When it comes to rare earth elements, China is constantly reminding markets who controls the spigot.

Indeed, over the last few weeks, Beijing has signaled tighter constraints around exports and processing equipment related to rare earth metals. In response, Washington and allies have stepped up efforts to shore up domestic supplies. Last week, for instance, the U.S. and Australia announced a critical-minerals deal that could reduce (some) reliance on China.

For companies whose bottom lines rely on rare earth metals, this tension has been nothing short of a headache. For one mining company, however, their scarcity has been a boon for its stock -- MP Materials (MP 7.40%).

The case for MP right now

MP Materials operates the only rare earth metal mine and processing facilities of considerable scale in the U.S. -- the Mountain Pass mine in California. This mine is rich in the kinds of light earth metals that can be refined into neodymium-praseodymium (NdPr) oxide, which is a key ingredient in high-strength magnets.

Historically, MP has relied on Chinese partners to process its raw concentrate into oxides and magnets. Lately, however, with friendly trade between China and the U.S. falling apart, MP has had to cut ties and fast-track its own refining and magnet-making capabilities.

It's a major opportunity for MP to emerge as the U.S.'s go-to source for rare earth magnets, and a big reason that its stock has surged over 300% on the year.

NYSE: MP

Key Data Points

In July, the Pentagon struck a huge deal with the company. It agreed to a 10-year floor price of $110/kg for NdPR -- which is almost 40% higher than prevailing market levels -- and backed that commitment with a $400 million investment in MP. It also signed a long-term purchase agreement to buy all output from MP's next magnet plant.

About a week later, Apple (AAPL +2.28%) committed $500 million to expand MP's Texas magnet facility and recycling capabilities. The partnership will see the tech giant receiving U.S.-made recycled magnets for its devices starting in 2027.

Headwinds investors shouldn't ignore

The flip side of all this partnership talk is that MP doesn't have the manufacturing capacity to serve the U.S. market.

Currently, its Fort Worth Independence plant boasts a small output (about 1,000 tons per year), while its second magnet factory (10X Facility) isn't expected to hit full stride until 2028 or beyond.

True, when its 10X facility is up and running, its magnet production will literally multiply by 10 (hence the name) to exceed 10,000 tons produced annually. But building a factory isn't cheap (MP has already secured $1 billion to finance it), and the capital intensity of the project will likely keep MP unprofitable at least through 2026.

Finally, I wouldn't ignore the possibility that the tension at the heart of MP's recent market rally -- rare earth exports from China -- could deescalate, or pause (the U.S. is already expecting China to delay export controls). Although Washington would still likely support building up a domestic supply, the cooling of any urgency could make this red-hot stock -- trading at 48 times sales -- vulnerable to pullbacks.

So, should you buy MP today?

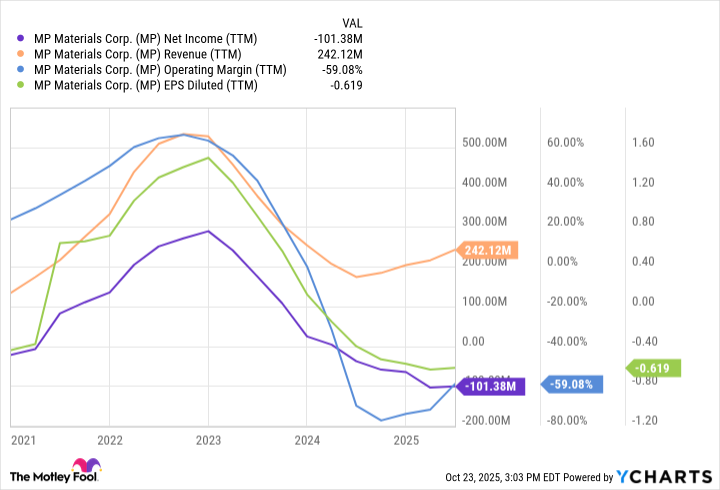

Here's the thing. MP stock ran hard on the Pentagon and Apple headlines, but profits aren't here yet. As the chart below shows, MP is still in its build-out phase.

MP Net Income (TTM) data by YCharts. EPS = earnings per share.

That said, the company has been improving its total financial picture. In its second quarter, MP's revenue jumped 84% year over year, with a 119% increase in NdPr production. Its loss on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis was $12.5 million. That's not great, but it's better than the $27.1 million loss a year before.

The bullish thesis for MP, then, is that it's the only scaled U.S. producer of rare earth metals with a clearer line of sight to cash flow than similar mining companies that may have a project outlined but are years away from an operational mine.

If MP can execute on its promise, it could grow well into today's high valuation. For long-term investors comfortable with volatility, I'd at least keep this company on your radar. For less volatility, you might want a metal exchange-traded funds (ETF) that could offer exposure to the same rare earth story.