When it comes to artificial intelligence (AI) investing, some investors hear the Nvidia story and think it's easy to make money with this disruptive technology. That's what happens when a stock becomes the first to exceed $5 trillion in market value.

Indeed, semiconductors are the picks and shovels of AI's evolution, but the AI investment landscape is sprawling, and as is the case across other sectors and themes, picking individual securities along the lines of AI isn't easy. Fortunately, exchange-traded funds (ETFs) provide efficient AI access. In fact, the Global X Artificial Intelligence & Technology ETF (AIQ 2.67%) isn't just a stock-picking replacement tool. It could be an ETF stalwart for decades to come.

Image source: Getty Images.

AI tailwinds abound for the Global X ETF

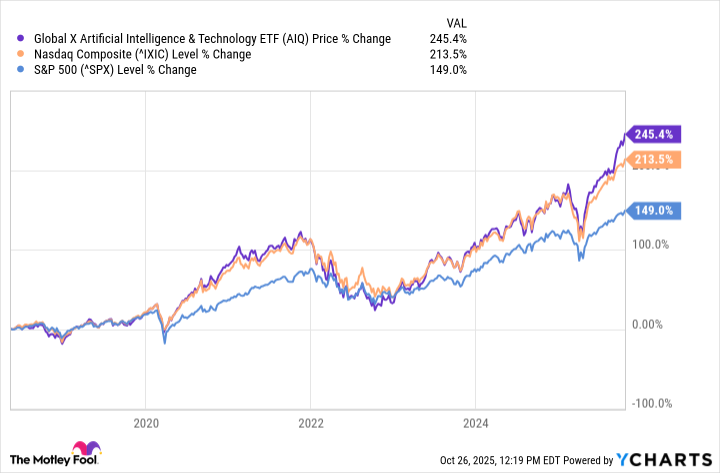

The Global X Artificial Intelligence & Technology ETF is a tool for thematic investing, and AI is a potentially durable theme at that. The $6.68 billion ETF's track record isn't up for debate. Since its inception on May 11, 2018, it's made a habit of outperforming broader benchmarks.

Those performances are in the rearview mirror. Investors considering the Global X Artificial Intelligence & Technology ETF today for the possibility of it being a long-term alpha generator want to know how it can deliver decades of dominance. Here's one example: Morgan Stanley estimates full AI adoption by S&P 500 member firms could stoke yearly financial benefits of $920 billion, possibly driving a market capitalization increase of $13 trillion to $16 trillion for the index.

At least two other factors bode well for the ETF's long-term prospects. First, there's the sheer depth of sector- and industry-level AI adoption. As of June, just 9.2% of businesses were using the technology, with that figure projected to reach 11.6% over the subsequent six months. That implies ample room for growth even as sectors such as consumer staples, real estate, and retail are already embracing AI in a big way.

Second, the Global X Artificial Intelligence & Technology ETF could be propelled by the growth of agentic AI -- the form of AI where autonomous systems complete tasks with little or no human input. Currently, generative AI is the most accessible form of the technology, but agentic AI could be where the growth is at. Remember that $920 billion in annual benefits to S&P 500 members, assuming the full AI adoption mentioned by Morgan Stanley? The bank estimates $490 billion would arrive courtesy of agentic AI.

NASDAQ: AIQ

Key Data Points

Global X ETF has good breadth

Increased corporate profitability and the growth of agentic AI are among the reasons why the Global X Artificial Intelligence & Technology ETF could be a stellar performer over the coming decades, but the "how" matters, too. In other words, investors considering the ETF should spend a few minutes examining its finer points rather than rushing in simply because "artificial intelligence" and "technology" are in the fund's name.

Good news: The ETF's finer points are, well, fine. Not only does the fund provide exposure to a compelling theme with long-term growth possibilities, but its sizable asset base and steady performance since inception indicate it won't be shuttered any time soon -- points to consider as the rate of thematic funds entering the ETF Graveyard is accelerating.

This ETF is also more expansive than many old-guard tech ETFs. It holds 88 stocks from seven sectors, and those holdings hail from more than 10 countries. That composition reflects the global and industry-level opportunities available through AI investing.

The Global X Artificial Intelligence & Technology ETF offers diversification in another way. None of its components commands a weight of more than 4.13% so the concentration risk is tame. That also signals investors aren't getting a "Magnificent Seven" fund in disguise. What they are getting is one of the best AI ETFs and one that could enhance portfolios for years to come.