and other utility needs, build the site, and then fill them with chips from companies like Nvidia.

NASDAQ: NVDA

Key Data Points

This means that for all of the massive AI data centers that are being announced this year, it will take a few years before Nvidia chips make their way into service. This requires the hyperscalers to be in contact with Nvidia years in advance of when they actually need the GPUs, which gives Nvidia a valuable view into the future.

With this in mind, investors need to start thinking about where Nvidia could head should its projection pan out.

A $5 trillion market cap is just the beginning for Nvidia

Should Nvidia's $3 trillion to $4 trillion data center capital expenditure projection pan out, it has a ton of room to run. Wall Street analysts project that Nvidia will generate about $206 billion in revenue during fiscal 2026 (ending January 2026), which is about a third of the total data center capital expenditures Nvidia expects for 2026. If we decrease that share to 25% by 2030 and use the bottom end of the total spending projection ($3 trillion), that means Nvidia could generate $750 billion in revenue.

If Nvidia can maintain its 50% profit margin, that would indicate $375 billion in profits. If we apply a 25 times earnings multiple to that profit projection, that would yield a $9.4 trillion company by 2030. That's more than a double from today's prices, which would indicate that Nvidia has the potential to crush the market. Additionally, it would position it nicely to become the first company to cross the $10 trillion mark not long after that.

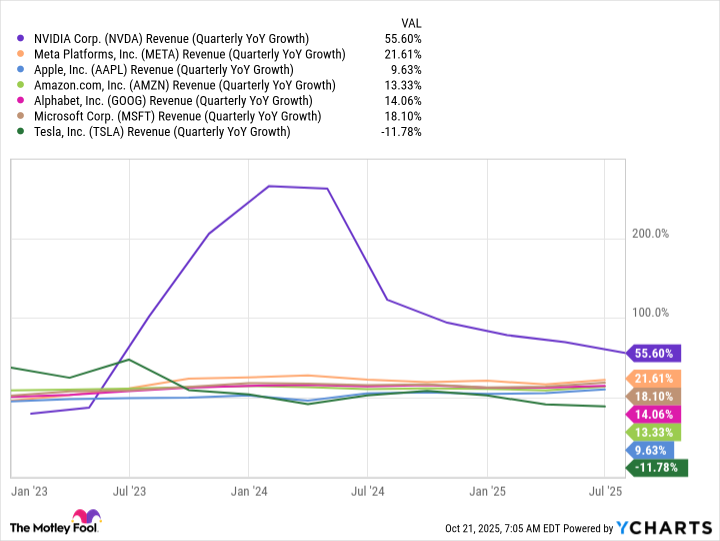

If AI spending pans out like Nvidia projects, it will be the first to cross several valuation thresholds, as Nvidia's growth is far greater than all of its big tech peers.

If Nvidia can maintain this growth, as its projections indicate it should, Nvidia will continue to be one of the best investments an investor can make over the next five years. As a result, I think it's still safe to invest in Nvidia right now.