Quantum computing stocks have been some of the biggest winners over the last year.

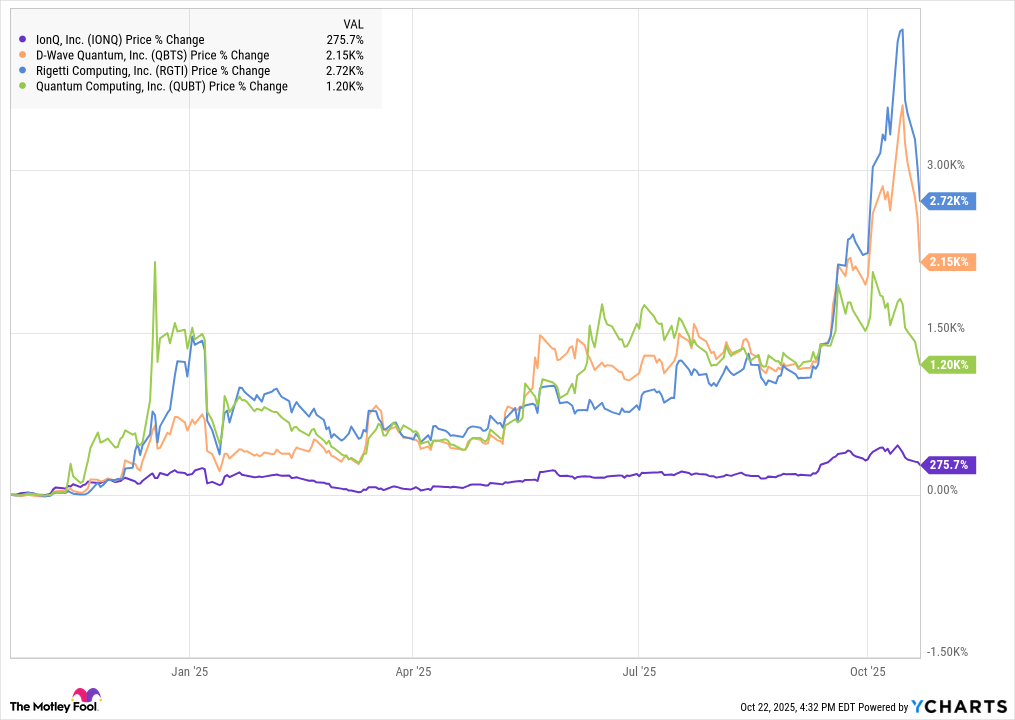

In fact, it's hard to find a group of stocks that have done better than the four development-stage companies: IonQ (IONQ +6.81%), D-Wave Quantum (QBTS +0.38%), Rigetti Computing (RGTI +3.72%), and Quantum Computing (QUBT +4.27%). As you can see from the chart below, these four stocks have skyrocketed over the last year.

A basket of all four of these stocks would have returned a whopping 1,600% over the last year even though they still have minimal revenue.

While the pure-play quantum computing companies have yet to generate significant financial results, excitement is building for the new technology. In the wake of the breakthrough in artificial intelligence (AI), investors are looking for the next potentially disruptive technology, and quantum computing has caught their eye.

Quantum computing, based on quantum physics, is much more powerful than traditional computing. Attention on this new technology has soared as a number of tech luminaries, including Nvidia CEO Jensen Huang, have acknowledged that useful quantum computing could be here sooner than expected. A milestone achieved by Alphabet's (GOOG 0.85%) (GOOGL 0.83%) Willow quantum chip last December also helped drive interest in quantum computing and sent those four stocks soaring.

Now, it seems that Google has taken another step forward in its quantum ambitions.

Image source: Getty Images.

Google's latest quantum breakthrough

Nearly a year ago, Google said that its Willow quantum chip achieved a benchmark computation in less than five minutes that would have taken one of today's fastest supercomputers 10 septillion years.

On Wednesday, Google said that Willow had demonstrated "the first-ever algorithm to achieve verifiable quantum advantage on hardware." Google said that the breakthrough is a significant step toward the first real-world application for the technology.

The algorithm, which it calls Quantum Echoes, is useful in learning how systems in nature are structured, including molecules, magnets, and black holes. Willow also runs the algorithm 13,000 times faster than a comparable algorithm would on one of the world's fastest supercomputers. It's the first time in history that a quantum computer has run a verifiable algorithm faster than conventional supercomputers.

In a separate experiment, Google also developed a new technique it calls a "molecular ruler" that can measure longer distances than conventional methods used today.

What it means for pure-play quantum stocks

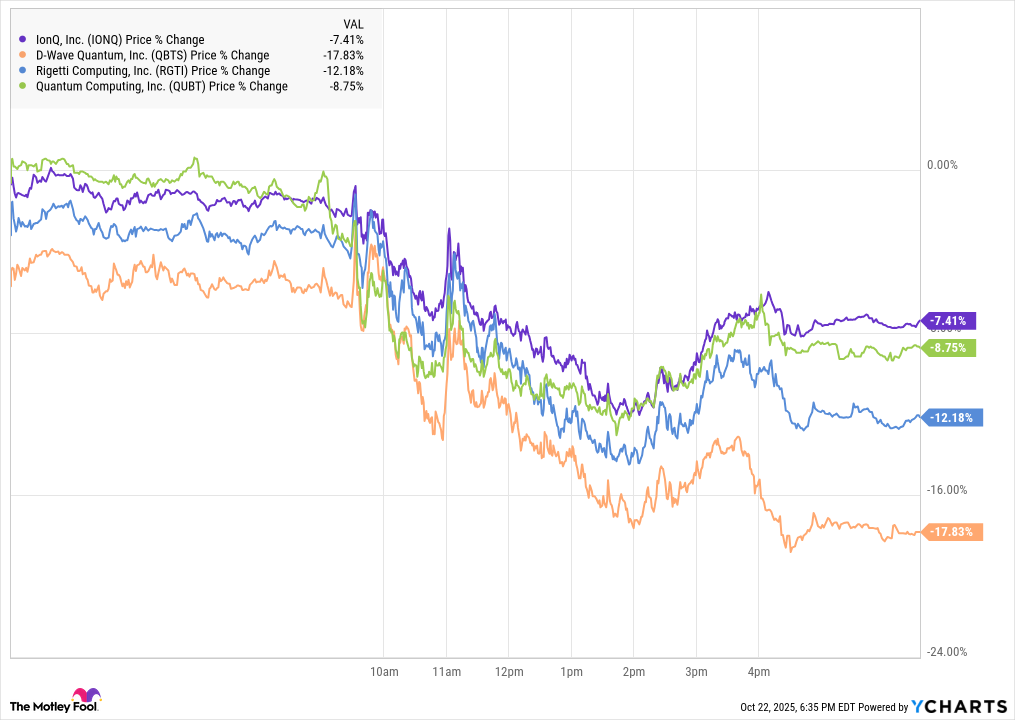

As you might expect, the pure-play quantum computing stocks didn't react well to the news, as the development seems to show them getting left behind by Google. All four of the stocks were down at least 7% on Wednesday.

For all the excitement around the quantum computing stocks, Alphabet still looks like the clear leader in the industry. Not only is it making a significant scientific achievement with Willow, but the chip also has more qubits, a measure of quantum computing power, than any quantum processors used by the smaller companies.

Willow has 105 qubits, while IonQ's biggest processor, Forte, has 36 qubits. IonQ and its peers are working on developing computers with thousands of qubits, but Google clearly has the lead for now.

What's also notable about Wednesday's sell-off is that these stocks had the opposite response when the original Willow news was announced last December. Quantum computing stocks are much more valuable now, but investors no longer see Google pioneering a market that smaller operators will benefit from. Instead, they seem to sense that a bubble has been created and that Google's technological achievements don't directly benefit companies like IonQ.

NASDAQ: GOOGL

Key Data Points

The best quantum computing stock to buy

At this stage, Alphabet looks like the best quantum computing stock to buy, hands down. At a market cap of around $3 trillion, it won't deliver the kind of multibagging returns that the pure plays are capable of, but it's the clear technological leader in quantum computing right now. It has the deep pockets and business relationships to continue funding its ambition and to find customers, and it has a track record of success in emerging technologies with products like Waymo autonomous vehicles and its Gemini AI chatbot.

That may be disappointing to investors in the earlier-stage companies, but these four companies now have a combined market cap of nearly $50 billion with little in the way of revenue.

If you're looking for a smart quantum computing stock to buy, Alphabet is the best choice. Not only is it the pacesetter in technological development in quantum computing, but it also has much less downside risk than stocks like IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing.

It's already one of the most profitable companies in the world. Quantum computing could make it even more powerful.