Earnings season has arrived, and as usual, growth investors have their eyes on all things related to artificial intelligence (AI). On Nov. 3, data analytics specialist Palantir Technologies (PLTR +0.02%) will publish financial and operating results for the third quarter.

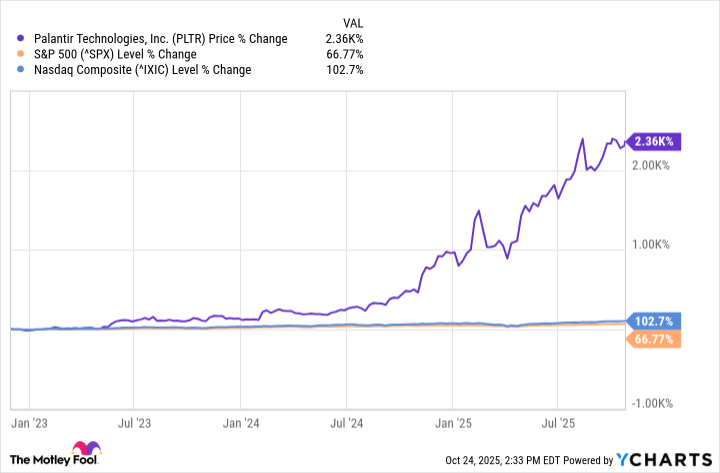

It's been almost exactly three years since OpenAI commercially launched ChatGPT, igniting the AI revolution as we know it. In that time frame, shares of Palantir have gone absolutely parabolic -- soaring by nearly 2,400%, handily topping both the S&P 500 (^GSPC +0.32%) and Nasdaq Composite (^IXIC +0.22%).

Let's dig into why Palantir has become a darling of the AI boom and assess what investors should be on the lookout for. Is Palantir stock a good buy right now?

Why is Palantir stock rising?

At its core, Palantir developed a host of AI-powered software suites -- dubbed Foundry, Gotham, and Apollo. Together, these tools comprise the company's Artificial Intelligence Platform (AIP), which has become one of the core pieces of software infrastructure deployed by both government agencies and large private enterprises.

Over the last three years, Palantir has proven that it can compete head-to-head with direct competitors like C3.ai, as well as larger incumbent software vendors such as Salesforce and SAP.

Just this year alone, Palantir has won a number of high-profile contracts in the public sector. Most notably, the company recently won a deal with the U.S. Army worth up to $10 billion over the next 10 years -- providing Palantir with an enviable degree of revenue visibility in a heated AI software landscape.

To drive home how strategically important Palantir is for the Department of Defense (DOD), consider that the U.S. military also expanded an existing contract by nearly $800 million -- bringing the total deal value to $1.3 billion.

Palantir is thriving beyond the public sector, too. Some of the company's more interesting collaborations in the private sector hail from electric vertical takeoff and landing (eVTOL) manufacturer Archer Aviation, as well as telecommunications company Lumen Technologies.

While Archer and Lumen are both considered relatively small in comparison to legacy providers in their respective industries, I am encouraged by Palantir's willingness to partner with next-generation companies working to bring much-needed technological innovation to antiquated sectors.

Palantir's strong traction and blistering pace of new customer acquisition has excited investors, particularly in the retail community. As such, Palantir's share price has climbed exponentially higher in tandem with AI euphoria.

Image source: Getty Images.

How does Palantir stock typically move following an earnings report?

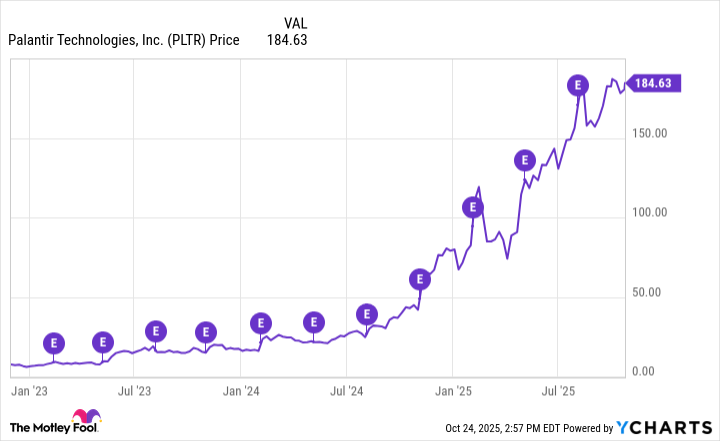

In the chart below, I've illustrated Palantir's stock price movement over the last three years. The purple circles with the letter "E" in the center represent earnings reports. As the trends below clearly show, Palantir stock generally experiences outsize momentum following an earnings report.

Considering the company is accelerating both revenue and profits -- combined with a track record of beating and raising financial guidance -- along with the overly optimistic, perhaps even hubristic, rhetoric of CEO Alex Karp, it's no wonder that Palantir stock has been on such a joyride.

Is Palantir stock a good buy?

If you bought Palantir stock over the last three years, congratulations. Yet while the stock has shown unrelenting resiliency throughout the AI revolution, does that make it a good buy?

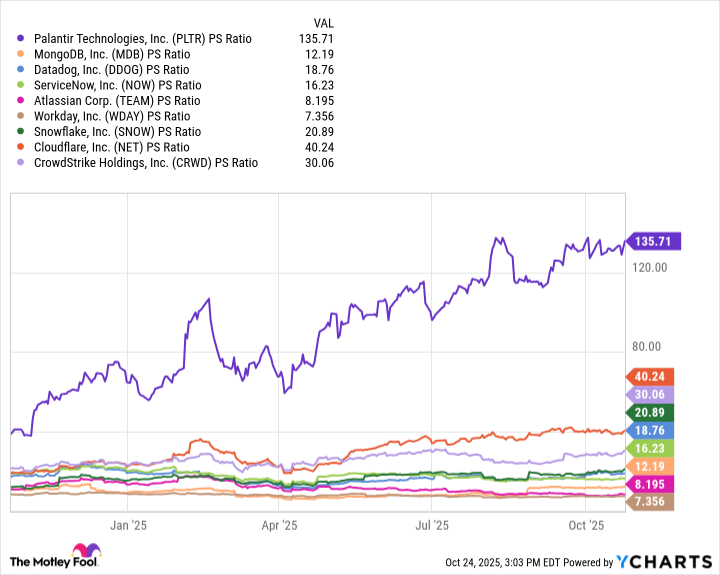

PLTR PS Ratio data by YCharts

Per the analysis above, Palantir's price-to-sales (P/S) ratio of 136 is multiples higher than any of its peers in the software landscape. The stock is undeniably trading at a premium, and that leads me to my next point.

During the peak of the dot-com bubble in the late 1990s, the P/S ratios of internet darlings such as Microsoft, Amazon, and Cisco Systems peaked in the range of 30 to 40. Per the graphic above, Palantir trades in a completely different universe compared to those levels.

The disparity between Palantir's current premium relative to prior bubble stocks makes me think the company's valuation is not only frothy, but unsustainable. Ultimately, I think Palantir stock is due for a correction sooner than many investors may be anticipating.

I'm not alone in this view, either. Among the 25 sell-side analysts on Wall Street who cover Palantir, 17 have a rating of hold on the stock.

The important nuance to understand here is that if you only look at history through Palantir's lens, the stock would appear as a no-brainer right now -- ripe for even more profits. But that doesn't mean you should buy the stock.

By taking into account a more thorough analytical download, history indicates that hot stocks and emerging themes eventually normalize. For this reason, prudent investors understand that they should wait for a more reasonable entry point in Palantir stock -- or risk experiencing unwanted volatility in their portfolios.