The Dow Jones Industrial Average is home to some of the most storied, iconic American brands. Companies such as Coca-Cola, Disney, Home Depot, IBM, and Walmart are just a handful of the index's components.

About a year ago, the Dow shook things up, replacing longtime member Intel with semiconductor giant Nvidia (NVDA 1.55%). From a structural standpoint, the change makes sense. Over the last few years, Intel has struggled to keep pace with its peers in the chip space. Meanwhile, Nvidia has essentially become the ultimate barometer of the stock market's latest megatrend: The artificial intelligence (AI) revolution.

NASDAQ: NVDA

Key Data Points

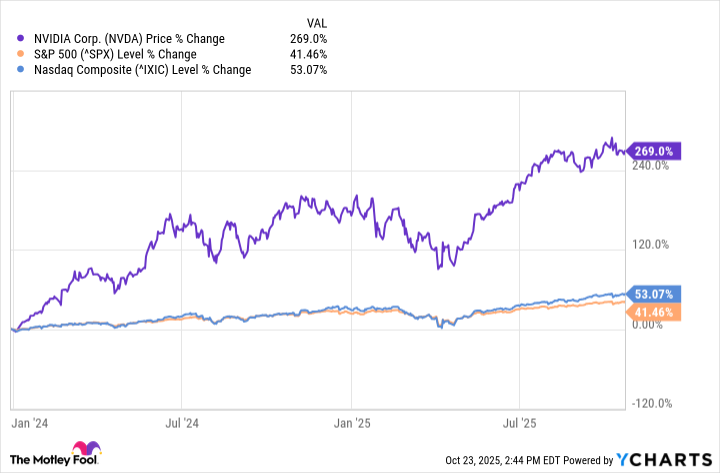

Since last January, shares of Nvidia have gained nearly 270% as of this writing (Oct. 23). For perspective, this is more than five times the gains generated in the Nasdaq Composite and S&P 500.

While this type of momentum might have you thinking the Nvidia train is headed for a speed bump, analysts across Wall Street beg to differ. Let's explore several key tailwinds that could help fuel Nvidia's generational run even further, and assess why now still looks like a great time for long-term investors to double down on the stock.

What catalysts does Nvidia have?

For the last three years, Nvidia's primary source of revenue and profits has been its compute and networking business. This is the segment of the company responsible for selling high-performance AI accelerators, known as graphics processing units (GPUs), and accompanying data center services.

Right now, Nvidia's next-generation chip architecture -- dubbed Blackwell -- is in high demand among big tech hyperscalers like Microsoft, Alphabet, Amazon, Meta Platforms, Oracle, and OpenAI. What's even more encouraging, however, is Nvidia's pace of innovation. Over the next couple of years, the company is slated to release even more powerful successor chips, known as Blackwell Ultra and Vera Rubin.

This dense product roadmap brings up an important question: Why is Nvidia already planning next-generation hardware as it currently scales Blackwell?

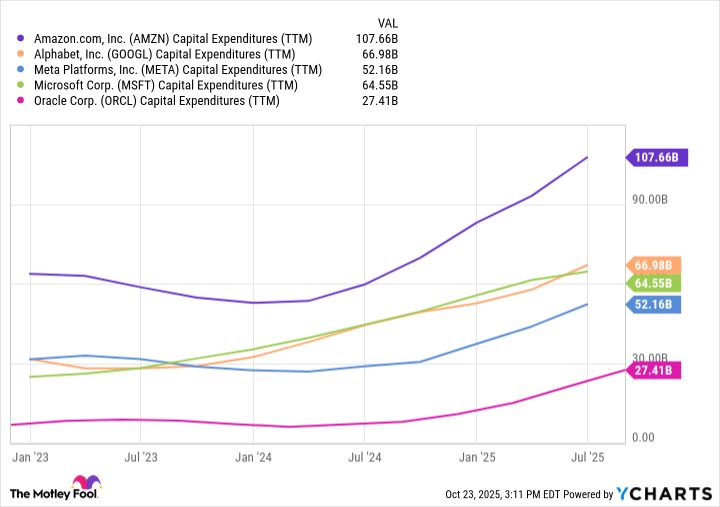

The answer to that can be summed up by looking at the long-term forecasts of capital expenditures (capex) from the hyperscalers. Over the last few years, cloud hyperscalers and big tech titans have poured hundreds of billions of dollars into AI data centers, packing these facilities with best-in-class GPU clusters and networking equipment.

AMZN Capital Expenditures (TTM) data by YCharts.

These dynamics have served as a bellwether for Nvidia throughout the AI boom. But according to Wall Street, the AI infrastructure revolution is just getting started.

According to management consulting firm McKinsey & Company, an estimated $7 trillion is expected to be spent on AI infrastructure over the next five years. In the near term, research from Goldman Sachs indicates that the hyperscalers will spend nearly half a trillion dollars on AI buildouts just next year.

It's this rise in AI infrastructure that has technology analyst Beth Kindig of the I/O Fund calling for Nvidia to reach a $6 trillion valuation by 2026 -- implying more than 30% upside from its current market capitalization of roughly $4.5 trillion.

Image source: Nvidia.

What is Wall Street's view of Nvidia?

According to data from Yahoo! Finance, a total of 64 sell-side analysts cover Nvidia stock. Among these researchers, 59 place a rating of "buy" or an equivalent on Nvidia stock. Only one analyst rates Nvidia stock as a sell.

Image source: Getty Images.

While the topics explored above provide some qualitative details surrounding Nvidia's bullish prospects, let's dig into the numbers to add some quantitative color around why so many on Wall Street still see Nvidia stock as an attractive value.

Is Nvidia stock a buy right now?

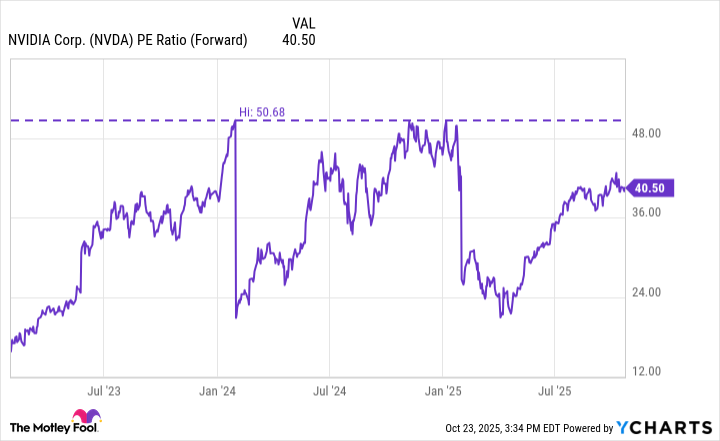

A valuation metric that I like to look at is the forward price-to-earnings (P/E) multiple. This ratio accounts for projected earnings growth in a company -- potentially giving investors a glimpse of how optimistic Wall Street is over a company's future profit potential.

NVDA PE Ratio (Forward) data by YCharts.

In the chart above, investors can see how Nvidia's forward P/E has fluctuated throughout the AI revolution. Two key details stick out from the analysis above.

First, Nvidia stock has clearly enjoyed some outsized momentum over the last few months, leading to a prolonged period of valuation expansion. That said, the company's forward earnings multiple of 40 is materially lower than the prior peak of 51, witnessed early last year.

This is an important nuance to digest. What the trends above are implying is that despite having more tailwinds behind it now -- and a greater ability to command even more record profits -- Nvidia stock is actually cheaper today than it was in early 2024.

In this case, I am aligned with Wall Street. I think Nvidia is poised to benefit from numerous secular tailwinds as the AI infrastructure boom accelerates. While the stock is not inexpensive, per se, it trades at a relative discount compared to earlier stages of the AI revolution. That makes it an attractive buy-and-hold opportunity for long-term investors right now.