A government shutdown generally happens when Congress fails to pass spending bills necessary for funding various agencies. That has been the case since Oct. 1, with the government closing down for the 20th time since 1976 and the first time since 2018 (the longest shutdown so far).

Government shutdowns affect many people, especially those working for federal agencies deemed nonessential. But what are the implications for the stock market? Let's look at three key things investors should know about the market during shutdowns.

Image source: Getty Images.

1. The S&P 500 is generally unfazed

The S&P 500 (^GSPC 0.53%) -- which tracks around 500 of the largest American companies on the market -- hasn't typically had any dramatic changes during past government shutdowns, especially negatively. During the past 10 government shutdowns (not including the current one), the S&P 500 has finished in the red only three times:

| Date Range | Days | S&P 500 Change |

|---|---|---|

| Nov. 21 to Nov. 23, 1981 | 2 | (0.1%) |

| Oct. 17 to Oct. 18, 1986 | 1 | (0.3%) |

| Oct. 6 to Oct. 9, 1990 | 3 | (2.1%) |

Source: Standard Chartered.

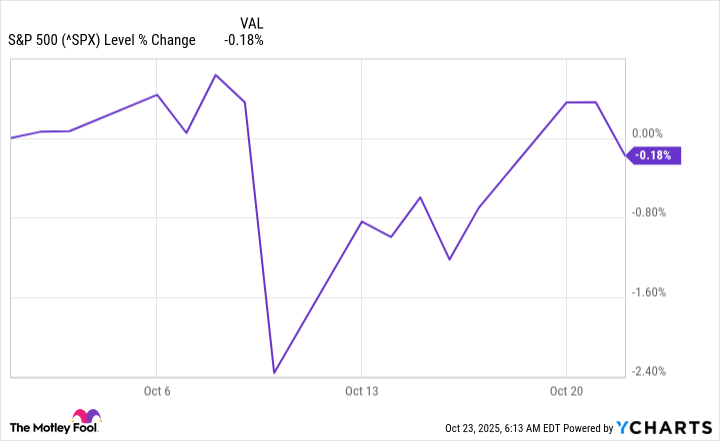

Since the government shut down on Oct. 1, the S&P 500 is only down around 0.2% through Oct. 22.

Past results don't guarantee future performance, but the S&P 500 so far is aligning with the market's historical performance during shutdowns.

2. Key federal data is often delayed

There is a handful of key federal reports that investors rely on for insights into the economy's health, including inflation, unemployment, consumer spending, and GDP growth (or lack thereof).

When the government is idled, this data is often delayed or not released because agencies like the Bureau of Labor Statistics and the Census Bureau are temporarily closed or operating with limited staff. That's why this year's announcement of the 2026 Social Security cost-of-living adjustment came out after a delay.

3. IPOs and other corporate actions usually slow down

The U.S. Securities and Exchange Commission (SEC) is responsible for reviewing and approving initial public offerings (IPOs). Unfortunately, when the government closes down, the SEC's normal operations shut down with it.

This means companies wanting to go public or make major filings (like merger-related documents) will likely have to delay their plans because there won't be anyone available to review prospectuses (documents with key investor information about a company's operations, financials, and risks) or registration statements.

This might not have a direct impact on companies currently trading on the stock market, but it can slow the pipeline of those hoping to go public.