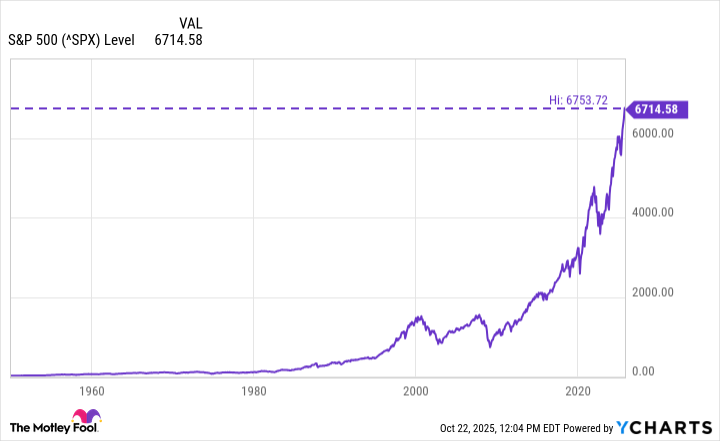

After the brutal bear market of 2022 -- when surging inflation, aggressive rate hikes, and recession fears wiped out trillions in market value -- few investors expected such a swift comeback. Yet, since the current bull market began in October 2022, the S&P 500 (SNPINDEX: ^GSPC) has been on a powerful tear, fueled by a rebound in technology, resilient consumer spending, and a steady recovery in corporate profits.

Artificial intelligence (AI) stocks have been the clear leaders, with mega-cap names like Nvidia, Microsoft, and Apple setting the pace for the broader market. At the same time, sectors like industrials, energy, and healthcare have quietly joined the rally as investors position for long-term economic stability.

Now, with the S&P 500 once again flirting with record highs, many are asking the same question: Is it wise -- or reckless -- to invest when the stock market could be topping out? History offers a clear answer -- one that may change how you think about buying at the top.

What all-time highs really mean for investors

Contrary to popular belief, an S&P 500 all-time high isn't a warning sign of an imminent bubble or stock market crash. In reality, it's a natural byproduct of economic progress and innovation.

Since its inception nearly 70 years ago, the S&P 500 index logged more than 1,200 all-time highs, according to research from RBC Global Asset Management. Unsurprisingly, most of those milestones occurred during strong bull markets. That's because investors tend to reward long-term growth in earnings, productivity, and innovation. When inflation cools, interest rates stabilize, and corporate profits expand, new highs in the market are the logical result.

Sitting on the sidelines out of fear of "buying at the top" often proves far more costly than stomaching short-term volatility and corrections. History makes these dynamics clear: Even when investors buy at record highs, the S&P 500's long-term returns have remained robust.

How to invest wisely when markets hit new peaks

For investors who feel uneasy about buying when the market is at record highs, diversification and balance are essential.

One effective approach is to consider equal-weighted S&P 500 ETFs. Unlike traditional index funds that are heavily concentrated in mega cap titans, equal-weight ETFs give every stock the same representation. This provides broader exposure -- including to mid-cap and value-oriented companies that could outperform in the next phase of the cycle.

Alternatively, investors who prefer to ride the momentum can explore growth-oriented ETFs, such as the Vanguard Growth ETF.

No matter the strategy, the most powerful investing principle remains consistency. Investing regularly through dollar-cost averaging helps smooth out volatility and ensures you're always participating in the market -- regardless of short-term swings and headlines.

SNPINDEX: ^GSPC

Key Data Points

The long view: Time, not timing, creates wealth

Every investor wishes they could buy at the bottom -- but history rewards those who simply stay the course. Since the 1950s, the S&P 500 has weathered recessions, wars, political turmoil, and even a global pandemic -- yet the index has continued to climb higher over time.

The takeaway is clear: Markets rise because human progress does not stop. Buying at an all-time high might feel uncomfortable or even unwise to some, but history shows it's often been a winning move for patient investors.

As the old adage goes, the best time to invest was yesterday -- and the second-best time is today. Staying disciplined and diversified is one of the surest ways to let compounding do its work and create wealth for the long haul.