Intuitive Surgical (ISRG 1.17%) has dominated the market for robotic-assisted surgery (RAS) devices for the better part of the last 20 years, with little competition to speak of in many of the indications where it's approved. However, that is changing; the medical device specialist will face more challengers than it has before.

One of them will be Medtronic (MDT 2.26%), which is racing toward regulatory clearance in the U.S. for its own robotic device, the Hugo system. With these two medical device giants about to go head-to-head, which is the better buy?

Image source: Getty Images.

The case for Intuitive Surgical

Intuitive Surgical first launched its da Vinci system in 2000. Since then, the company has earned regulatory clearance for several additional iterations of its crown jewel, with the fifth generation earning approval last year. The da Vinci system is indicated across a range of surgeries, including urologic, general surgical, bariatric, and gynecological procedures. Intuitive Surgical had an installed base of 10,763 for its da Vinci system as of the third quarter, up 13% year over year.

The company generates consistent revenue and profits, and it has for a long time. Third-quarter sales came in at $2.51 billion, 23% higher than the year-ago period. Intuitive Surgical's non-GAAP (adjusted) earnings per share (EPS) were $2.40, compared to the $1.84 it generated in the year-ago period.

NASDAQ: ISRG

Key Data Points

Intuitive Surgical has plenty of growth potential. The RAS market is underpenetrated, despite the minimally invasive surgeries that robotic systems enable, which lead to better outcomes than traditional open surgeries. The company also benefits from a strong economic moat due to high switching costs, given the high price tag and steep learning curve associated with its da Vinci system. Over the long run, it will benefit from increased sales of instruments and accessories as procedure volume continues to grow.

And despite challenges such as tariffs, Intuitive Surgical should find a way to overcome them -- perhaps by negotiating with the administration to mitigate their impact in exchange for increasing local manufacturing, or passing higher expenses on to its clients (or a combination of the two). Although the stock lagged the S&P 500 this year, Intuitive Surgical's future looks bright.

The case for Medtronic

Medtronic has a long list of devices across multiple categories, and its diversified business generates consistent revenue and earnings. Its latest period was the first quarter of its fiscal year 2026, ending on July 25; total revenue increased 8.4% year over year to $8.6 billion, while adjusted EPS rose 2% year over year to $1.26. Those are solid results, and the company is making changes that could help improve them.

First, Medtronic is getting rid of its only consumer-facing business, its diabetes unit, which has been a drag on operating margins and the bottom line. Although the diabetes care segment had recorded faster sales growth, in the current tariff-fueled environment, prioritizing stronger margins and profits might be the way to go.

NYSE: MDT

Key Data Points

Second, Medtronic's venture into the RAS market will help boost revenue growth. It has requested clearance for its Hugo system in urologic procedures, setting it up for a face-off against Intuitive Surgical. Medtronic will also seek approval across other areas, including gynecological procedures. The vast growth opportunities in RAS will provide a strong long-term tailwind.

Lastly, Medtronic is a terrific dividend stock. It has increased its payouts for 48 consecutive years, and should soon join the group of Dividend Kings, corporations with a 50-year (or longer) streak of annual dividend increases. Medtronic is a reliable pick for long-term, income-seeking investors.

Which is the better buy?

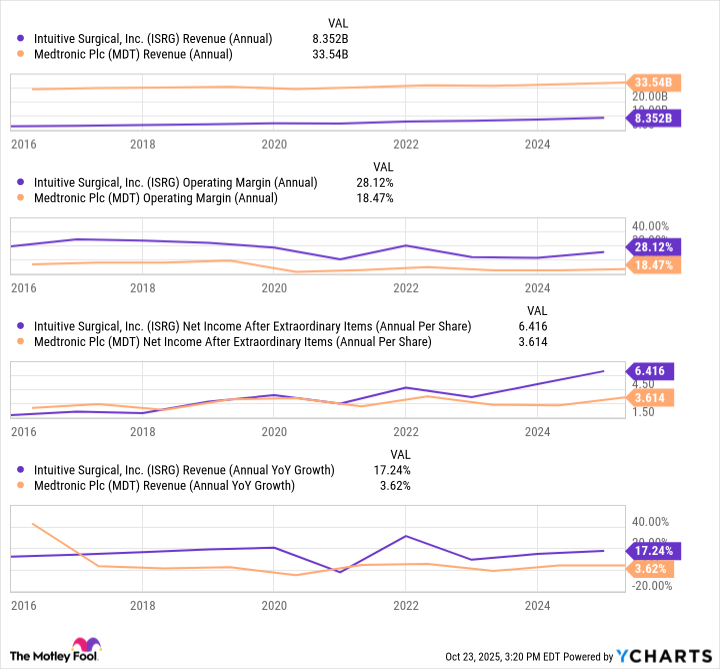

Medtronic is the larger company and generates higher annual revenue. However, Intuitive Surgical's top-line growth, margins, and earnings look stronger than those of its competitor:

ISRG Revenue (Annual) data by YCharts.

That's why Intuitive Surgical's shares are more expensive. The company is trading at around 48 times forward earnings, while the average for the healthcare industry is 17.5, and Medtronic's is at 17. Some might say Intuitive Surgical's shares are too expensive, especially amid tariffs and increased competition from Medtronic in the RAS field.

So, what's the verdict? In my view, it largely depends on investment styles and preferences.

Despite its issues -- and its valuation -- Intuitive Surgical still looks like the better stock for growth-oriented investors, given its large addressable market and faster top-line growth. But Intuitive Surgical should be far more volatile. That makes Medtronic the better option for income-seeking investors looking for low volatility and stability.