One of the most overlooked stories on the stock market in the last few years may be the success of the cruise industry, which has delivered a roaring comeback after being largely paralyzed for more than a year by the pandemic.

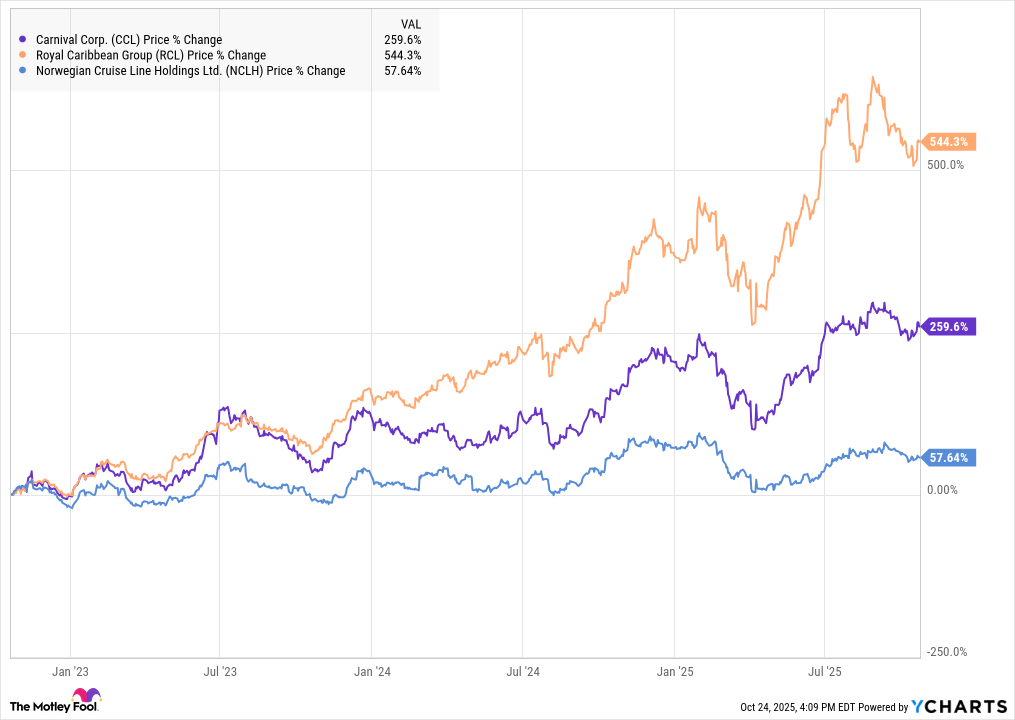

While much investor attention has been focused on artificial intelligence stocks, a basket of the three major cruise stocks, Carnival (CCL +0.07%), Royal Caribbean (RCL 0.88%), and Norwegian Cruise Line Holdings (NCLH +0.34%), would have crushed both the broad-market S&P 500 index and the tech-heavy Nasdaq-100.

Moreover, Viking Holdings (VIK 0.85%), which operates the popular Viking River Cruises, has beaten all three of those stocks since its IPO in May 2024, further evidence that the cruise sector deserves more attention.

Carnival is the world's largest cruise operator, so it's a good company to start with if you're interested in learning more about the sector. As you'll see, there are several great reasons to buy the stock now.

Image source: Getty Images.

1. It continues to deliver record results

Cruise demand has been strong since the end of the pandemic, and Carnival has been a clear winner from that trend, reporting record bookings nearly every quarter.

In its fiscal 2025 third quarter, which ended on Aug. 31, revenue rose 3.3% year over year to $8.15 billion, edging past estimates at $8.11 billion and marking the company's 10th consecutive quarter of record revenues. Net yields, or pricing, improved by 4.6%, driven by strong demand and onboard spending.

Its bottom-line performance was more impressive as adjusted net income rose from $1.75 billion in the prior-year period to $1.98 billion. On a per-share basis, adjusted earnings rose from $1.27 to $1.43. It also achieved an adjusted return on invested capital of 13% for the first time in 20 years.

Its new exclusive destination in the Bahamas, Celebration Key, has been well-received, earning stellar reviews and driving new bookings. In fact, booking trends over the summer were stronger than a year ago and are outpacing capacity growth, supporting healthy pricing and showing strong future demand, even as concerns about macroeconomic weakness in the U.S. grow.

Management said that 2027 bookings are off to a strong start as well, and it forecast adjusted net income growth of 60% for the fiscal fourth quarter, all of which are positive signs that its momentum will continue.

2. There's still room to improve its balance sheet

During the extended period early in the pandemic when cruising was, for the most part, off limits, Carnival and other cruise operators were forced to sell more equity and take on debt simply to survive.

While Carnival has paid down some of its debt and reduced the interest rates it's paying on the debt that remains, it can still make a lot more progress on that front, which would lift its bottom line further.

As of the end of fiscal Q3, the company had $26.5 billion in debt, down by about $1 billion from the beginning of the year, and it had paid over $1 billion in interest expenses through the first three quarters.

If benchmark and market-based interest rates continue to fall, that should make it easier for the company to lower its interest expenses and pay down its debt. Management has been aggressive on that front, refinancing $11 billion in debt this year, and it earned a credit rating upgrade from Moody's.

By further paying down debt and lowering its interest expenses, it can grow adjusted net income even if its operating income remains flat.

NYSE: CCL

Key Data Points

3. The price is right

Though it has delivered strong recent performance, opened its Celebration Key destination, and brought several new cruise ships into service, Carnival is still priced like a value stock, trading at a price-to-earnings ratio of 15.2.

Carnival might not have outstanding growth prospects on the top line as it competes in a mostly mature industry, but the cruise sector has been surprisingly resilient even as other discretionary spending sectors are showing weakness.

Plus, the company has several levers it could pull to improve its margins, including growing net yields, which should get easier with new features like Celebration Key, paying down debt to lower interest expenses, and controlling costs. Share buybacks would also be a method by which it could lift earnings per share.

Overall, given the steady growth of the business, its clear path to debt reduction, and its attractive valuation, Carnival stock looks poised for more growth.