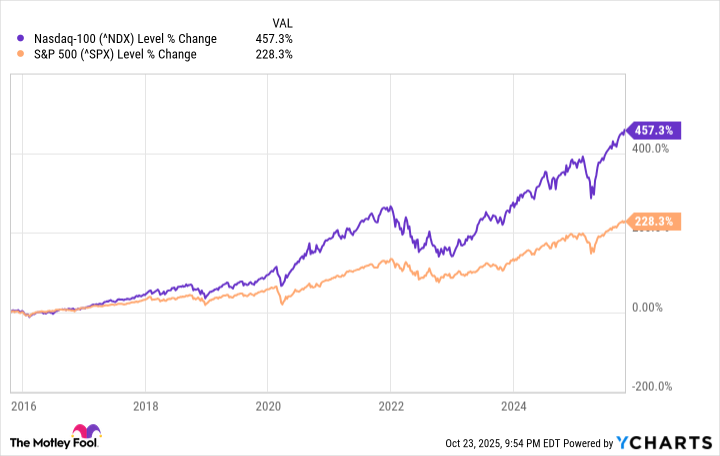

The S&P 500 (^GSPC +0.50%) is the most diversified of the main U.S. stock market indexes, because it hosts 500 companies from 11 different sectors of the economy. At the opposite end of the spectrum is the Nasdaq-100 index, which is made up of just 100 companies, and many of them operate in the technology and tech-adjacent industries.

Over the last decade, the Nasdaq-100 has delivered twice the return of the S&P 500, thanks to its high degree of exposure to high-growth tech giants like Nvidia, Microsoft, and Apple:

As a result, owning a slice of the Nasdaq-100 could supercharge any diversified stock portfolio. The Invesco QQQ Trust (QQQ +0.44%) is an exchange-traded fund (ETF) that tracks the performance of the index by investing in the same stocks, and here's how it could turn an outlay of $200,000 into $1 million in under 20 years.

Image source: Getty Images.

Large holdings in America's "Magnificent Seven" stocks

The "Magnificent Seven" is a group of seven companies that dominate various segments of the technology industry, including artificial intelligence (AI), semiconductors, electric vehicles, cloud computing, social media, digital advertising, and more. The seven stocks have a combined weighting of 34.4% in the S&P 500, but a much higher weighting of 44.1% in the Invesco QQQ ETF:

|

Magnificent Seven Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

Nvidia |

9.45% |

|

Microsoft |

8.35% |

|

Apple |

8.28% |

|

Alphabet |

6.12% |

|

Amazon |

5.02% |

|

Tesla |

3.45% |

|

Meta Platforms |

3.43% |

Data source: Invesco. Portfolio weightings are accurate as of Oct. 22, 2025, and are subject to change.

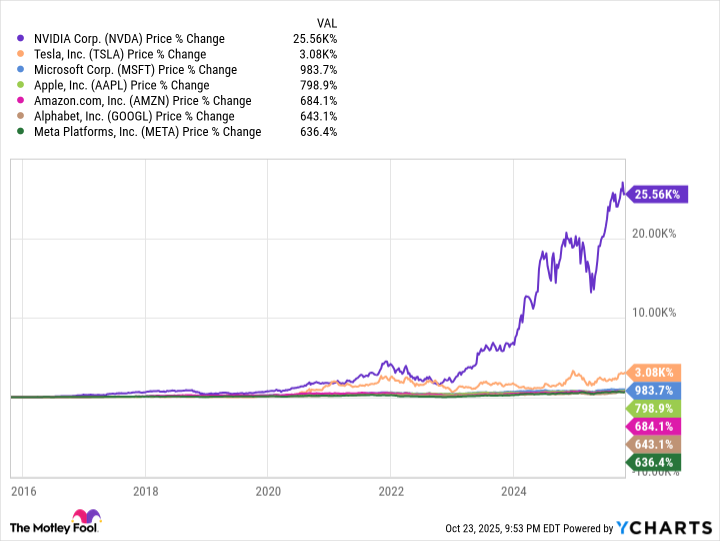

The Magnificent Seven stocks have generated a median return of 798% over the past decade, so since the Nasdaq-100 (and by extension, the Invesco ETF) assigns them much higher weightings than does the S&P 500, the index's significant outperformance comes as no surprise.

Although the Invesco ETF is very tech-heavy, it does offer a splash of diversification. Non-technology stocks like Costco Wholesale, Linde PLC, PepsiCo, Starbucks, and Monster Beverage are also in the fund, in addition to many biopharmaceutical stocks and even media stocks.

Turning $200,000 into $1 million

The Invesco QQQ ETF has delivered a compound annual return of 10.4% since its inception in 1999. However, that yearly return has accelerated to 20.3% over the last decade, thanks to powerful tech trends like AI.

Here's how long it could take the ETF to turn an investment of $200,000 into $1 million based on three different compound annual returns:

|

Compound Annual Return |

Time To Reach $1 Million |

|---|---|

|

10.4% |

17 Years |

|

15.3% (midpoint) |

12 Years |

|

20.3% |

9 Years |

Calculations by author.

NASDAQ: QQQ

Key Data Points

As demonstrated, the Invesco ETF could be a millionaire maker in under 20 years even if its annual return reverts to its long-term average of 10.4%. Investors could even become millionaires in under a decade if the fund's annual returns continue at the current pace of 20.3%, but that probably isn't realistic because not even the tech sector can grow this quickly forever.

Many of the companies in the Magnificent Seven already have a dominant market share in their respective industries. Alphabet's Google, for example, already processes 90% of all internet search queries worldwide, leaving little room for growth. Then there is Meta Platforms, which already serves almost 3.5 billion users every single day across its social networks like Facebook, Instagram, and WhatsApp, so it won't be easy to continue attracting new signups without a significant increase in the global population.

But AI could certainly drive above-average returns in the Invesco ETF for the next few years at least. According to Cathie Wood's Ark Investment Management, this technology could create a $13 trillion opportunity in the software industry by 2030. The benefits will also flow through to the hardware space; Nvidia CEO Jensen Huang estimates data center operators will invest up to $4 trillion upgrading their infrastructure to meet demand from AI developers over the same period.

The Invesco ETF holds a number of chip stocks besides Nvidia that will benefit from that spending boom, including Broadcom, Advanced Micro Devices, and Micron Technology, which will help investors capture plenty of that value.

In summary, there is a reasonable chance the Invesco QQQ ETF can deliver a fivefold return over the next 10 to 20 years, so it could be a great buy right now.