Roughly 30 years ago, the advent and proliferation of the internet broke down barriers between Wall Street and Main Street that had existed for more than a century. With the click of a button, information was no longer a luxury for the privileged few. Whether it was the latest news, earnings report, income statement, balance sheet, investor presentation, or management commentary, the internet gave way to the retail investor revolution.

Over time, retail investors have come to play a larger role in overall equities trading volume. This was especially evident in early 2021, when euphoria surrounding short squeezes hit a crescendo and briefly sent heavily short-sold stocks to the moon.

This event has ushered in multiple subsequent rounds of short squeeze hype, the latest of which has been spearheaded by plant-based meat products provider Beyond Meat (BYND 10.57%). While social media interest, volume, and volatility are incredibly high for Beyond Meat stock, historical precedent points to almost certain disappointment for its shareholders, as has been customary of short-squeeze-hyped stocks.

Image source: Getty Images.

Beyond Meat's "short squeeze" was really a misinformation-driven FOMO rally

Though history tells us investing is best approached with a long-term mindset, the heightened volatility witnessed in stocks and cryptocurrencies since the start of the decade has given rise to a group of retail investors constantly on the lookout for a quick buck. The prospect of a short squeeze provides what these investors are looking for.

Between the closing bell on Oct. 16 and pre-market trading on Oct. 22, Beyond Meat stock skyrocketed roughly 1,600%, from $0.52 per share to a peak of $8.85. With multiple third-party financial sites reporting the company's short interest at anywhere from 81% to 162%, it appeared as if a bona fide short squeeze was underway.

But after minimal digging of Beyond Meat's SEC filings, the truth surfaced: this wasn't a short squeeze. Rather, it was a very short-lived misinformation-driven rally spurred on by the fear of missing out (FOMO).

On Oct. 13, Beyond Meat issued a press release regarding its 0% convertible bonds due in 2027 that showed 96.92% ($1.115 billion) had been tendered in a proposed debt-for-equity swap. As a result, 316,150,176 new shares would be issued on Oct. 15 to these bondholders, thereby raising the outstanding share count to approximately 397.6 million.

NASDAQ: BYND

Key Data Points

On Oct. 16, Beyond Meat published another press release noting the lockup restrictions of these newly issued 316.15 million shares would end at 5 p.m., ET, on the same day (Oct. 16). This paved the way for these former bondholders to sell their shares, should they choose to do so, and for these shares to become freely tradable. In other words, this entire share allotment entered the float (the number of tradable shares), which is the figure used to determine short interest.

Based on the Oct. 24 update of the newest shares held short figure of 51,834,529 (as of Oct. 15 settlement), and a more-than-quadrupling in Beyond Meat's outstanding shares and float, the company's accurate short interest is less than 14%, and not the 81% to 162% figure that's been circulating message boards on X (formerly Twitter), Reddit, Stocktwits, and other online investing sites.

Ultimately, the issue here is that investors failed to use primary sources, such as Securities and Exchange Commission (SEC) filings and press releases directly from Beyond Meat, to verify the company's share count and calculate its short interest. Whereas some third-party sites can take days (or perhaps even longer than a week) to update share count information, investors would have known the accurate share count and could have calculated the correct short interest for themselves back on Oct. 17.

Investors who piled in thinking they'd found the next short-squeeze rocket have been sorely disappointed.

Most short squeeze-hyped stocks will be duds for investors

A short squeeze is incredibly difficult to predict and usually short-lived. The mechanics of a short squeeze require a couple of factors to work together in harmony. For one to occur, there often needs to be:

- High short interest (the number of shares held short, divided by the float).

- A climbing borrow rate, which signals high interest in wagering against a company's share price, increased volatility, and/or scarcity for available shares to borrow for short-selling.

- A relatively high days-to-cover (DTC) ratio, which is based on the number of shares held short divided by a company's average daily trading volume. The higher the DTC, in theory, the longer it would take for short-sellers to buy shares and exit their position.

- The desire by short-sellers to exit their positions. The only absolute "must" for every short squeeze is a catalyst that makes pessimists want to head for exit. Since they have to buy to cover in order to exit their short-sale position, it can lead to a brief parabolic rise in a stock.

While short squeeze events do naturally occur from time to time, they're virtually impossible to forecast.

More importantly, history suggests companies with high levels of short interest are duds more often than winners for investors.

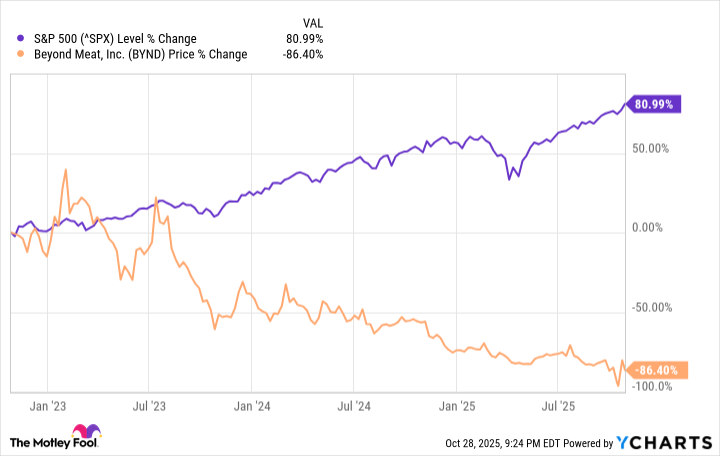

^SPX data by YCharts. Returns from Oct. 27, 2022-Oct. 27, 2025.

As of the closing bell on Oct. 28, there were 232 stocks with short interest of 20% or above, according to data from Finviz. Over 53% of these stocks are down year-to-date, while just shy of 65% are underperforming the 17.2% year-to-date return of the S&P 500. Consistently, hyped short squeeze stocks underperform Wall Street's benchmark index.

The bigger issue that retail investors seem to be overlooking when seeking out the next short squeeze candidate is that heavily short-sold stocks are wagered against for a reason. While some of these companies are proven/profitable businesses that are simply pricier than they've been in a long time, most of these 232 heavily short-sold companies are losing money and/or diluting their shareholders to raise capital.

The key points being that there's far more to finding a successful short squeeze candidate than high short interest. It's absolutely imperative that investors use primary sources, such as company press releases, investor presentations, and filings with the SEC, to get up-to-date share count information, as well as fully understand how financially sound a public company with high short interest truly is.

Most heavily short-sold businesses have well-defined structural flaws, which makes them poor candidates for investment -- and is precisely why short squeeze-hype events tend to end in disappointment.