A plethora of public quantum computing companies have emerged in recent years as investor interest has heated up over the technology's game-changing possibilities. Rumors even surfaced in October that the Trump administration might invest in some of these businesses, including Rigetti Computing (RGTI +3.56%), but that was debunked by the Commerce Department.

Still, shares of Rigetti are up around 3,000% over the past year through the week ending Oct. 24. Rivals have done well, too. Quantum Computing Inc. (QUBT +0.59%), which also refers to itself as QCi, saw shares surge over 1,000% in that time.

Rigetti and QCi have the opportunity to carve out market share in this promising sector, but that depends on the strength of their technology. Here's a look at both companies to evaluate which is the superior quantum computing stock to buy.

Image source: Getty Images.

Quantum Computing Inc.'s performance

Quantum Computing Inc. focuses on photons as the basis for its technology. Photons are light particles with properties suitable for many applications.

They are excellent at transmitting quantum data across long distances, making them great for digital communication, for example, to network quantum computers together. QCi's competitors, such as Rigetti, employ different technologies that are too unstable for this kind of use.

Photons are also inherently secure because each possesses a random quantum state. As a result, QCi's tech is ideal for quantum cryptography. This is important because quantum computers are so powerful that they can hack through most of today's cyber defenses. A major U.S. bank bought QCi's cybersecurity solutions for $332,000 in July.

That sum is substantial for the company. Although its tech offers various advantages, QCi has produced scant revenue this year. Through the first half of 2025, its sales totaled $100,000, down from $210,000 in 2024.

NASDAQ: QUBT

Key Data Points

Exploring Rigetti's business

Rigetti has embraced superconducting qubits for its technology. This is a commonly used method across the industry, adopted by companies such as International Business Machines and Google parent Alphabet.

Superconducting qubits are favored over other approaches for their speed in executing computations, and have been shown capable of scaling up with low error rates. Calculation errors are one of the major drawbacks of quantum computers, contributing to why they aren't widely adopted.

Rigetti's latest quantum device, the Cepheus-1-36Q, released earlier this year, boasts calculation errors that are half that of its predecessor. It's also the industry's largest multi-chip quantum computer, according to the company.

This milestone demonstrates Rigetti's progress toward a quantum computer suitable for widespread adoption. However, the technological advances have translated into limited revenue so far.

Through the first half of 2025, the company's sales totaled $3.3 million, a drop from the $6.1 million produced last year. A promising sign is the company's sale of two quantum computing systems totaling $5.7 million at the end of September.

NASDAQ: RGTI

Key Data Points

Deciding whether to invest in Quantum Computing Inc. or Rigetti Computing stock

Although both companies experienced year-over-year sales declines in 2025, at this early stage in the industry, their futures depend more on tech that can capture customers over time. That said, their businesses need income to survive, or they'll never get there.

Quantum Computing Inc. and Rigetti are deeply unprofitable. At the halfway point in 2025, QCi's operating loss totaled $18.5 million, while Rigetti suffered a $41.5 million loss.

That's why they executed equity offerings to boost their cash balance. QCi amassed gross proceeds of approximately $750 million in October. Rigetti raised $350 million in June. Now both have plenty of funds to maintain operations for the near term as they ramp up revenue generation.

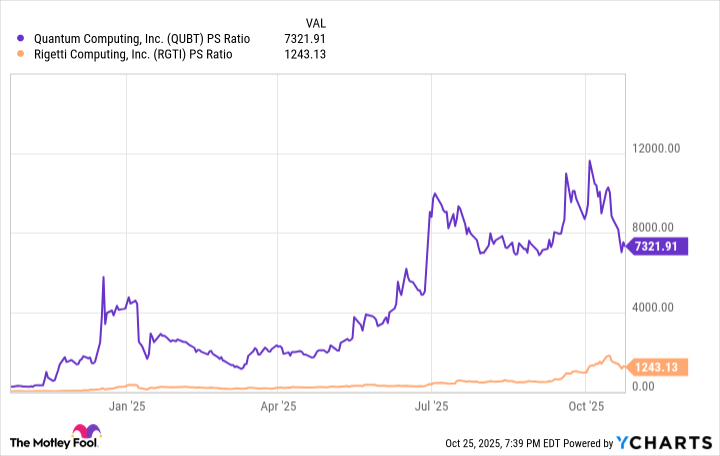

Given their different technological strengths, choosing to invest in QCi or Rigetti is not a straightforward decision. One consideration is share price valuation. This can be assessed using the price-to-sales (P/S) ratio, which indicates how much investors are prepared to pay for every dollar of revenue generated over the past 12 months.

Data by YCharts.

The chart reveals that QCi's sales multiple has soared over the past year, and is far higher than Rigetti's. This indicates that QCi stock is more expensive, although its rival is not cheap either. For instance, IBM's P/S ratio is 4, while Alphabet is at 8.

Rigetti's larger revenue and lower stock valuation suggests it's the better investment choice over QCi. However, the quantum computing industry is still too nascent to know which technology holds the greater long-term potential.

Considering QCi and Rigetti's inflated valuations, the ideal approach is to hold off buying until their stock prices drop. In addition, their Q3 earnings can provide more insight into their commercial sales performance, so it's best to wait for those results as well.