What if I told you there was a stock out that there that put out industry-thumping margins, was resilient to economic downturns and industry cyclicality, has immense pricing and brand power, and has ample opportunity for growth. Where would you look?

You wouldn't be blamed if the automotive industry -- known for being capital-intensive and for thin margins -- was next to last on your list of guesses. But that's exactly where we find a hidden gem: Ferrari (RACE 1.76%). Here are three reasons buying Ferrari might make a ton of sense for your portfolio.

Image source: Ferrari.

1. Increasing brand value

There are a lot of factors that go into Ferrari's strong brand image. One example is the company's rich racing heritage of winning in the highest levels of motorsports, primarily in Formula 1, and having those vehicle technologies trickle down into its ultra-luxury and supercars.

Another example is the extreme exclusivity of purchasing a Ferrari -- it's not as simple as pulling up to the dealership and selecting a vehicle. Ferrari consumers go through an exhaustive process and many models are sold exclusively to previous owners. Ferrari famously sells one fewer vehicle than the market demands, driving its strong pricing power, but also leaving room for consistent and stable growth.

While it's sometimes challenging for investors to gauge the power or value of a brand, one recent annual report does just that for us. According to Interbrand Best Global Brands report Ferrari's brand value jumped 17% to $15.4 billion, ranking it as the 54th position while other well-known automakers such as Ford, General Motors, and Stellantis, failed to crack the top 100 global brands.

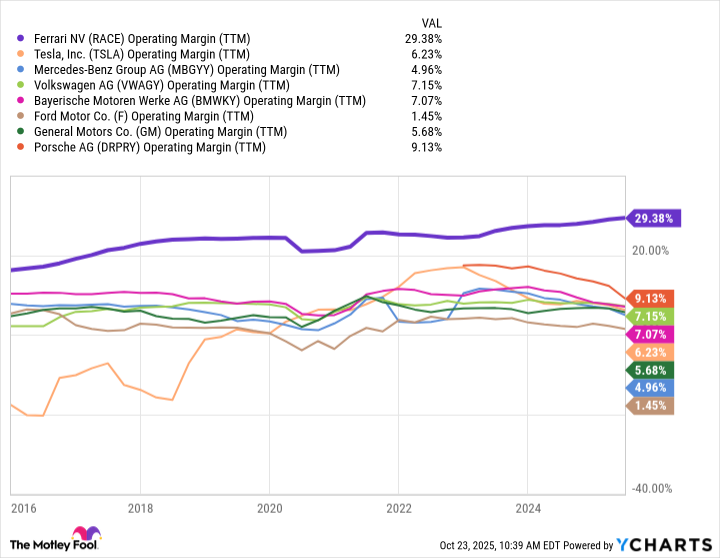

2. Industry-thumping margins

The best thing about strong pricing power is that it brings more opportunity for Ferrari to bring more dollars down to the bottom line. Ferrari has proven extremely adept at doing this and not only produces luxury-like margins in an industry known for single digits, it's still increasing its margins consistently over time.

RACE Operating Margin (TTM) data by YCharts

Another reason Ferrari has strong margins is simply its product portfolio that remains in high demand at just about any price point. For example, Ferrari unveiled its F80 supercar and even though it won't ship until late next year, it has already filled its entire order book at a price tag of nearly $4 million per vehicle.

This isn't just for show, either, and investors will enjoy hearing that Anthony Dick, who covers the automotive sector for Paris-based private bank ODDO BHF, told Barron's that margins on the F80 could be so lucrative it might generate 2% of sales volume but generate 20% of all profit.

3. Building for the future

Ferrari's business is currently humming along nicely, but nothing in the automotive industry remains stationary for long and the global transition to electric vehicles is underway. While Ferrari is in no rush, it's important for the company to build for the future and develop electric vehicle technology for its lineup. There are two important developments on this front.

First, Ferrari is currently more electrified than many realize. In fact, 45% of Ferrari's shipments during the second quarter were hybrids. Second, the company's first fully electric car, the Elettrica, is on its way and will boast four doors, four electric motors, nearly 1,000 horsepower, a range of more than 330 miles, and a price tag estimated to be around $500,000.

Deliveries are expected to start next year and investors should keep an eye on its success because developing a brand image in EVs is important to the company's future.

NYSE: RACE

Key Data Points

What it all means

Companies such as Ferrari, with industry-thumping margins, pricing power and margins competitors dream of, and a brand image few global companies can compete with, are simply few and far between. It's also why Ferrari trades at a premium valuation of nearly 40 times price to earnings.

Ferrari's business should continue to thrive from the same playbook that's driven its current success, and long-term investors should continue to be rewarded.